A-REITs: Building income returns

| Summary: Income investing is the overriding theme for many investors, especially with interest rates at historical lows. And, after a rough period during the global financial crisis, listed Australia Real Estate Investment Trusts (A-REITs) are proving popular once again as a reliable source of income generation. |

| Key take-out: Correlations with the broad market returns have been rising over time. This could be the result of their ongoing integration into the sharemarket or the current “yield appeal” of the sector in a low interest rate environment. Investors increasing their exposure to the sector should be aware that the volatility of the sector is greater than non-REIT companies and, in times of downturns, could be greater for A-REITS. |

Key beneficiaries: General investors. Category: Investment portfolio construction. |

In the dark days of the global financial crisis the Australian Real Estate Investment Trusts (A-REITs) sector was on very shaky ground, with a number of large listed entities coming close to toppling over.

It was an A-REITs disaster story in the making, brought about by poor management decisions and bad property asset purchases, which combined with the wave of global investor panic that flowed from the GFC.

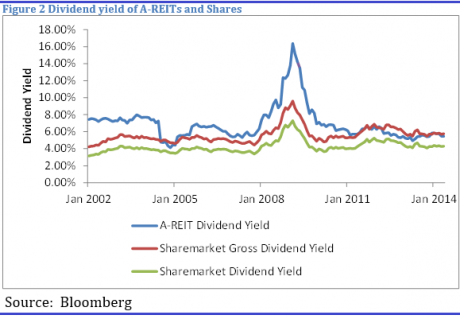

Now, five years later and after extensive fiscal reconstructions across the sector, A-REITs are back in vogue with investors. Their key attraction is in providing a source of reliable and consistent income, which is relatively higher yielding than some other asset segments. In fact, many are paying high yields comparable to the grossed-up yield of the broader sharemarket, although their yields are unfranked.

A-REITs can trade like shares, especially in downturns, but their high relative yields may provide some downside support to A-REIT prices in the event of future market volatility.

REITs in Australia

The REITs market in Australia has been evolving since the 1970s and has become quite complex and sophisticated relative to global REIT markets due to the concept of stapling. Securities stapling is explained further below in the section, “The stapling phenomenon”.

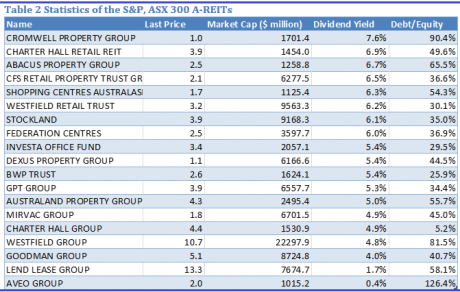

Investors have plenty of choices. Indeed, the total number of listed A-REITs is 50, with a combined market capitalisation (market cap) of close to $100 billion. The S&P ASX 300 A-REIT Index consists of 19 securities with a market cap of approximately $86 billion, which is about 6% of the market cap of the sharemarket (S&P, ASX 300 Index).

The top five companies are more than 50% of the market cap of the A-REIT sector. Indeed, the A-REIT sector has been criticised for being too concentrated and dominated by a few players such as the Westfield companies, Stockland Trust and the Goodman Group – with the Westfield Group having a market cap of about $20 billion. The smaller A-REITs range from market cap of under $1 billion to over $5 billion.

Limited investment opportunities in Australia due to institutional grade property already taken up by superannuation funds and REITs did lead A-REITs to seek offshore property and non-core businesses during the lead-up to the GFC.

Nevertheless, A-REITs are integral to the investment markets by providing retail investors access to high-quality Australian commercial property, allowing flexibility and liquidity of investments by being listed on the ASX and providing some yield benefits based on the regular distributions.

A-REITs and yield

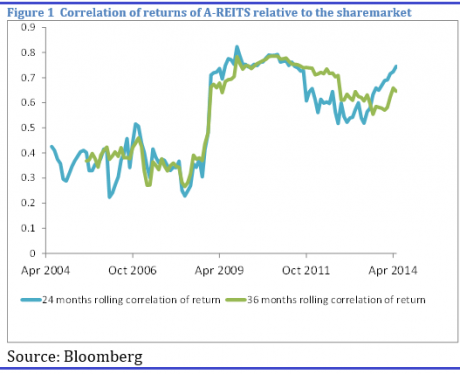

Investors have treated A-REITs as a separate asset class providing an easier, more liquid entry into the commercial property sector. This is despite the fact they are listed on the ASX and may be considered to be equity, due to the relatively higher volatility of returns (18% for A-REITs versus 13% for shares) and increasing correlation of returns over time with the broad market (see figure 1).

Over the short term A-REIT prices have not been as correlated with the sharemarket – after recovering from the lows of 2008, the growth in A-REITs’ prices has been subdued and they have underperformed the broader market year-to-date and also in 2013.

The growing popularity of A-REITs in more recent times has been due to the relatively strong yields paid by some of the companies in the sector.

The overall sector pays a yield of 5.3% (figure 2), although some companies in the sector have yields closer to 7%. However, distributions are predominantly unfranked due to the company tax-free nature of the payments.

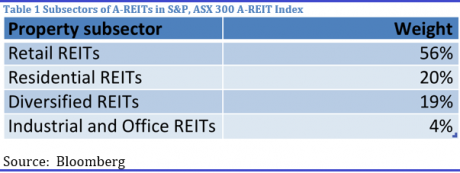

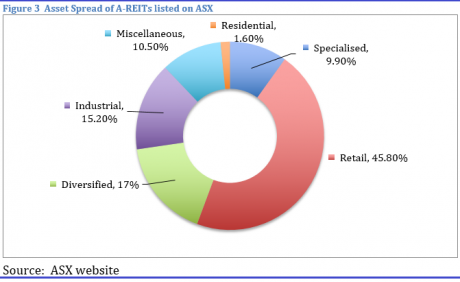

While the recovery in the residential property market may have encouraged some investors to buy A-REITs, approximately 80% of the listed trusts are exposed to retail, industrial and commercial property (see table 1 for subsector weightings).

