Abbott's 'fiscal emergency' is the symptom, not the disease

In his book Dog Days, economist Ross Garnaut includes a convenient critique of his own thesis, under the heading ‘How will you know if I am wrong?’

In that section, he reminds readers that he predicts one of two possible futures for the Australian economy.

The better path would be “an early and large real depreciation, with a hard start but better outcomes.” By that he means the dollar must fall, and wages must not rise to offset that fall.

In short, Australians must start paying themselves at levels that reflect the value of what they produce vis-a-vis our major trading partners.

It’s a difficult future, but the other alternative is much worse.

The other option, writes Garnaut, is to continue pretending we don’t face an economic crisis (note: not a fiscal crisis) and stick to “business as usual” policy settings.

“This gives us economic growth well below our capacity of 3-and-a-bit per cent per annum, slowly deteriorating employment conditions for a growing population, and a slow squeeze on real incomes.

“The [at the time of publication] officially projected budget surplus in 2016-17 does not materialise. The modest economic growth is worse than it looks because it is dominated by increased resource exports that contribute relatively little to Australian jobs and incomes.”

According to Garnaut, then, we are already some way along one of those paths.

With the AUD/USD exchange rate stuck at 94 cents rather than Garnaut’s preferred 63 cents, can you spot which one?

The latter scenario of the Dog Days thesis is supported by several current indicators that have not been helped by the chaotic rollout of the Abbott/Hockey budget plans.

There is the too-high currency, low consumer confidence, low business confidence, weak investment, weak credit demand, the resources ‘capex cliff’ and inadequate job creation for a growing population.

The last of these is becoming an urgent problem. This week’s ABS labour force data showed the disappointing result of unemployment rising to a headline rate of 6.0 per cent seasonally adjusted, or 5.9 per cent in trend terms.

However, this does not fully tell the story of stalling employment.

Aside from the relationship between participation and the headline jobless rate, explained by Callum Picking on Thursday, (The RBA must ease Australia's labour pains, July 10) it’s also necessary to consider growth in population, incomes, GDP and productivity to see where things are headed.

Let’s start with GDP. The demand for labour, goods and services during the construction phase of the resources boom has added several points to GDP, and thus has kept GDP growth at about trend levels right up to the present day.

However, as completed resources projects go into production -- particularly iron ore mines -- the workforce required to run them is substantially less, meaning between 75,000 and 100,000 jobs will go in the next year or two.

That’s great for the labour productivity of that sector -- more output per hour worked -- but the ‘GDP’ counted in all those resources sales will not prevent the jobless queues lengthening.

On the positive side, it will be a good source of corporate tax revenue, even without a proper resource rent tax. It is too late for the MRRT to be redesigned to reimburse Australian citizens for the one-off sale of their mineral assets, something royalty rates have not been responsive enough to capture.

But shareholders of the big miners will do well, and as they supplied the capital to build the mines, that’s largely fair.

Booming iron ore sales should be seen in this light -- more than two-thirds of the Rio Tinto and BHP Billiton shareholders are overseas, and it is they who will accrue the profits in return for risking their capital.

Meanwhile, as noted previously, the Department of Immigration and Border Protection has no plans to curtail current levels of immigration -- about 220,000 per year. That combines with low mortality rates (we’re living longer) and still-high fertility rates to mean a strongly growing population.

Immigration may need to be looked at, because although migrants usually do well in finding jobs and also add to aggregate demand, the currently weak employment market may not accomodate new Australians as well as it previously did.

Specifically, one of Garnaut’s favourite metrics – total hours worked per month – is in trouble when seen in the context of a growing population.

