AEMO: No need for peaking power, nor baseload

The Australian Energy Market Operator (AEMO) believes there is unlikely to be a need for any new power generating capacity until beyond 2022-23, except for Queensland, which will require a small addition in 2019-20.

AEMO, who is responsible for operating the eastern states electricity system and ensuring its safety and reliability, provides an assessment each year, known as the Statement of Opportunities, outlining when each state is likely to require new fossil-fuel power generating capacity to ensure the lights stay on.

The table below outlines its assessment for each state with the medium growth scenario generally seen as the base case.

Likely timing at which Low Reserve Conditions will occur under low, medium and high growth scenarios

Source: Australian Energy Market Operator – Statement of Opportunities 2013

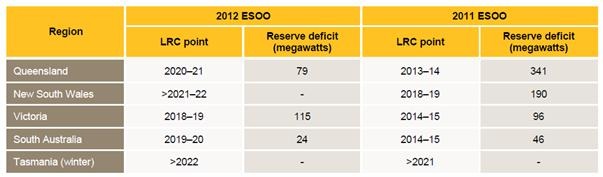

Compared to last year’s assessment, AEMO has pushed back the point at which it believes new fossil fuel power generation is required for every state except Queensland. However, compared to the assessment just two years ago, the downgrade in requirements for new generation are dramatic.

Part of the reason for the large reductions actually has nothing to do with market fundamentals, but rather because in 2012 AEMO stopped using transmission companies’ forecasts and developed its own. Transmission companies have had a strong incentive to inflate electricity demand estimates because their revenue and profit was tied to convincing regulators they needed to build more infrastructure capacity.

2012 and 2011 assessments of timing for new generation under the medium growth scenario

Source: Australian Energy Market Operator – Statement of Opportunities 2012

According to AEMO, the reason for pushing back the need for new fossil-fuel or ‘thermal’ generation is due to:

“Reduced growth in energy use across the National Electricity Market (NEM) compared to 2012, rising domestic rooftop photovoltaic (PV) generation, increasing consumer response to recent growth in electricity prices, and the development of new large-scale renewable generation is expected to defer new thermal electricity generation investment.”

Given these findings, it is rather peculiar that Origin Energy and other critics of the 2020 Renewable Energy Target continue to insist that the growth of renewables will impose billion dollar costs through the need for extra “back-up” peaking power.

If these critics wish to be taken seriously they really need to supply some comprehensive quantitative analysis using real weather data that explains how AEMO has somehow got it wrong.