A small world growth outlook, after all

The Organisation for Economic Cooperation and Development, much like the Reserve Bank, expects below trend growth for Australia over the next couple of years. But the global recovery is set to continue, albeit at an incredibly slow pace.

The OECD says that global activity and trade is set to strengthen gradually in 2014 and 2015, but the recovery will remain only modest. According to the OECD, the modest recovery reflects the continued flow through of improving financial conditions, loose monetary policy and reduced drag from austerity measures.

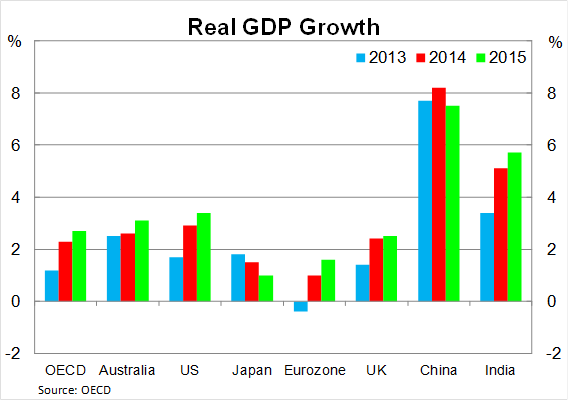

For Australia, the OECD expects growth to remain moderate at 2.5 per cent in 2014, before picking up to 3 per cent in 2015. Forecast growth by the OECD is right in the middle of the range provided by the Reserve Bank in its recent Statement on Monetary Policy.

The OECD stated that in the absence of inflationary pressures, loose monetary policy will be necessary to sustain demand once the mining investment boom comes to an end. It also said that it was important to avoid any additional fiscal tightening beyond that currently factored in. But it added that improving our fiscal deficit to allow for greater fiscal manoeuvrability was welcome.

The OECD believes that the risks for the Australian economy seem balanced, with uncertainties over the pace of Chinese growth and commodity price developments the main concern. I’d actually argue that US monetary policy is the biggest risk for the Australian economy right now, particularly given the necessity of reducing our currency. On balance, the outlook from the OECD is very similar to that produced by the Reserve; although notably it said little about the Australian dollar.

The OECD expects that the US recovery will gather momentum to the extent that the unemployment rate and output gap will decline, while the fragile recovery in the eurozone will make little dent in the high level of unemployment throughout the region. It believes that the unemployment rate in the US will drop to 6.9 per cent in 2014, before falling to 6.5 per cent in 2015. By comparison, the unemployment rate in the eurozone is expected to remain at around 12 per cent over the next two years.

The OECD projections point to tapering of the Fed’s asset purchases in 2014, although monetary policy is set to remain exceedingly accommodative throughout Europe. In my view, the key for the US is how quickly it winds back its asset purchase program. To avoid disruption in financial markets, the purchase program should be wound down in a slow but steady manner that allows markets to adjust without the rug being pulled out from under them.

In Japan, the OECD expects growth to slow in by 2015 due to fiscal consolidation. In 2014, the Japanese government will raise the consumption tax rate for the first time since 1997; this will be accompanied by fiscal stimulus of around 1 per cent of GDP to smooth the effects of the tax hike. The OECD appears particularly concerned about the high level of Japanese government debt.

Growth in China is set to pick up in 2014, before softening to 7.5 per cent in 2015. However, the OECD noted that potential GDP growth in China has slowed markedly in recent years and this will weigh on the economy in the years ahead.

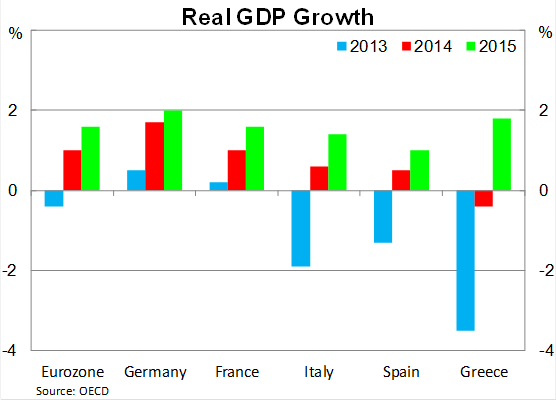

Deleveraging, weak bank balance sheets and tight credit conditions will continue to weigh on the eurozone, although growth is expected to recover modestly. The OECD notes that fiscal consolidation should continue as planned but automatic stabilisers should be allowed to operate fully to avoid undermining the fragile economic recovery.

Economic activity will recover in most eurozone economies in 2014 and 2015 but private demand will remain modest in most countries, with high unemployment, weak income growth and tight credit conditions providing a headwind to activity. The graph below shows the major eurozone economies plus Greece; personally I am a little more bearish on the eurozone recovery and less convinced that growth will rebound significantly without a bigger improvement in labour market conditions.

The OECD outlook was fairly similar to the Reserve Bank’s analysis a couple of weeks ago. There remains considerable uncertainty surrounding the global economy, particularly Europe and the United States – and specifically with regard to the debt ceiling and ‘tapering’ discussions. As I have mentioned previously, growth in Australia is intrinsically tied right now to policy decisions in the United States and our economic outlook will improve markedly if the Fed decides to taper sooner rather than later.