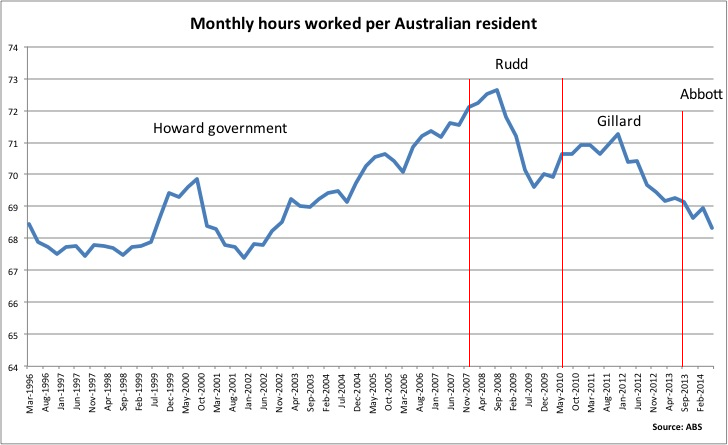

As the chart below shows, the number of hours worked per Australian resident has varied in a range of about 5.5 hours a month since the Howard government came to power in March 1996.

That might not sound much, but based on current average full-time weekly earnings of $1437 per week, that range would equate to about $210 per month in gross earnings. And remember, that’s per resident, not per worker.

Looking at the chart above, then, it’s clear that following the ebullient spike in hours worked around the dot-com boom years of 1999-2000, there was a strong rise associated with the rollout of mining boom years from about 2002.

That crashed by three hours per resident per month during the GFC.

Labor argues, with some merit, that without the two emergency stimulus packages of 2008 and 2009, that drop-off would have been much larger. There was also an easing of immigration in 2010, with the intake falling to around 160,000.

Hours worked per Australian resident recovered strongly through the first Gillard government, but then began a steady decline through the second term -- ravaging corporate tax receipts on the way and setting the scene for the Abbott team’s “fiscal emergency” campaign into the 2013 election.

The truth, that Prime Minister Abbott would be wise to admit sooner rather than later, is that we are not in a “fiscal emergency” per se, but an economic crisis that results in declining tax revenues.

Put another way, the fiscal crisis is the symptom, but an economic crisis is the disease. The Abbott government has falsely claimed it can dig Australia out of the impending hole by reducing public-sector demand – that is, by slashing spending.

That is not a view currently shared by a slight majority of Senators, and many of the budget savings therefore look unlikely to pass the upper house.

Much of that, of course, is politics. But that does not change the fact that it is the big-picture economy that needs urgent action, not the national debt.

To see why, let’s look again at Garnaut’s ‘How will you know if I am wrong?' remarks.

Garnaut picked an inflection point in Australia’s terms-of-trade boom as being at the end of 2011 -- a date completely consistent with the drop-off in hours worked in the chart above. The once-in-a-lifetime 75 per cent increase in our terms of trade could not last forever.

Garnaut then wrote in late 2013: “You will know that I was unnecessarily worrying my fellow citizens if the weakening labour market of the past two years goes into reverse before too long and takes us back to the full employment of the official projections in 2015-16, and if the budget deficit starts shrinking rapidly after this year (as in the official projections) -- and all without large real depreciation or concern about the financing of our external deficits.”

He is talking about the projections in Labor’s last budgets.

He continues: “However, the reader should be worried that I might be right if the availability of employment for a growing population continues to drift downwards and there are no signs of increased investment in trade-exposed industries. Or if we deal with the immediate employment problems by increasing domestic spending without a big improvement in competitiveness, and Australian indebtedness to foreigners starts to grow strongly again.”

Well we won’t get out of this predicament by more private sector borrowing.

Australians continue to deleverage from world-beating highs of private debt built up during the Howard-era credit-boom.

And we won’t escape the downward trend by slashing public spending and terrifying consumers with talk of a ‘fiscal emergency’.

Investment in the trade-exposed non-resources industries must be encouraged, as well as domestic demand via the fanning back to life of consumer confidence.

On Friday, Prime Minister Abbott told the Fairfax papers, after a week of controversy over asylum seekers and the failed carbon tax repeal, that he would keep his four central commitments -- "to scrap the carbon tax, to stop the boats, to build the roads and get the budget back under control".

He added: "There will be a lot of shouting from the sidelines, there will be a lot of colour and movement, there will be a lot of days when learned commentators would like to focus on the circus rather than the substance, but nevertheless I am very confident that all these things will be done.''

Well, Prime Minister, the carbon tax, the boats, the roads and the fiscal emergency are the ‘colour and movement’ and the ‘circus’.

The ‘substance’ of Australia’s economic future needs urgent attention.