A market dip at June 30

|

Summary: The market has risen over the course of 2016-17. We analyse the driving forces behind the big moves on the Australian stock market over the financial year, with exclusive commentary from CommSec's chief economist, Craig James, and global investment banks. |

|

Key take-out: The Australian stock market is up around 10 per cent from this time last year. Investors shouldn't be concerned by the sea of red at June 30, as there hasn't been much to complain about herein, apart from underperforming telecoms, property trusts, automotive and select consumer discretionary stocks. |

It might not have always felt like it, and it might not look like it right now, but it's been an exceptional financial year for Australian shares on the whole.

A sea of red swept the local market on the last day of the financial year, though it's unlikely to be a sign of worse to come. One fund manager offers the view, that in light of more hawkish central banks, this is "reversion from an interest rate perspective". Other strategists believe it comes down to the grounding of high-flying US tech stocks, or just end-of-quarter general book balancing.

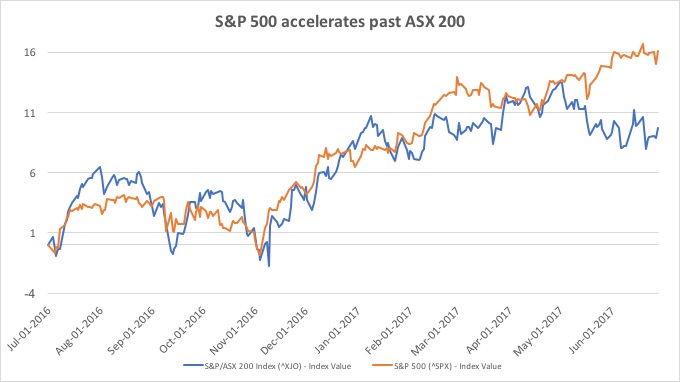

The Australian stock market has come a long way in 12 months though, and while it might be lagging its global peers, the local market has just come off its least volatile financial year in 16 years. That's according to analysis by Australia's largest retail broker, CommSec.

There's been only 32 days since July 1 the market has risen or fallen by more than 1 per cent in a day. That's the lowest result in 12 years.

Craig James, CommSec's chief economist, tells Eureka Report that “the year has been remarkable for being unremarkable”.

“Our analysis shows that we haven't seen investors getting irrationally exuberant or optimistic despite Trump, Brexit and any other big moves. It's a much tighter range than what's historically been the case,” says James.

We started the financial year with 5327 points on the All Ordinaries index, and total returns on Australian shares have since outstripped even property. The All Ords ends the year up around 10 per cent.

That hasn't stopped some analysts calling the local market “anaemic” recently in comparison to higher-performing peers like the US. After a spell of Trumphoria, which lasted from November 2016 until early in the new year, the ASX came down. The comedown wasn't all too sharp, but the local market has been a little muddled since, as it distances itself from the US.

But the ASX has still far outperformed other commodity-centric markets like Canada, Qatar, South Africa, Saudi Arabia and Brazil. It's been a wild ride for oil and iron ore everywhere, and a most interesting one for gold, which fell on Trump's election but gained with a weakening Australian dollar.

Consumers crunch away

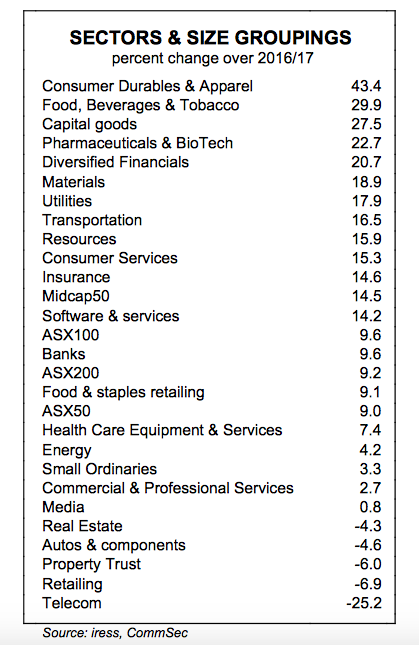

Looking at the ASX on a sectoral basis, there's not much to complain about, unless you're overweight in Australian telecoms, select retailers, property trusts and automotive.

The table to the right paints a picture of a consumer shopping spree, but as James notes, the top performing sector is skewed and underpinned by a couple of companies like Breville, Fleetwood Corporation and GUD. At the other end of the spectrum, an assortment of hard and soft goods retailers have fallen quite heavily, accounting for a 6.9 per cent drop in CommSec's general retailing sector.

By any measure, the worst performing group is telecommunications by far. Telstra takes the lion's share here, but TPG Telecom and Vocus Group were hit hard too. Telstra's competitive advantage in the mobile space is waning, and new entrants into the broadband market like TPG are poised to take market share.

By any measure, the worst performing group is telecommunications by far. Telstra takes the lion's share here, but TPG Telecom and Vocus Group were hit hard too. Telstra's competitive advantage in the mobile space is waning, and new entrants into the broadband market like TPG are poised to take market share.

