A declining demand bombshell for wind power

The decline in electricity demand over the last few years has left the incumbent energy supply industry shell-shocked. Consequently it has been incredibly hostile to the Renewable Energy Target adding extra supply that will leave wholesale electricity prices further depressed.

But Tim Nelson from AGL Energy dropped a bit of a bombshell at the Clean Energy Week conference, suggesting that this oversupply of capacity meant bad news for the renewables sector too.

The slide below from his presentation suggested that electricity prices were likely to be pushed so low that it would be uneconomic to bring on sufficient renewables capacity to meet the RET. Because existing coal power generators’ operating costs are extremely low, they will continue to be cash flow positive even with very low power prices. In addition, closure involves large clean-up and mine remediation costs.

Nelson's suggestion was that government might need to buy out and shut a large existing power generator to reflate power prices (‘contract for closure’).

Source: Tim Nelson of AGL Energy (2013) presented at Clean Energy Week – Brisbane.

This caused quite a stir amongst conference attendees, and represented a serious challenge to the renewables industry. Essentially the industry was told it might have to accept a cut in the size of the target, or lobby government to help out the incumbent fossil fuel generators.

Some attendees speculated whether this might signal a shift in AGL’s support more generally for the Renewable Energy Target, something AGL denies.

In addition there was some dispute amongst conference attendees about whether this was an accurate assessment of market conditions. For example, Kobad Bhavnagri, an analyst at Bloomberg New Energy Finance, believed that the expected future electricity price would continue to be sufficiently high to allow new renewables projects to be viable.

In the end much hangs on the fate of the carbon price. Without a carbon price the viability of renewables projects does become slim over time as inflation erodes the value of the $92 LGC shortfall penalty.

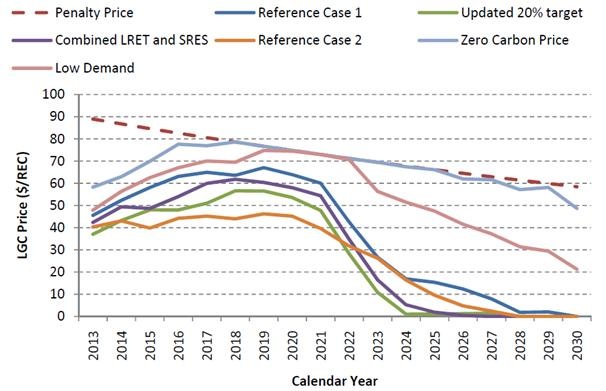

The chart below, taken from economic modelling by SKM-MMA for the Climate Change Authority, illustrates in the red dashed line how the real value of the penalty price erodes over time due to inflation.

Under a scenario of a zero carbon price, the price of LGCs required to support wind farms ends up exceeding the penalty price. This also happens under a scenario where electricity demand was to grow very slowly (native electricity demand across Australia of about 240TWh in 2020).

Projected price of Large-Scale Renewable Energy Generator Certificates ('LGCs') under different scenarios

Source: SKM MMA (2012)

In the end it doesn’t take much of a carbon price to fix this problem. A carbon price of just $10 rising steadily by a few dollars each year would significantly lower the risk of hitting the shortfall penalty. It would also help to induce some older generators to exit the market. Unfortunately such a result hangs on Europe addressing its huge emissions allowance oversupply.

The renewables industry confronts incredibly desperate and hostile lobbying resistance from the incumbent generators. At the same time the ineffectual level of the EU carbon price, and the possibility of no carbon price in the future, means that more direct methods of lowering emissions become alluring.

In such a situation it could be tempting for the environmental movement and the renewables industry to enter into a bargain with the fossil fuel generators for peace on the RET, in exchange for a government buyout and closure of a large coal generator. But so far the asking price for such a buyout has been in the billions of dollars.

While the Coalition said it would implement such a measure in the lead-up to the 2010 election, it has gone silent on this more recently. The Labor government adopted exactly this policy, but then pulled out during negotiations with power generators.

Furthermore the prospect that government might purchase polluting power plants actually acts to inhibit timely exits of these power stations. Even if your power plant is losing cash (and most coal generators aren’t), if you think the government might pay you a billion dollars to close down, of course you’ll keep it going.

This failure for politicians to agree on a clear policy framework for the electricity sector has meant that the best strategy for everyone is to delay investment and lobby like crazy.