AGL kicks off the age of large solar

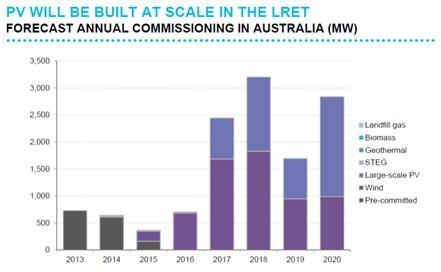

In 2020, the last year of Australia’s Renewable Energy Target, more large-scale solar capacity will be brought online than wind capacity, according to the latest forecasts from analysts Bloomberg New Energy Finance. The news, which comes as Australia’s largest solar project gets the go-ahead, shakes up the thinking that wind will be the only utility-scale renewables focus through to the end of the decade.

The forecast alteration was discussed by Bloomberg New Energy Finance’s Kobad Bhavnagri at the recent Clean Energy Week conference, with a solar surge in the back half of this decade now expected thanks to the swift reduction in costs.

Source: Bloomberg New Energy Finance

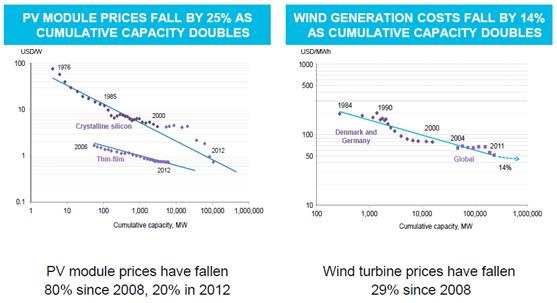

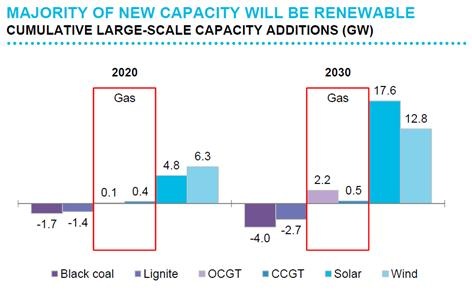

Such is the rapid change in the economics of solar that just last year, at the same conference, Bloomberg New Energy Finance outlined a forecast that wind would dominate new build until at least 2020. At the time it was thought 0.4 gigawatts of large-scale solar would be added prior to 2020 – or in less technical terms: next to nothing. Now that forecast has ballooned to a more noticeable 4.8 GW on the back of continued price falls – 20 per cent in 2012 alone and 80 per cent since 2008.

“It essentially is about price,” Bhavnagri – BNEF’s lead clean energy analyst in Australia – told Climate Spectator. “Projections for future prices (assessed month-by-month and quarter-by-quarter) have come down.”

Source: Bloomberg New Energy Finance

Wind will still edge out solar in the cumulative stakes from now until 2020 as, aside from AGL’s Solar Flagships development and perhaps a couple of small projects, there is expected to be scant large-scale solar until 2017. But then it could boom – with the equivalent of around 30 times the AGL development ahead of us if the current projections prove accurate.

In a rapidly evolving energy market the forecast is subject to regular updates – as has been shown over the past 12 months – but if solar can prove cost-competitive with wind by 2020 it would complete a swift descent along the cost curve.

The assessment of ‘cost competitiveness’ is a complex one, however, with the different profiles of solar PV and wind needing to be considered. For instance, wind will be generating across both day and night while solar PV is supplying all its power during daylight hours when demand is typically highest. As a result, BNEF models factor in greater value for solar compared to wind.

“We assume a 15 per cent premium for power produced by PV,” Bhavnagri explained.

Another issue is that the best wind sites typically are chosen first, which has an impact on wind prices moving forward.

As a result the ‘discount’ for wind varies from state to state based on wind resources left available to exploit. Given South Australia has such strong wind penetration, a higher discount rate is applied to recognise that there are fewer high quality wind resources close to suitable infrastructure yet to be tapped. In contrast, a premium is actually factored in for WA thanks to the ‘Fremantle Doctor’, which sees strong wind resources available during peak demand periods in the late afternoon.

One factor not captured in the models that could see solar gain momentum during the back half of this decade is community acceptance and government approvals.

While wind remains a popular source of power amongst the Australian public, there has been some push-back against wind developments in recent years. Solar, on the other hand, is consistently found to be the nation’s most loved energy source, according to surveys.

A solar plant is also not subject to any special state development laws (unlike wind) and is more concentrated in terms of size, making approval easier to obtain from government authorities. As way of comparison, AGL’s record 155 MW solar project will be spread across two sites and cover a total of 660 hectares. A similar sized wind project – the 140 MW Capital wind farm – is spread over 3,500 hectares.

Given this and the sharp cost reductions, it’s not hard to see the AGL solar project as a precursor to a major lift in development in a few years time.

Perhaps the greatest significance of all this is that it shuns the argument that the RET can’t be achieved because there is not enough community acceptance (nor appropriate sites) for wind to be developed at such large scale in such a short space of time.

It would also diversify our renewable energy sources earlier than expected. A heavy reliance on wind to meet practically the whole large-scale Renewable Energy Target is not as smart as a mix of technologies, from a purely technical standpoint.

The diversification will really pick up post-2020, however, as the forecasts suggest solar’s growth will accelerate markedly (see below).

Source: Bloomberg New Energy Finance (does not include small-scale PV)