AEMO downgrades electricity demand again

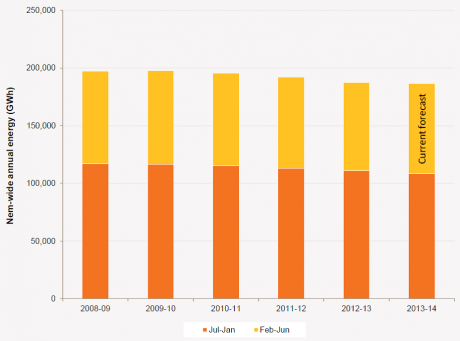

The Australian Energy Market Operator has released an updated assessment of its forecasts for electricity demand, and downgraded its forecast of demand again. As the chart below illustrates, AEMO now expects that annual electricity consumption for 2013-14 financial year will be lower than the preceding year across the eastern Australian National Electricity Market. This is now a four-year run of electricity demand falls.

NEM-wide annual electricity consumption

Source: AEMO (2014)February Update: Supply-Demand Snapshot, published March 2014

It seems each year AEMO has expected electricity consumption to resume an upward trajectory and each year consumers have stubbornly refused to co-operate.

AEMO had only just updated its forecasts in November last year when it found electricity consumption was 3.5 per cent lower than forecast in the first quarter of 2013–14. This resulted in AEMO revising its forecast down by 1.3 per cent for 2013–14.

Yet during the period October 2013 to January 2014, electricity consumption was lower than this updated forecast by an average of 1.5 per cent.

On a year-to-date basis, 2013-14 consumption to January 2014 is 2.3 per cent lower than the same period in 2012-13.

One thing that’s very important to recognise is that this downturn in demand relative to forecast is, according to AEMO, “predominantly due to variances in commercial and residential consumption in November 2013”. This downgrade in demand is not being driven by industrial restructuring.

However, looking forward into next year AEMO notes that closure of Alcoa’s Point Henry aluminium smelter in August 2014 will further reduce industrial consumption in Victoria by approximately 360 MW.

The table below details that AEMO foresees little need for new scheduled conventional generating capacity (not wind or solar) for some time in order to keep the lights on. This is taking into account the substantial growth in wind power additions due to the Renewable Energy Target, which rebukes the nonsense that wind will impose lots of hidden costs on consumers because of the need for new power stations to provide back-up.

Year at which AEMO forecasts requirement for new power generating capacity

Source: AEMO (2014)February Update: Supply-Demand Snapshot, published March 2014

AEMO has now pushed back by a year to 2020-21 the time at which it foresees Queensland might need new conventional scheduled generation capacity. This is in spite of the announcement by Stanwell that it will be withdrawing its 385 MW Swanbank E gas fired power from service for up to three years, and is still to commit to returning one of the Tarong coal power units (350MW) later in the year (they say they “may” return it to service depending on market conditions).

Also AEMO does not foresee any need for additional scheduled generating capacity (not wind or solar) across the remaining states of the NEM for the entire outlook period to 2022-23. This is in spite of EnergyAustralia mothballing one unit of Wallerwarang (500MW) in January and the withdrawal of the other unit (also 500MW) at the end of March.

What’s a bit bizarre about all of this is that in spite of this huge overhang of excess generating capacity and concerns about climate change, there is still 3270 MW of new coal power plant capacity still proposed for potential construction. Some people just never give up hope.