A rate cut won't cut it for investors

PORTFOLIO POINT: Investors won’t get a major boost from another interest rate cut, and lower rates won’t do much to weaken the Australian dollar.

Judging from the “commentariate”, the Reserve Bank of Australia will soon embark on another round of interest rate cuts – a weaker Australian dollar being either an explicit goal or a desirable consequence.

As unorthodox as this would be, for an inflation-targeting central bank faced with the strongest growth in over five years, the precedent has already been set. So this commentary has to be taken seriously – and it is. The futures market predicts an 80% chance of a cut at tomorrow’s meeting – and if not then, in November.

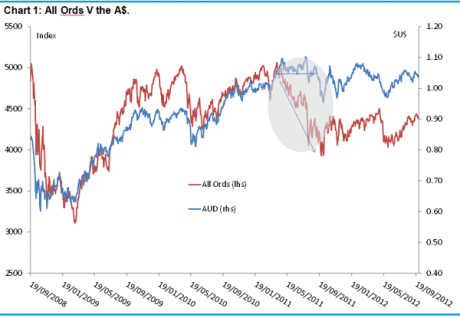

Now the theory, and certainly the hope, is that as the RBA cuts the A$ will weaken, offering exposed businesses and exporters much-needed relief. The strong A$ in turn has been cited as a major reason why the All Ords has underperformed US markets. The argument here is that the high unit is putting investors off the Aussie sharemarket – too expensive. It sounds logical enough.

Unfortunately there are three reasons why, notwithstanding my generally bullish view, investors who hope lower rates might weaken the A$ and boost the All Ords will be disappointed.

- Firstly, interest rate cuts are unlikely to lead to a sustained decline in the currency.

- Secondly, I’m not sure the high A$ is actually weighing on stocks, nor for that matter are ‘high’ interest rates.

- Lastly, the economic impact of lower rates will be immaterial. The confidence boost that lower rates usually provide are yet to be seen and will be offset by events offshore in any event. Indeed history suggests that confidence is likely to deteriorate from the very fact that the RBA is lowering rates –seemingly confirming a weak economy.

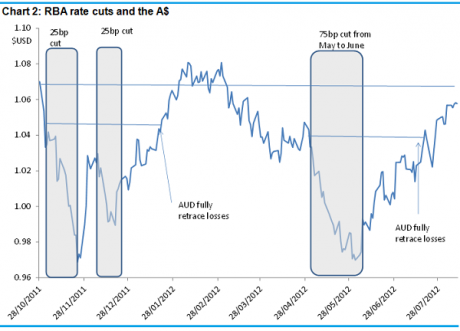

To see this, take a look at Chart 2. It shows the A$ with the RBA’s rate cuts mapped on. The RBA board has cut rates at four meetings so far, for a cumulative 125bp worth of easing.

Now, in each case, the A$ did weaken post the decision. Dramatically in some cases, and while there may have been other things going on at the time, which also weighed on the unit, the fact is the A$ did weaken.

It’s important to note, however, and as you can see in the chart, that the fall proved to be nothing other than a transitory phenomenon. Indeed, since the RBA commenced this easing cycle back in November 2011, the A$ has almost fully recovered to its pre-cut position.

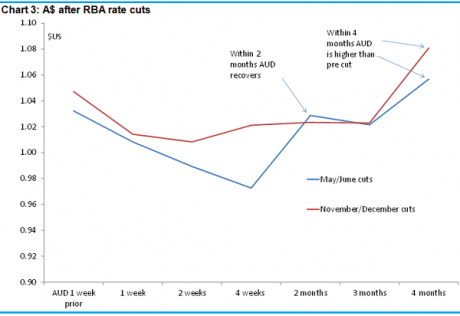

You can see this illustrated again in Chart 3. Note that the RBA seems to like cutting at consecutive meetings, so I thought it might be good to look at the combined impact. At the two and four week period, the market is only dealing with one rate cut – and in each case the A$ is indeed weaker. The full effect of both rate cuts is felt between the one and two month mark.

As you can see from the chart, during this period, there really is no discernible impact of lower rates. At best it is marginal and, as mentioned, by the fourth month the currency is actually higher on each occasion. So as we start the merry month of October, the A$ is not too far from where it was prior to the November 2011 rate cuts, when the cash rate was 125bp higher. It’s quite clear then that lower rates have been unsuccessful in lowering the A$.