Consumer staples stocks, such as Woolworths and Wesfarmers, have improved over the past year, but discretionary counterparts, like Harvey Norman, have dropped off. And all of this could be attacked by Amazon, which some analysts have likened to a “category killer” and “digital monster”.

…Or is it a consumption crunch?

In light of recent performances, Australian equity strategists at investment bank Morgan Stanley think a “consumption crunch” appears to be playing out.

The strategists say discretionary spending is being impacted by falling incomes, cost of living inflation and broadening credit rationing.

Overall, Morgan Stanley is “cautious” about the consumer outlook and thinks it will be “difficult for consumers to continue to live at or beyond their means”.

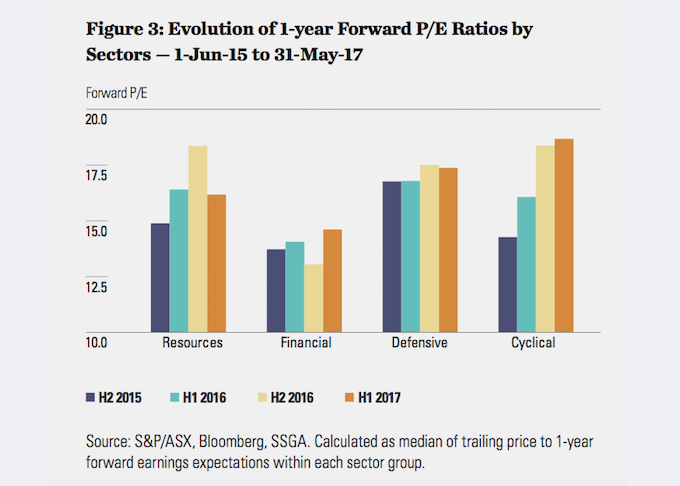

Toby Warburton, head of active quantitative equities at investment bank and fund manager State Street Asia-Pacific, says the zig-zags we've seen in the market this calendar year are reflective of "investors digesting political news and a US growth story".

Warburton thinks the market gains in tandem with "a realisation policies are changing", but with the market falling ahead of June 30, this shows "investors are a little worried" about the reality of this narrative.

"There's a number of different things at play. This includes more hawkish comment, not just from US, but the ECB, and Bank of England, and also perhaps a realisation we are coming to the end of this loose monetary policy cycle around the world," says Warbuton.

"It won't be a sudden tightening, but it's the beginning of the end. And I'm not sure the market really thinks the economy is ready for interest rate rises; we want to get back to a normal environment, but there's a question as to whether we are actually ready to get there."

The State Street chart below shows that increasing valuation multiples have driven prices higher, particularly within more cyclical sectors. State Street believes these sectors - like utilities and real estate - could be outstripped more than anything else in the future as they are "typically sensitive to interest rate rises".

Big banks make big moves

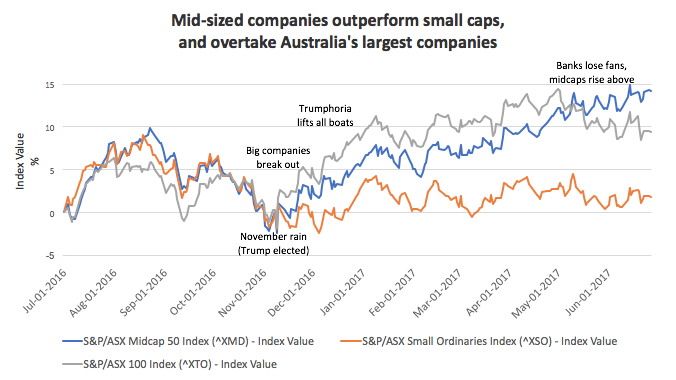

At the top end of town, fortunes have changed at our banks recently which, along with resources, are the bedrock of the local index. After paying out half-yearly dividends and reporting $30 billion in profits, there was a flurry of profit-taking at the banks last month. Investors are concerned over high valuations, housing exposure and a narrative-changing Government which has slapped Commonwealth Bank, Westpac, ANZ, National Australia Bank and Macquarie Group with a new levy.

Our four biggest banks make up around 25-30 per cent of the ASX 200 altogether, so a drawdown will always punish the benchmark local index. However, in spite of setbacks, the S&P/ASX 200 Banks index has actually gained around 10 per cent since July 1 last year.

As well, a silver lining for some investors is that mid-sized companies now appear to be back in favour.

Gold shows its shine

Whether it's geopolitical, or driven by fundamentals, commodities have been benefitting either way. As a sector, the S&P/ASX 200 Resources index has rallied more than any other groups over the past 12 months, up around 20-25 per cent.

