AGL shifts sides: 'Scrap SRES, LRET can't be met'

AGL had until recently been the sole major incumbent power generator and retailer that provided strong support for the Renewable Energy Target. To have one of the big three Australian gentailers saying the RET was achievable and wouldn’t impose huge costs on consumers was incredibly helpful to the renewable energy industry in fending off criticism from EnergyAustralia and Origin Energy.

However, that support has now evaporated. In its submission to the RET Review Panel AGL states:

AGL believes that there is a material risk that the Large Scale Renewable Energy Target (LRET) cannot be achieved. A convergence of factors is making future investment in renewable energy intractable. These factors include: policy uncertainty, associated barriers to exit (due to policy uncertainty); declining electricity demand; and the design of the National Electricity Market (being an energy-only market).

It also argues that the small-scale renewable energy scheme which supports the installation of solar systems be abolished, stating:

Household solar PV now no longer requires subsidies to be an attractive proposition for households. Furthermore, the level of electricity generation from small scale solar is approaching or slightly exceeding 4 TWh, which was the original policy intent. This suggests policy driven support for household or small scale solar is no longer required.

Having such a credible player in the power sector with a strong track record of investment in renewable energy change its tune is a big blow to supporters of the Renewable Energy Target. It also makes it hard for those within the Coalition government that wish to maintain the scheme to fend off criticism from their climate sceptic colleagues.

What is likely to be especially troubling to renewable energy supporters is that AGL does not suggest any alternative pathway for the RET that it believes is achievable and would deliver on the original goals for the RET. For example, it does not argue that the target be retained but delayed somewhat – for example, by reducing the target in the short-term but increasing it in the longer term.

Instead it says that the large-scale scheme be abandoned with existing investments grandfathered:

In the short term, it is clear that the existing policy will not be able to achieve its objectives … Investment has become intractable. There is little point continuing with higher targets for the LRET in the future if the underlying economic fundamentals prevent investment in new renewable capacity. In this context, it is critical that existing investments be appropriately recognised as having been made due to legal obligations to invest in new renewable energy projects or enter into Power Purchase Agreements (PPAs)

AGL argues that the electricity market is caught in an intractable bind which makes investment in new power capacity, including renewable energy, unviable. With electricity demand growing very slowly and no carbon price, AGL suggests that the electricity market is caught in a spiral to the bottom. Coal power stations’ very low operating costs mean owners are likely to bid wholesale power prices down to very low levels as they find themselves squeezed at one end by extra supply from renewable energy, and at the other end by low electricity demand. Consequently, we will be stuck with low power prices for a very long time. They argue the level of wholesale prices out to 2030 are likely to be so low that even with the RET providing an additional revenue stream of up to $92 per megawatt-hour for renewable energy, it is insufficient to make the projects economic.

Therefore unless the government either acts to buyout and permanently close a large coal generator, or reintroduces a meaningful carbon price, there’s no point persisting with the Renewable Energy Target.

However, it seems that a number of independent energy analysts have a different view to AGL, even accepting the fact that coal generators are unlikely to voluntarily exit the market permanently.

It is undeniable that the withdrawal of the carbon price has made renewable energy projects less attractive. But there is some argument as to whether this means it is now unattractive to invest in any new renewable energy at all and that the scheme is permanently broken.

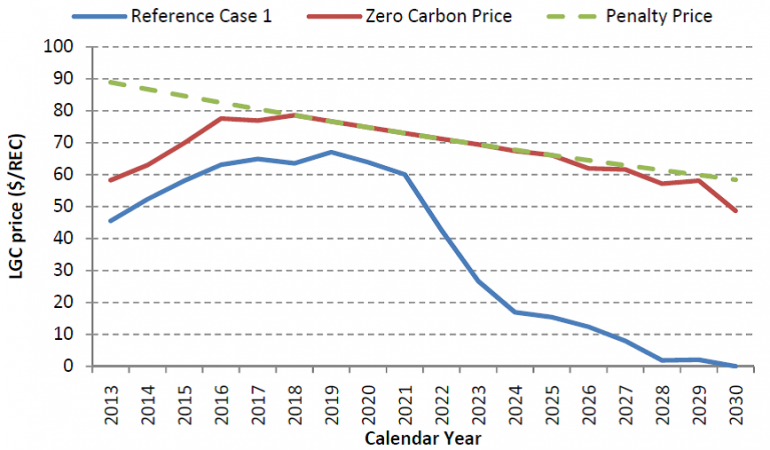

In support of AGL’s argument, modelling by SKM-MMA for the Climate Change Authority found that under a zero carbon price scenario, construction of projects would fall short of the target because of inadequate financial returns. Under their modelling of a no carbon price scenario the renewable energy certificate price (illustrated in red) would come up against the penalty price cap illustrated in dashed green (which declines over time in real terms as a result of inflation).

Price path for large-scale renewable energy certificates (LGCs) with and without carbon price

Source: SKM-MMA for Climate Change Authority (2012)

But when you delve deeper you find this doesn’t mean we have an intractable problem. According to the modelling, if the penalty price was just lifted by $3 per MWh then the target would be met. This would make very little difference to the overall cost of the scheme.

Also ROAM Consulting in more recent modelling concludes that while abandonment of the carbon price makes achievement of the target more finely balanced, it concludes:

“On balance, ROAM therefore believes that meeting the RET in the business as usual scenario without a carbon price is economically feasible. An increase in the shortfall charge or scheme duration would further increase the likelihood of the goals of the legislation being met.”

There are plenty of reasons for why a headlong rush of renewables build to 2020 and then a drought afterwards would be difficult – and an alternative, slower but longer path better. But one would want see a lot more evidence before concluding that the energy market is irreparably broken unless the government bails out the incumbent generators.