Abbott and Shorten are snookered by Murray

The Murray report has handed the major parties the equivalent of a large arsenal of nuclear weapons. But in this case, it would be the decision not to use them that would bring about ‘mutually assured destruction'.

That's not likely. As paranoid PUP leader Clive Palmer suggested last week, the major parties prefer a world in which one or the other wins. Both see a two-party state as the natural order of things.

But the unexpected courage of Murray's recommendations bells the cat on a number of issues that, if not addressed, will drag down Australian living standards and therefore offer political opportunities to the minor parties.

In particular, Murray has called for reform of the tax breaks associated with negative gearing, capital gains, dividend imputation and superannuation contributions and distributions.

All these are skewing the distribution of wealth within Australia, and thereby pushing a large financial burden onto 20-something Australians.

And when voters see their own or their children's futures threatened, power flows to minor parties that promise solutions to the problems, without having to worry about forming or staying in government.

The minor party most relevant to the Murray reforms is Nick Xenophon's newly announced ‘NXT' party -- the ‘Nick Xenophon Team'.

That is because Xenophon's enduring popularity on the South Australian Senate ballot paper is based on his personal brand, which he rightly describes at being at the “sensible centre”. He sides with Labor and the Greens sometimes, and with the Coalition sometimes.

And unlike the Palmer United Party, which is watching a primary vote of 6 per cent withering to something more like 2 per cent, there is plenty of consistency in Xenophon's campaigns on everything from gambling reform to the grocery duopoly, the NBN and carbon pricing.

Consider, then, the possibilities with a hot topic such as superannuation tax concession. A scared Coalition and Labor could refuse to act on Murray's advice. Though it is not technically a ‘recommendation' of the report, Murray pulls no punches in describing the hugely inequitable use of Australia's ‘retirement income system' as something it was never supposed to be: a ‘wealth management and estate planning system'.

The report states: “... superannuation is seen as an attractive savings and wealth management vehicle for middle- and higher-income earners due to the highly concessional tax treatment of contributions and earnings ...

“Superannuation tax concessions are not well targeted at the objectives of the superannuation system ... Individuals with very large superannuation balances are able to benefit from tax concessions on funds that are likely to be used for purposes other than providing retirement income, such as tax-effective wealth management and estate planning.

“Poorly targeted tax concessions increase the cost of the superannuation system to government. In turn, this increases the fiscal pressures on government from an ageing population.”

Political parties targeting younger voters, as will NXT and the Greens at the next election, will not have a lot of trouble boiling that down into digestible slogans.

As Business Spectator pointed out in March, the current tax system has distorted capital allocation within the economy, locked up too much in the housing market, and created an almost impossible fiscal challenge for governments (Breeding a generations of tax slaves won't work, March 14).

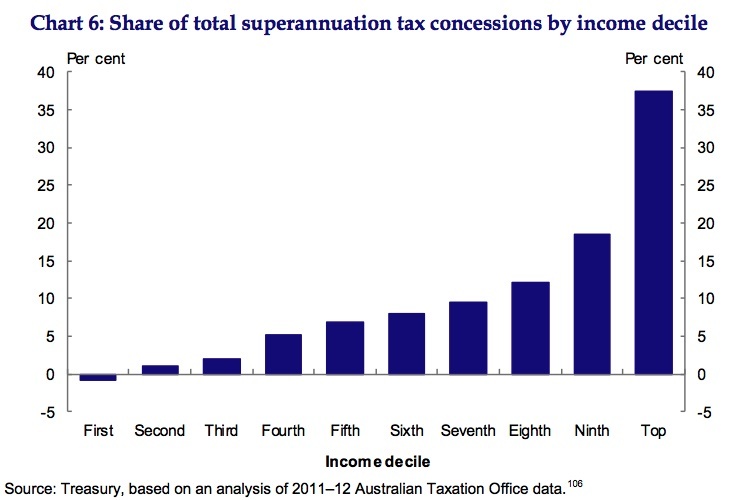

A 2013 report from the Grattan Institute put figures on the value of concessions being given to predominantly wealthier Australians (see chart below from the Murray report).

It conservatively estimated that the federal budget allows $6 billion a year in tax concessions on contributions to super funds; $3bn in concessions on fund earnings; and $7bn spent on paying a pension to people whose affairs are structured to be ‘asset rich' but ‘income poor'.

So far the Abbott government's budget repair task has focused on cutting spending, disproportionately impacting lower-income Australians.

That leaves the door wide open for Xenophon or the Greens, to tell younger voters that they are paying too much tax, while wealthier Australians are using the super system to ensure their children inherit more.

It won't be a hard sell.

Xenophon, who is currently vetting candidates, potentially for both upper and lower house seats ahead of the 2016 election, would be able to leverage his ‘sensible centre' position much more so than the Greens to ask why both parties have declared war on young Australia.

In short, Xenophon's existing political brand will make life very uncomfortable for the major parties if they do not find a bipartisan position to at least taper in changes to super concessions, negative gearing and so on.

Xenophon told Business Spectator yesterday: “If they don't make the Murray recommendations an election issue, they should be very nervous about the consequences.”

The pain inflicted by a cross-bench threat like Xenophon could literally tear their parties apart.

And if Clive Palmer is right about one thing, it's that the ‘power duopoly' won't let that happen.