A fresh look at the hunt for yield

Summary: Our top five companies are yielding around six per cent. The banks face significant threats including disruptive players, the possibility that something will go wrong with the housing market and the need to hold more capital. The banks are reducing costs by lowering deposit rates and investing in technology. BHP Billiton is also reducing costs and cutting back its capital expenditure. |

Key take-out: When you buy bank shares at the current levels you are making the assumption that Australia will not encounter a major reverse in its economy. |

Key beneficiaries: General investors. Category: Shares. |

At a time when Australian retirees and those looking to retire are seeking income the Australian share market has a remarkable offering.

Our top five companies are now all yielding either six per cent or in the case of the Commonwealth Bank which is a little below six per cent. And those yields are fully franked taking the actual return for most people to around the 7.5 to 8 per cent mark.

Clearly the share market does not expect the five companies (four of which are the big banks and the fifth is BHP) to maintain their dividends.

But those stocks are enabling retirees across the Australian landscape to maintain high income returns irrespective of the fluctuations in the share market.

So what are the chances of the four big banks and BHP maintaining or even increasing their dividends? Most of the major institutions are forecasting the over the next two to three years banks will hold their dividends and on some occasions increase it slightly.

So first let's look at the down side of our top five companies and then look at what they are doing to maintain their income distributions. I commented on BHP last week (see Battered and bruised: A new BHP emerges, September 2) so this time round let's start with the banks and the risks where the situation is fairly simple – the years of enormous growth appear to be over and the banks face several significant threats.

- The first is that they are highly profitable entities and disruptive players are looking closely at their business in an attempt to take a slice of the higher margin operations. We are seeing this in credit cards, in so called peer-to-peer lending and it is going to pop up in many different areas.

- Second, and perhaps just as big a threat, is the possibility something will go wrong with the housing market which will lead the banks into higher bad debts. The banks have had a magnificent run in home lending because dwelling prices have been pushed up by a restriction in supply, higher population, subsidies for local investors and an avalanche of overseas capital led by China. That means the underlying value of the loans improved so if borrowers got into trouble the banks could realise on the security. There is at least a 50/50 chance Australia will run into a recession where unemployment would rise. In terms of the loan book, higher unemployment is a threat because it will create bad debts at a time when dwelling prices fall. In addition we are building tens of thousands of apartments and many of the developers are financed by the banks on the basis of deposits on apartment purchase contracts paid by investors. And those deposits rely on bank assurances that do not bind the banks to lend. If the banks start walking away it will hit the market hard. If the Chinese pull back it will also hit the market hard. We have seen ANZ report bad loans in agri-business and resources, which is foretaste of what might happen. But in essence the banks are well covered in their housing loans but there is no doubt that if the Australian economy declines sharply they will be hit and they will have to reduce their dividends.

- Third, the banks are issuing more capital so they will require greater profits simply to maintain their payout ratios and their payout ratios are higher than their overseas counterparts, which means they haven't been investing as much in new technology and other cost saving measures as they should have.

So what are the banks doing about these three threats? They have achieved a considerable increase in their margins by lowering deposit rates sharply. Retirees have had to take this blow on the chin.

If Australia reduces official interest rates further then almost certainly banks will give depositors another kick to increase their profits. Separately, the banks are very quietly undertaking a revolution in technology. We saw Westpac this week explain how it will reduce its cost level below 40 per cent and increase its services to gain more market share but behind that announcement is a flurry of activity to reduce the bank's cost base.

If Westpac does not gain the increased market share the result will be a lot of labour shedding and the bank will have restructured itself to enable that to happen.

Meanwhile, National Australia Bank is installing a completely new banking system which will substantially reduce its cost but that is a higher risk plan. But so far it has worked and the bank is very confident.

Commonwealth Bank is further advanced in technology but must make sure complacency doesn't cause it to fall behind.

In essence the banks are looking to halve their costs over the next decade or so. And it is that drastic cost reduction that they believe will enable them to maintain their profitability and therefore their dividends – naturally a big chunk of the cost reduction will have to go to the consumers to defend the banks against the disruptive forces but the banks believe they can hold on to sufficient gains to record profit and dividend growth over the longer term.

Remember, when you buy bank shares at the current levels you are making the assumption that Australia will not encounter a major reverse in its economy because if it doesn't and population keeps growing banks will be able to hold and increase their dividends.

Looking beyond the banks, when it comes to BHP Billiton clearly if its export prices keep falling the company will struggle to maintain its dividends but like the banks BHP is slashing its operating costs and cutting back its capital expenditure.

On a global scale there is a risk for all our companies that if the US increases rates we will be headed into an era of rising interest rates which will change asset values. For what it is worth I do think US interest rates will rise but the rises will be moderate.

Longer term my greater concern is that neither of our two major political parties understand how you manage the economy without big deficits. If our governments keep this up then around 2020, or even earlier, the global lenders will demand much higher interest rates on Australian debt. This will hit banks and all big borrowers and lead to a deep Australian recession.

But that's a much longer term risk.

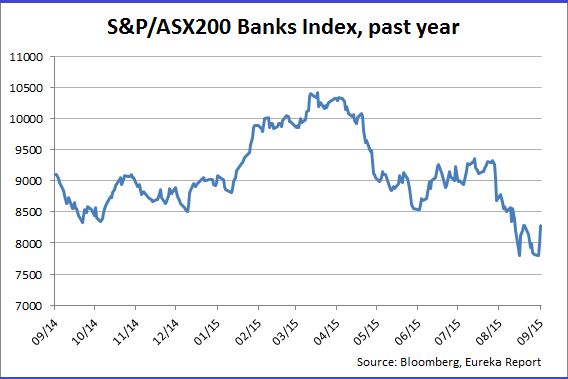

Meanwhile the stocks of these companies have fallen around 25 per cent from their peak between April and September. In essence you are investing in Australia to gain a good income at a time of very low interest rates.