Having said that, and a broader point, it’s not clear to me that the A$ is or was actually weighing on stocks to start with – well very much. Refer to Chart 1 again for a minute. You can see that from May 2011 there was an abrupt move in the All Ords away from the A$, seemingly supporting the view that the dollar was weighing.

But, and this is a big but, prior to that, investors were quite happy to keep buying stocks as the A$ pushed first through parity, then all the way through $1.05. There was a very strong correlation. Even when the currency hit $1.07 there were still buyers and the market pushed higher. It’s only when the A$ approached $1.10 that paths diverged.

It could be, as some have suggested to me, that $1.10 was some psychological threshold. The straw that broke the camel’s back as it were. But then if that’s true why didn’t the All Ords recover as firstly, the A$ stabilised, and secondly, as it declined through to September. Was this because of global growth fears through that period? Certainly that would have weighed but our market would have at least outperformed global markets if the high A$ has been a problem previously. And it didn’t.

Think back to that period. It was late July 2011 when global markets started to tank again. By that stage the All Ords had already lost 8%. The All Ords went on to lose another 15-16% in the global rout to September, only slightly less than the S&P500 which lost about 17%. Moreover, by late October the S&P500 was only 5% lower than before the global rout, while the All Ord’s was still down about 14% -- even though the A$ had declined from $1.09 to about $1.03 on average through October.

Now remember from January to March 2011, the market had no problem bidding the All Ords up while the A$ was at $1.03, and kept doing so all the way to $1.07. The All Ords was closer to 5000 then.

So no, I don’t think the A$ has had much of a part to play.

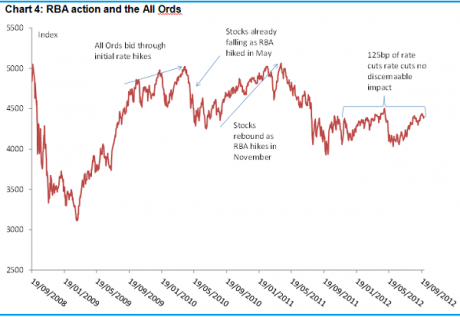

What about high interest rates? Again I think the evidence shows that the answer is still no. So, for instance, the All Ords received a decent bid through the initial phases of the RBA’s tightening cycle (see Chart 4 below) and while most gains were put on well before the rate trigger was pulled, an additional 6% was added on after.

Even as the RBA hiked in November 2010, stocks pushed higher and didn’t appear to lose any momentum apart from an obvious dip around March 2011 (floods and Japanese earthquake).

May 2011 is an important departure point for some reason– it’s as if there was some kind of regime shift around that period – a one-time shift in investor behaviour that took place. It wasn’t high interest rates or the dollar – that much we know. Similarly, global fears were certainly around, but as mentioned the S&P500 remained higher (broadly steady) right up to July (same with the Dax). Indeed iron ore prices were hovering around record highs!

In the absence of any other casual factor I suspect the real reason for the market’s underperformance was the rising pessimism on the Australian economy that began around that period. This pessimism hasn’t really gone away despite data repeatedly showing how false this view is/was and despite rate cuts to date.

Think back to that period. So many people were talking things down – talking us into a recession. We had business leaders, the associations that represent them, union leaders and, eventually, economists from the major global and domestic banks, repeatedly talking the economy down. That obviously weighs on investor sentiment and is the key explanation, alongside woeful management, as to why our market has performed so badly.

The economy, as we know, is actually running at its fastest pace in about five years, with domestic demand well above trend. Will lower rates mean even faster growth? Not at this stage is the best bet. Economic growth is already very broad-based, and it’s not clear where the additional strength will come from.

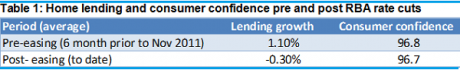

The housing sector, for instance, is unlikely to rebound. Indeed, since the RBA cut rates lending growth has slowed and consumer confidence is unchanged, having spent most of the time being significantly lower.

In summary then, the RBA is soon expected to cut rates but investors will find little support from such action. The A$ will likely remain little changed, and while growth will remain strong, history suggests confidence is unlikely to lift, especially with the looming fiscal cliff.

Moreover the housing sector, and confidence more broadly, if it hasn’t benefitted already, is unlikely to do so. The best we can hope for on the housing front is that prices will continue to recover under the weight of tighter supply – housing construction is very weak after all.