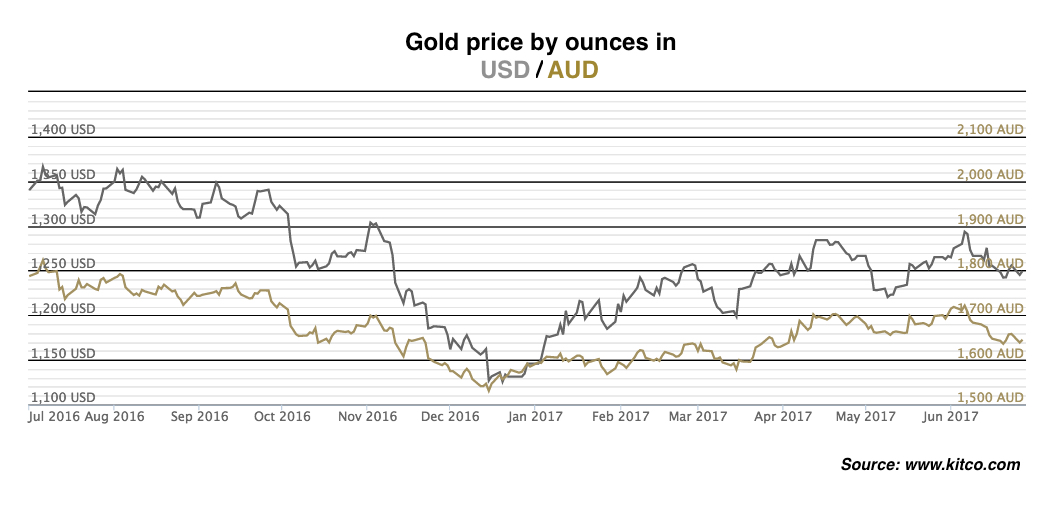

The price has looked right for gold buyers lately, and through geopolitical tension, the safe haven has gained steadily, but surely. Gold has moved erratically over the past 12 months though, from a high of around $US1370 an ounce almost a year ago to a low of $US1125/oz in late December, and is now back up to around $US1250/oz. A chart below from Kitco shows how this has played out.

For Australian gold miners, price moves have been amplified by changing currency values. The gold price hit an all-time high of $A1823/oz in early July last year when the exchange rate was lower at US72.5c. This price is heavily influenced by the US dollar and exchange rate, but fresh capital for exploration continues to roll in, and conditions are said to be better than ever for local gold miners who are almost all profitable at these high price levels.

Peaks and troughs

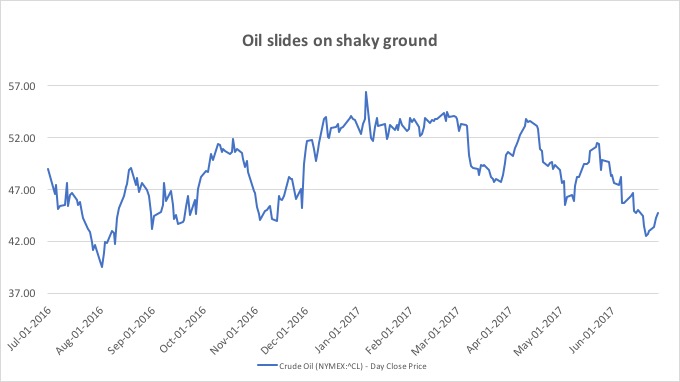

After a strong 2016, prices for oil and iron ore approached one-year lows in the past two weeks.

But iron ore has just entered a bull market, rallying more than 20 per cent since mid-June. RBC Capital Markets expects Chinese mills will seek to boost output, which will drive demand for higher-quality ore. Oil, on the contrary, has been slipping at the helm of OPEC producers. There's been a string of meetings discussing production cuts for the oversupplied market.

CommSec's James says iron ore prices are “relatively healthy” where they are at the moment, if China continues to chug along. However, overall, he thinks “it will be hard to see price growth” in commodities.

“Looking over the next 12 months, what investors will be looking for is continued improvement in the global economy which will drive demand for resources,” says James.

“Another good thing happening in resources in general sector is companies will continue focusing on productivity and enhancements, improving efficiency, and reducing costs, and that's producing better bottom lines.

“China certainly continues to remain upbeat about its prospects, and looking at the other countries throughout Asia, the outlook looks quite encouraging.”

What's next?

James is optimistic about the year ahead, on an equities and consumer level, bucking the view of some investment banks like Morgan Stanley.

“I suppose what consumers are doing at the moment is fretting a little that wages aren't growing at the same extent as they were in the past, and if you look at wage growth and compare that with inflation, the household consumption deflator, wages are still outpacing prices,” said James.

“People are fretting over wage growth rather than looking at what they can buy with it.”

James expects a tighter job market to put upward pressure on wages, which will “be good news for a range of stocks in the consumer sector”.

It would have taken a crystal ball, at the very least, to foresee the macroeconomic swings and roundabouts of recent times, including a slew of shock political moves.

The financial year began following Brexit, then there was a local election, a US election, and a raft of European elections. There were concerns this would bring more political instability than markets could absorb, but for the most part, politics drove indices higher. Even when outcomes were unexpected.

Despite this, CommSec hit the nail on the head with its point forecasting.

“Looking at the screen right now, we have met our original forecasts for the All Ordinaries being between 5700-5900 points at this time of the year. Our expectation for the next 12 months is we will get to somewhere between 6000-6200 points by June (2018),” says James.

“Certainly, the last 12 months has gone to script, according to our forecasts, and we don't have too many reasons to pour over the forecasts even further. We are pretty comfortable with the outlook we have for the next 12 months.”