A walk on the economic wild side

| Summary: The distance between economic fact and fiction is often not very far at all. Another surge in domestic house prices and a rebound in the Australian dollar to above parity are just some of the wild card outcomes for 2014. |

| Key take-out: A rally in the Aussie to new highs may occur if the Fed stops tapering and embarks on an even more aggressive round of quantitative easing, all while the Reserve Bank adopts a tightening bias instead of easing. |

| Key beneficiaries: General investors. Category: Economics and investment strategy. |

It is the time of year to think through a broad range of financial market possibilities and this report highlights some investment thoughts that could be considered as wild for the year ahead.

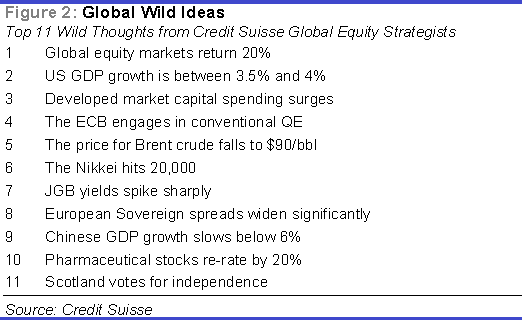

A wild thought is an event or idea that is not a core view but still remains credible and would have a disproportionate impact on stock prices. Our global equity strategists have compiled a list of 11 wild ideas for 2014. Meanwhile, our global sector analysts have come up with 70 more. Four more have been added to the list that are particularly relevant to the Australian investor. They include (1) Australian house prices rising by more than 10%, (2) the Aussie dollar appreciates back to post float highs (3) Australia develops a fully functioning credit market and (4) local companies become net-retirers of equity, not the world's biggest issuers as they were last year.

Global Wild List

In the normal course of business, we value sectors, companies and markets based on strict methodologies and valuation models to arrive at our central forecasts and investment views. However, any central case is surrounded by a range of outcomes and related risks. These are events that we may have had an inkling of, but sit in our peripheral vision rather than our central focus. While there is comfort sticking with the central path, this article attempts to be less conservative, and rather than forecasting what will likely happen focuses on the unlikely.

The most relevant of these for Australian investors is, of course, those with an Asian focus. The Chinese economy slowing to less than 6% GDP growth in 2014 will have painful implications for Australia. This is considered to be a hard landing, and perhaps the most similar event in the past was the Asian crisis in 1997-98. This was a period when the Australian equity market fell by 17% and the Australian dollar collapsed 32%. Perhaps, to the surprise of many, the Australian economy did not go into recession (two consecutive quarters of contracting real GDP) and this allowed companies to largely continue to pay dividends. The aggregate dividend per share for Australian companies fell by only 15% during the Asian crisis. By comparison, DPS fell by 26% during the global financial crisis.

A second of global wild thought that will have clear implications for Aussie investors is Japanese government bond yields spiking. The Aussie dollar would appreciate considerably if Japan goes through a funding crisis as more investors put on the yen carry trade, which includes a long Aussie dollar position. In addition, Japan remains Australia's second-most important trading partner and buys 17% of our exports. So any weakness in Japanese domestic demand will have obvious implications for Australia's external position.

1. House prices rise by more than 10%

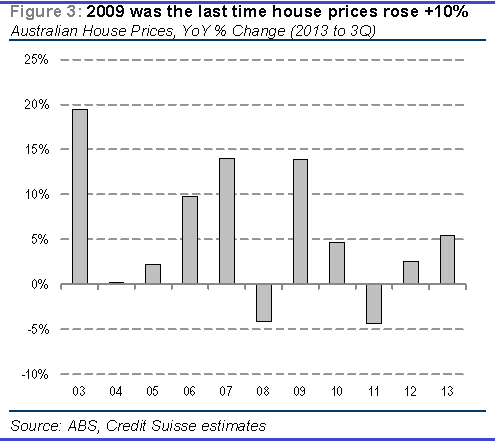

Australian house prices are already considered to be some of the most expensive in the world. However, a wild, but still credible, possibility is they increase by double digit amounts in 2014. The last time nationwide house prices rose by more than 10% was back in 2009 as they recovered from the financial-crisis driven downturn (Figure 3). Current consensus expectations are for house prices to rise modestly (0-5%) in the year ahead as the reflationary forces of lower interest rates and strong immigration will be largely offset by de-leveraging pressures.

