A focus on GDP misses the bigger picture

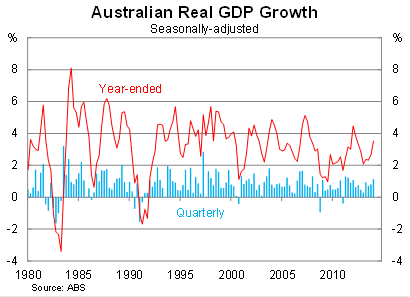

The Australian economy grew strongly in the March quarter but more timely indicators of activity suggest the economy has slowed significantly in the June quarter. With the iron ore price declining and the Chinese economy looking shaky, we should not dwell long on the past when we face so many near-term challenges.

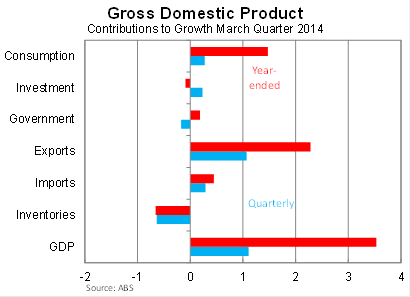

Real gross domestic product rose by 1.1 per cent in the March quarter, beating market expectations, to be 3.5 per cent higher over the year. The result reflected strong growth in export volumes, with more modest contributions from the likes of consumption and investment.

The Reserve Bank of Australia will certainly be pleased by export growth but it should be concerned by how narrow the drivers of growth are. Beyond exports – and to a lesser extent residential investment – there is very little to get excited about.

Household consumption rose by just 0.5 per cent in the March quarter, considerably less than the 1.2 per cent rise in retail trade volumes during the quarter. Household consumption is a broader measure of retail spending but the divergence is fairly high by historical standards.

Business investment fell by just 0.3 per cent in the quarter, to be 3.9 per cent lower over the year. This result was much stronger than indicated by the capital expenditure data released by the Australian Bureau of Statistics, which pointed to a quarterly decline of around 4 per cent.

Residential investment, excluding alterations and additions, rose by 6.4 per cent in the March quarter as building approvals transitioned to the production stage. Unfortunately non-residential investment declined by a further 2.7 per cent, following a 1.6 per cent fall in the December, to be 3.3 per cent lower over the year.

Government spending declined by 0.8 per cent in the March quarter, with spending cuts at the federal level more offsetting a modest rise in spending at the state and local level. The decline was largely driven by defence investment, which accounted for around 60 per cent of the total quarterly decline. The lumpiness of defence spending presents some upside risk to GDP growth for the June quarter ahead of budget cuts for the 2014-15 financial year.

Net exports continue to be the primary driver of the Australian economy. Exports rose by 4.8 per cent in the March quarter, compared with imports which fell by 1.4 per cent. As a result, net exports contributed around 1.4 percentage points to growth in the quarter -- the largest quarterly contribution in five years.

The data for March is undeniably positive but that doesn’t change the economic outlook, nor should it change the RBA’s approach to monetary policy. The economy has slowed noticeably since March, and Australia faces a number of near-term and medium-term challenges that makes the outlook far from certain.

With a subdued labour market and consumer confidence plummeting, the outlook for household spending is far from pretty. Add in declining real wages and budget cuts that target those with the highest propensity to consume and it begins to look ugly (A bad time for households to tighten the purse strings, June 3).

Construction is set to rise further over coming quarters, based on the number of buildings approved over the past year, but with approvals declining sharply over the past three month the boost to GDP is set to be fairly short-lived (Don’t dwell on the myth of a housing construction boom, June 2). Regardless, residential investment is such a negligible share of GDP that it won’t make a big difference anyway.

Mining investment continues to loom ominously on the horizon and it is not yet clear what will fill the potential three to four percentage point hole it could leave in GDP growth over the next couple of years. At present, the only sector capable of heavy lifting is resource exports, but as Leith van Onselen of Macrobusiness explained earlier today, resource exports are not necessarily the golden goose that they appear to be (Why you should discount today’s GDP result, June 4).

Growth in the March quarter was healthy but it is painfully clear that growth is too concentrated in exports and too dependent on the health of the Chinese economy. With the iron ore price declining sharply and the Chinese economy looking decidedly shaky, not to mention negative real wages and budget cuts, it would be misguided to place too much stock in today’s data and lose focus of the bigger picture.