The impact of the GFC

Pre-GFC days saw REITS as relatively passive investments with steady rental streams providing regular income to investors. The traditional REIT was predominantly involved in property investment, not actively managed and had a high payout ratio of around 90%. This resulted in a yield higher than the broad sharemarket, and A-REITs continue to pay higher yields than the unfranked yields of non-REIT companies.

But, in the period of low interest rates leading up to the GFC, many A-REITS invested outside their mainstream businesses and payout ratios in some cases exceeded 100% of underlying earning, helped by the accessibility of easier money.

When the GFC hit, the shares in the A-REITs sector suffered extreme volatility – and were even more volatile than their global counterparts. The negative sentiment leading to the sell-down was due to many companies carrying high levels of debt, facilitated at the time by low interest rates and by their endeavors to continue to meet high payout ratios. Also, the involvement in non-property activities was enabled by the stapled structure of many of them – so other businesses that were non-property related could be combined under the REIT structure.

The stapling phenomenon

Stapling involves a trust holding the assets of the company, and one or more associated companies, and managing the assets, which are bound together through one vehicle. The REIT regulations only apply to the segment of the company that adopts the REIT model under the stapled vehicle. Other assets under the stapled structure do not require compliance to REIT regulations.

Stapled structures may have contributed to the big sector losses experienced in 2008, which involved investments in less profitable, non-core businesses, and high levels of debt.

Stapling is predominantly an Australian phenomenon, with about 90% of the sector’s market capitalisation stapled. The rational in other countries to prevent stapling is that it reduces the income tax base for governments – most income earned under the REIT structure is tax-free (see “Why Stapled Securities?” by Professor Kevin Davis, June 2012, Australian Centre for Financial Studies).

A-REITs are “pass-through” entities for tax purposes, as income received is not subject to company tax as long as it is paid out to investors. But this income paid out as distributions is taxable in the hand of the investors at the personal income tax rate (or in the case of superannuation at the 15% rate applicable). Income tax payable on distributions can be deferred if the distribution paid is considered a return of capital. This reduces the cost base of the investor, but capital gains tax may be payable when the security is sold.

In Australia the dividend imputation system results in reduced tax paid at the investor level – due to the tax credit an investor may receive, being the difference between the company tax rate and the investors’ income tax rate. So this reduces the incentive for the Australian government to legislate against the stapled structure, as investors pay tax on distributions from A-REITs at their personal income tax rate.

It is evident that some A-REITs are still carrying on operations outside of core property activities. Although under the REIT structure property related assets must represent at least 75% of total assets, there is still sufficient flexibility to engage in other activities, especially under the stapled structure, that include funds management, asset management, and non-core property development.

Another important issue is the level of debt carried by A-REITs. Debt reached historically high levels for some companies in the lead-up to the GFC. Since the sector’s restructuring, including the selling of non-core assets and capital raisings, A-REITs’ debt has fallen back to more conservative levels in most cases. But, as A-REITs are only required to report consolidated gearing – “look through” gearing, which includes the gearing of associated companies under the REIT structure (off-balance sheet), may not be reported. The result of this is that gearing may be higher than what is actually reported.

A-REIT investment options

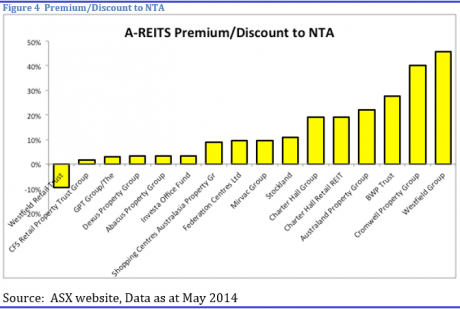

As mentioned previously, there are about 19 A-REITs in the S&P ASX 300 A-REIT index (see Table 2). The larger A-REITs (by market cap) have lower yields than many of the smaller A-REITs, as their share prices have moved up and are trading at larger premiums to their net tangible assets (NTA) after trading at discounts for a few years after the GFC.

Capital growth from A-REITs is less likely going forward, as most are trading at premiums to their NTAs (Figure 4.). The dividend yield or distribution from most A-REITs will be the majority of the return going forward and the higher yielding securities are compensating for a higher risk premium on the back less certainty about their structure and operations.

Exchange-traded funds (ETFs) are another option for investors interested in an exposure to A-REITs. There are currently three ETFs trading on the ASX that are exposed to the Australian property sector, with Vanguard’s ETF offers the most diversified exposure to A-REITs by tracking the broader S&P ASX 300 A-REIT index.

Conclusion

A-REITs can provide a source of reliable and consistent income as well as being relatively higher yielding.

Correlations with the broad market returns have been rising over time. This could be the result of their ongoing integration into the sharemarket or the current “yield appeal” of the sector in a low interest rate environment.

Investors increasing their exposure to the sector should be aware that the volatility of the sector is greater than non-REIT companies and, in times of downturns, could be greater for A-REITS. This occurred during the GFC.

A-REITs do provide a more liquid way to gain exposure to good-quality commercial real estate.

Since 2008 the companies have generally reduced gearing, focused on their core property businesses, and may continue to provide some reasonable and stable returns for investors.