AGL's tense shift towards energy solutions provider

AGL reported its FY14 results yesterday observing that the overriding thematic of the year was ‘soft demand conditions’.

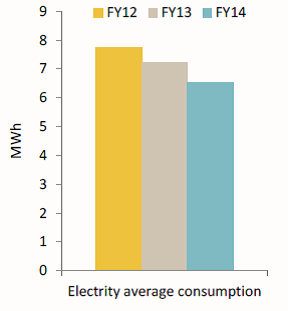

Average household customer electricity consumption was down nearly 10 per cent for the year and this comes on top of similar falls in prior years (detailed in the chart below). Part of this year’s fall is attributed to the mild May and June but, nonetheless, “AGL expects average consumer demand to continue to be impacted by energy efficiency, solar and new technologies”.

With less volume AGL finds itself unable to make the kind of margin per customer which it has in the past in the retail end of its business. Earnings per 'customer account' were down 16.7 per cent compared to last year for AGL. At the same time, the reduced energy sales also flow down the line to lower prices and margins in the power generation part of its business as well.

The problem for AGL, and indeed other power companies, is that energy equipment suppliers for buildings – such as solar PV but also other products, such as energy efficient lighting – are cutting their lunch. These equipment suppliers are helping customers to reduce the amount of energy they need from the grid.

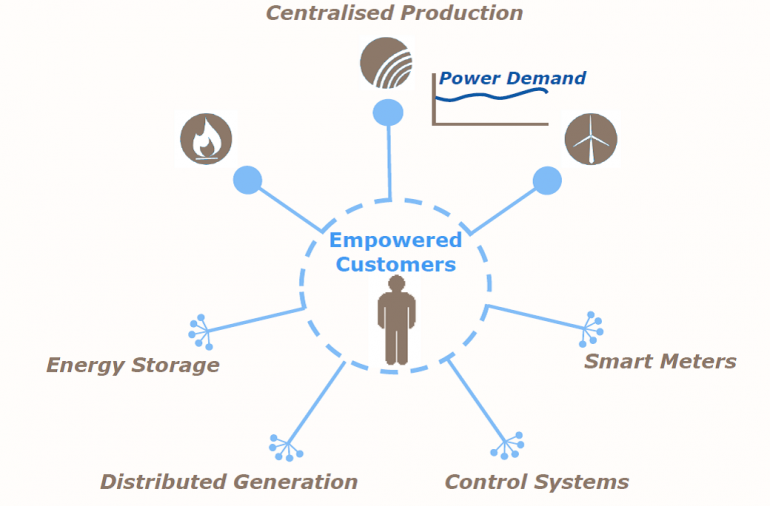

AGL’s chief executive Michael Fraser appears acutely aware of this challenge. He suggests that the company needs to transition from a conventional vertically integrated energy supplier which makes money through selling volume of energy, to what they term an integrated energy solutions provider, which they symbolise in the picture below.

Essentially, AGL believes it needs to vertically integrate yet another step beyond the centralised grid and into its customers’ homes. Under such a model the company would make money less by selling electrons from the grid and more by charging for services linked to equipment such as solar PV, batteries and devices which would improve a household’s energy efficiency and shift its electricity demand out of the periods when power is most costly, such as very hot and very cold days.

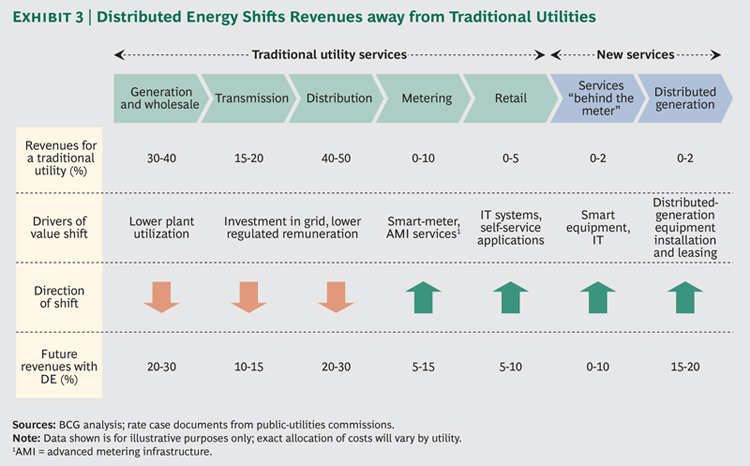

Boston Consulting Group released a paper recently looking at how this energy solution provision model may arise and the challenges it presents for traditional power utilities. BCG outlines in the diagram below how the revenues available upstream from the customer are likely to erode over time due to solar, cheaper batteries and more efficient and communication-enabled electrical equipment. It shows that while the revenue available to generation and power networks, declines, the available revenue for behind-the-meter equipment and services – as well as metering equipment – rises.

Figure 3: Boston Consulting analysis ... How distributed energy shifts revenue away from traditional utilities

AGL is clearly aware of the threat to existing power generators from distributed energy and energy efficiency. Yet it's just made two major acquisitions of large coal generators in the last few years to become the largest power generator in the country. Why on earth would it do that given its management seems to recognise the likelihood of structural decline in centralised grid generation, as per BCG’s analysis?

The answer is the prices for the power generators were extremely low and there are some counterveiling influences at work which act to push power prices up in spite of demand going down.

AGL explained in its presentation yesterday that Macquarie Generation has access to coal at around $1.50 per gigajoule until 2025, while other NSW black coal generators have seen coal price rises of between $0.5 to $1 per GJ – and now pay above $2.50.

In addition its competitors’ coal costs are expected to rise by a further $0.5 in 2022.

This coal price advantage they value at $768 million on a total acquisition cost for Bayswater (2640MW) and Liddell (2000MW) of $1.5 billion. AGL suggests that even if the Tomago aluminium smelter were to shut and it then subsequently shut Liddell Power Station, the acquisition would still make great financial sense because AGL would have only paid $295 per kilowatt for Bayswater. This is an extraordinary deal. The minimum price to build a kilowatt of capacity from scratch is about $750 for a gas peaking turbine, $1400 for combined cycle gas and $2000 for a new coal power station or wind farm.

But there’s more. Fraser points out that the east-coast power market has experienced some quite high levels of power output from the major gas generators this past financial year – Tallawarra operated at 81 per cent utilisation, Swanbank E was 69 per cent, Darling Downs 57 per cent. Even the Braemar power plants which are expected to largely operate during just peak periods had, in fact, about a 30 per cent utilisation.

This has been a function of a temporary glut of very cheap gas, as gas fields upped their throughput in preparation for the Gladstone LNG plants coming online next year. Once they come online this cheap gas will disappear and prices will skyrocket. This will lead to an abrupt withdrawal of power from these gas power plants, substantially inflating the need for NSW black coal generators.

In spite of any long-term strategic shift towards a more customer-empowered energy market, given the facts above the short-term gain for AGL from getting deeper into coal generation was clearly irresistible.

The problem, however, is that even if AGL recognises this structural shift, legacy assets – especially ones of the scale of Bayswater, Liddell and Loy Yang A – have a habit of dominating management attention and inhibiting innovation. It could all be short-term upside that doesn’t hinder AGL from adeptly responding to future changes ... but business management history suggests otherwise.