A small miner you dare not miss in 2014

Altona Mining (AOH) looks to be on a new upcycle that could see the emerging copper producer rally a further 25% or so over the coming months.

Recent price action shows the mining junior is starting to win back investors after coming through what can only be described as a very challenging 2013, during which the company lost nearly half of its value.

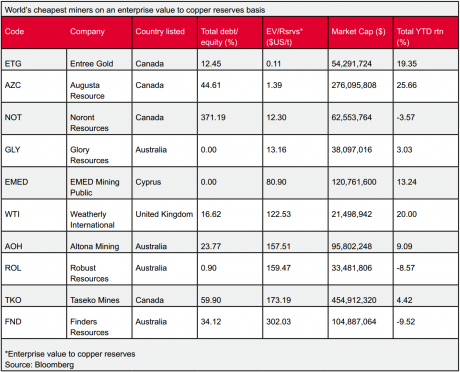

The battering has left Altona placed as one of the world’s cheapest copper miners. According to data compiled from Bloomberg, Altona is trading on an enterprise value (EV) to copper reserves that is under $US160 a tonne compared with the sector’s median of $US1,200 a tonne.

But “cheap” isn’t usually enough to attract investors. After all, stocks are usually cheap for good reason, and embattled shareholders would remember how Altona was de-rated by the market this time last year when Xstrata Copper decided not to exercise its option to purchase a 51% stake in the junior’s Roseby project in Queensland.

Xstrata’s decision coincided with broader market fears that mining juniors would be unable to raise capital to fund the development of projects due to the gloomy outlook for hard commodities.

Against this backdrop, the stock was knocked off its perch of 30.5 cents at the start to 2013, and had been range bound between 16.5 cents and 13.5 cents since June to early January 2014.

However, Altona’s valuation is becoming increasingly hard to ignore and it’s likely to be one of the stocks leading the charge upwards when the small mining sector rebounds later this year – an event we are tipping for in 2014.

Outside of the commodities outlook and investor confidence, there are a number of other tailwinds that are expected to drive interest towards the $95 million market cap miner.

The latest positive development is management’s move on January 6 to cut its debt by more than half to $US10 million from $US20.5 million. The early debt repayment was funded from cash reserves and the closure of Altona’s gold hedge book, leaving the miner with $18.5 million in the bank after the transaction.

The move has lowered Altona’s risk profile and the market responded positively, sending the stock to 17.5 cents a share, which is comfortably above the 16.5 cents psychological level that had capped its advance for more than six months.

Another positive for Altona is profits. Its Outokumpu copper-gold project in Finland helped it post a $12.6 million maiden annual net profit last year.

While Altona is still seen as a risky investment due to its small single-mine operation, Outokumpu has been delivering ahead of expectations. What’s more, the latest drill result shows that the ore body could be materially bigger than initially thought.

Altona announced in November that the main deposit at the Outokumpu project, called Kylylahti, extended below the 650 metre mark. Drilling 108 metres below the bottom of the deposit found 2.4% copper and 1 gram of gold per tonne.

Management is considering expanding production by 27% above the feasibility study design for Outokumpu to 700,000 tonnes a year.

Outokumpu is also one of the lowest-cost copper producers among its Australian-listed peers. The C1 cash cost (which includes the costs of mining, milling and concentrating, on-site administration and general expenses, property and production royalties not related to revenues or profits, metal concentrate treatment charges, and freight and marketing costs less the net value of by-product credits) came in under $US1.50 a pound in the September quarter compared with costs of over $US2 a pound for Oz Minerals (OZL) and PanAust (PNA).

It’s still too early for analysts to increase their valuation of the stock as further drilling is needed, and the Roseby project is up in the air. Roseby is still the main game for Altona given that Roseby has an estimated total resource of 1.5 million tonnes of contained copper compared with Outokumpu’s 100,670 tonnes.

But even then, the stock is still looking good value as it is trading on a consensus price-earnings multiple of around six times for the current financial year and is comfortably below the average broker price target of 31 cents.

One also cannot write-off the prospect of Roseby ever being developed. Chinese investors are keen on doing deals and will likely step up efforts this year. Altona may yet find a partner to shoulder the $320 million capital cost required for the project.