There needs to be a combination of events that can potentially push nationwide house prices 10% higher over the next 12 months. First, the central banks need to cut rates a further 50-100 basis points and the banks need to pass this onto mortgagees. Second, unemployment does not materially rise from current levels even as business investment contracts. Third, the government remains lax about immigration and allows the population to continue to grow strongly. Fourth, authorities do not implement aggressive macro-prudential regulation. Finally, we need to see credit household use more credit in purchasing a property.

The increase in house prices will obviously be positive for those real estate companies holding property inventories like Mirvac and retailers that benefit most from a rise in housing transactions like Wesfarmers, Harvey Norman and JB Hi-Fi. The process of increasing household leverage will immediately be positive for the banks which are currently enduring subdued credit growth and the building material companies like CSR.

2. Currency appreciates back above 2011 highs vs the USD

The Australian dollar was one of the weakest currencies in 2013 depreciating by 14% against the US dollar. However, a wild thought is that the downward trend stops and the Aussie appreciates back above 1.10 vs the US dollar, which has been the post float high (Figure 4).

That was a time when investors were concerned about the potential emergence of a full-blown currency war. Currently, consensus forecasts are for the AUS/USD cross rate to end 2014 at US0.87. Our global FX strategy team forecasts US0.80, which is 10% below current levels.

A rally in the Aussie to new highs may occur if the Fed stops tapering and embarks on an even more aggressive round of quantitative easing, all while the Reserve Bank adopts a tightening bias instead of easing. Stronger Chinese growth will also help supporting higher commodity prices.

This scenario will obviously not be helpful for US dollar earners like Amcor, Ansell, Brambles, CSL and James Hardie. Higher commodity prices will, of course, support the miners. The small-cap miners have more operational leverage to rising prices. While there will likely be market wide earnings downgrades via those companies with international businesses, in the longer term a stronger currency may actually be good for Australian. A strong currency will force domestic businesses to become more productive and move up the value chain. There has been a long history, around the world, of companies adapting to a stronger currency and becoming more efficient, instead of moaning about the additional headwinds and remaining inefficient.

3. Australia develops a fully functioning corporate debt market

Perhaps our wildest idea is that Australia develops a fully functioning credit market, allowing investors to trade the asset without impediment. It is unusual that one of the most developed savings systems in the world does not have access to an asset that is a cornerstone of many allocations around the globe. Credit is higher yielding than government bonds and provides lower volatility than equities. The Murray Financial System review will no doubt look at the impediments to the development of the credit market in Australia. We expect the review to be released late in the year.

While the development of a corporate bond market will provide investors with more choice on where to allocate capital, it will be negative for the equity industry. We have seen in Europe over most of the last 10 years that the rise in the credit market has been at the expense of the equities fund management industry. So those listed fund managers in Australia that remain equity focused could be at risk of losing business. However, it will be positive for others like Challenger, which is at the forefront of developing an annuity product for investors. During the fledgling stages of previous credit markets around the world we have tended to see an explosion of LBOs. This was certainly the case in the US in the 1980s (remember Drexel Burnham Lambert?) and in Europe in the early 2000s. Many of the LBOs were again targeting smaller companies on the equity market.

4. Australian companies become net retirers of equity

In 2013 Australian companies were the biggest equity issuers in the world. On our calculation they grew their equity base by 3%, which is equivalent to $40 billion of net new paper that was absorbed by investors. This includes IPOs, rights issues, dividend re-investment plans net of mergers and acquisitions involving cash or a non-listed acquirer and buybacks. By comparison, US companies were net-retirers of equity (Figure 1). Standard & Poor's reports US companies bought back around $500 billion of their own stock last year, which more than offset some of the biggest IPO issues in the world. Part of the difference in Australian and US equity market performance last year can be explained by equity issuance. There was growing investor demand for equities in both markets, but in Australian more of this demand was tapped by new paper.

This is a hopeful wild thought as investors in Australia remain dividend focused. The tax system favours companies returning cash via dividends instead of buybacks. However, dividends are not always the best way of returning capital, especially when the cost of equity is high and the cost of debt is low. To have a material pick-up in buybacks and cash M&A there needs to be a combination of a lower cost of debt vs equity and strong free cash flows.

Companies who have been consistent equity retirers via buybacks have tended to outperform in the US, so the same can happen here too. Meanwhile, small caps will no doubt benefit if M&A picks up as these companies make for easier acquisitions vs large caps. A drop-off in IPOs and rights issues will of course be negative for investment banks.

This is an edited version of a report published by Credit Suisse research analyst Hasan Tevfik.

* This article is part of the “It's Time” series in Eureka Report focussing on new opportunities for investors in 2014. Click here to see the entire series.