A house-price curse for retirees

Clive Palmer is onto something when he repeats, ad nauseum, the tale of the old ladies who visited his electorate office to complain they couldn’t afford their weekly movie ticket, coffee and chocolate cake any more.

They eat cake. They vote. And Palmer has declared many times that he didn’t get into politics to deprive old ladies of their cake.

Well two things need to happen. First, Palmer needs to show a bit more imagination and start telling a few other anecdotes before we all fall asleep.

Secondly, Australia is going to have to wake up to some unpleasant truths about the superannuation system and its inability to provide for a growing number of retirees (How Keating’s super plan missed its target, August 29 http://www.businessspectator.com.au/article/2014/8/28/politics/how-keatings-super-plan-missed-its-target).

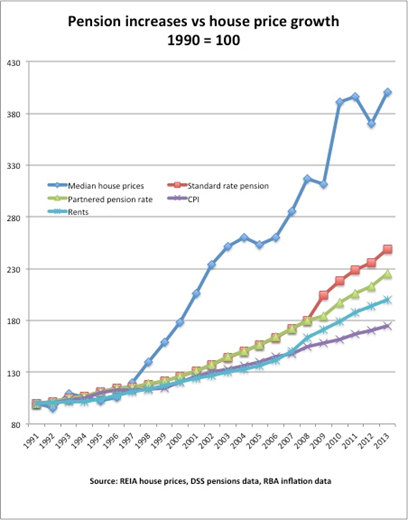

Today I wish to look at one aspect of the problem, through a graph showing good and bad news for retirees in approximately the lower quarter of the income scale – the very people to whom Keating’s scheme was supposed to deliver a more dignified retirement.

Remember that before the super guarantee was announced in 1991, a low-paid factory worker or similar would retire with a full government pension, and most likely little in the way of a company pension.

Typically, in those days, it was only big companies that had pension schemes, and many of them only offered membership to middle management and above.

But Keating rolled out a forced savings plan that rose to 9 per cent of income, and which will now be raised to 12 per cent over time. After the last election the Coalition delayed Labor’s increase schedule by two years to help balance the budget, but the long-term target remains the same.

But while 9 per cent of workers’ wages went into their super, something else happened just as the Keating government lost power – the cost of the most basic need of a working Australian, a home in which to live, began to escalate (the blue line in the chart below).

Against that pool of rapidly appreciating assets, Australians loaded up on debt as long-term interest rates became lower over time. Many withdrew a good deal of equity to buy cars, overseas holidays and the like.

Nonetheless, over 23 years of the super guarantee, the nation has built a huge pool of retirement savings that in aggregate looks great, but in the lower income groups is less impressive.

Despite years of forced saving, more than 60 per cent of retirees rely on the pension as their primary source of income -- that is, only 40 per cent have generated super pots big enough to earn them more.

But the real crunch for retirees is whether or not they have paid off their homes.

Australia has long been recognised as a country with a high rate of home ownership. However the last survey by the ABS of home ownership revealed that rate is falling. It notes: “The proportion of Australian households that own their own home with or without a mortgage has declined from 71 per cent in 1994-95 to 67 per cent in 2011-12.”

In the retired over-65 age group, it found that 72 per cent of lone persons and 82 per cent of couples owned their own homes outright.

The problem is, lower home-ownership rates across younger cohorts will reduce these rates too over time -- particularly given that house prices are continuing to defy expectations of a downward correction.

The question for the government, then, is what to do about a growing group of retirees who see their pension and meagre retirement savings chewed up by rent or mortgage repayments. The maximum single rate of rent assistance, at $63 per week, won’t help much.

The hard-hearted answer to that question might be “nothing”, but then many low income earners will have assumed that the super guarantee, with a pension, would look after them in retirement.

And so it might have done without that house price boom. Because while interest rates are at record lows, property investors can keep rents low. However, if rate rises arrive in 2015 as many expect, the negative-gearing formulas that investors use will start demand higher rents (whether the market will support them is another matter).

The good news for the 60 per cent of retirees whose primary income is the pension is that pensions have grown ahead of both CPI and average rents over past years.

However, the Abbott government announced in May that it would stop calculating pension increases as a fraction of full-time weekly earnings, and would instead index them to CPI.

In the chart above, then, the rent increases (the turquoise line) which currently track the wage-linked pension increases (the green line for couples), will keep rising when the increase in pensions flattens to the CPI rate of increase.

In short, if you’re one of the 72 per cent of single retirees who has paid off their homes, or 82 per cent of couples, you’re fine.

If you’re one of the others, in a market of rising rents, and rising mortgage rates, there will not be much Clive Palmer or anyone else can do to ensure you get your weekly slice of cake.