A crude reawakening or a sucker rally?

| Summary: Repeated political interference in the oil market makes investing a perilous past-time. But a rally since April is likely to run out of steam and may only have another 6-7% to go before governments become tempted to act again. While the drivers of demand are unchanged, and a strong US economy lessens the chances of US government interference, any significant rise will like prompt sabre-rattling from other governments. |

Key take-out: The recent oil rally is likely to slow. |

| Key beneficiaries: General investors. Category: Commodities. |

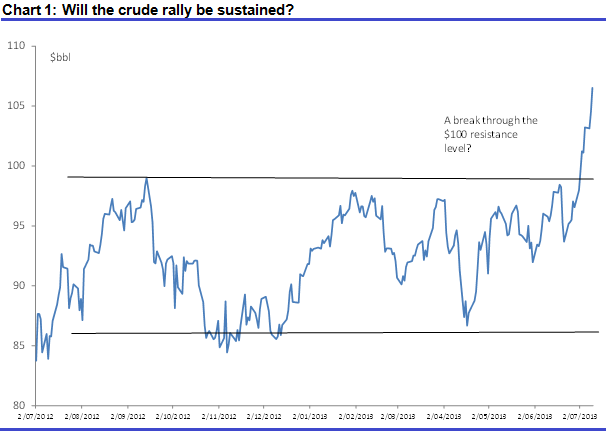

A lot has happened since I last took a look at crude. In September last year I argued that crude was a market to keep clear of, given the extent of political intervention (see Time to take profits in oil). For the brave, range trading was the order of the day. That turned out to be correct for some time. More recently, however, crude seems to have found a second wind – take a look at chart 1. Since a low in April, West Texas intermediate (WTI) has shot up 23% or about $20. That’s a big move and a clear breach of the $100 or so resistance that had formed since September 2012. The question is, where to from here and honestly that’s a tough one.

Source: Iress

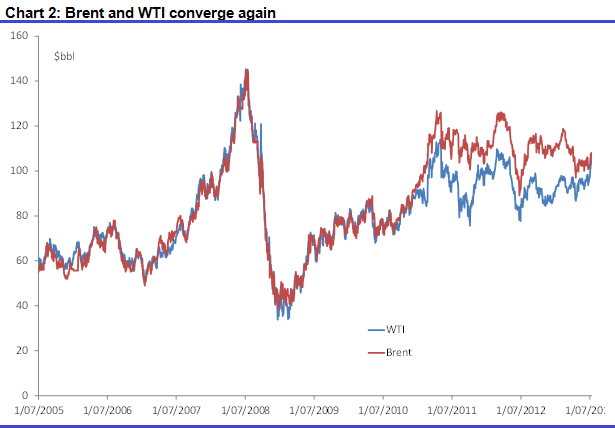

The picture is clouded, partly because a good chunk of that move in WTI is a correction back to other benchmarks. West Texas Intermediate (shown in the chart above) is a US crude benchmark and there were problems with infrastructure etc, apparently, which meant that shipping the stuff out from the gulf for export was a tad difficult. The result was a surplus of crude in the domestic US market, which is why WTI was trading below other benchmarks like Brent C (see chart 2). That at least is the accepted wisdom and the thing is, some of these bottlenecks or infrastructure issues have apparently been resolved – and so WTI is closing the gap with Brent, the key benchmark price for Europe.

Source: Iress

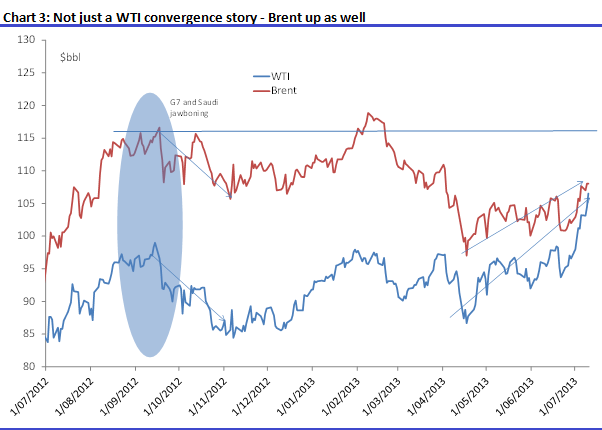

Having said that, it’s not like other benchmarks have been idle. Brent itself is up around $10 from a recent low to $107. There is momentum in the crude market itself. Chart 3 shows moves in WTI and Brent over the last year so you can get a better idea of recent price moves.

Source: Iress

The question is how much momentum is there and how far will it take things? There are a few key points to note here. While WTI has pushed through key resistance, Brent itself is merely off its lows and still a way down from a recent peak in January/February of $118. It’s not an insignificant move as such – $10 bucks is $10 bucks – but I don’t think it’s indicative, at this stage, of any significant change in momentum. So the price action, outside of the convergence story for WTI, isn’t really telling us anything out of the ordinary.

So what about the underlying fundamentals. Well these haven’t changed over the last few years, even as crude prices fell. They strongly support further growth in oil prices. So demand is strong, in particular emerging market demand is strong – and getting stronger. As we already know, China’s economy may slow to 7% or whatever, but the fact that its economy is nearly three times the size it was in 2007 means its actual demand for commodities, such as oil, is much stronger than when it posted double digit growth rates and the world was gripped with 'peak oil' fever. Indeed, China’s annual crude consumption is nearly 50% higher than then – and is growing at an annual average rate of about 7%. This means that in a little over three years, China’s oil consumption will be roughly double what it was during the so-called 'peak oil crisis'. But we know all this, it hasn’t changed and is a process that is ongoing – it isn’t going to change.

We also know that the world’s largest consumer, the US, is having a growth resurgence – the Fed is talking about tapering QE, private demand is strong and of course we know consumer spending on cars is picking up. What about the shale story? Talk at this stage, lots of talk and many questions as to whether reality will match the hype.

Fundamentals of course can only provide so much support and as we’ve learned recently there are other important considerations. Politically, I think the US, at least, will probably be less inclined to interfere with the crude market at this point. So I don’t think we’re going to see the co-ordinated political sabre rattling that we saw in September last year. Why? Because headline inflation is less of a worry, and in the Fed’s own words, growth is improving and becoming more sustainable. I’m guessing its assessment at the moment is that the economy can handle it and that's why it won't stand in the way of WTI’s convergence.

Nevertheless there has to come a point though where the sabre-rattling will start again. If we take a look at Brent, it was up near $116 before the US, France and Britain started talking about unleashing their vast reserves onto the market. A pointless threat as the OECD in total only has about 60 days of supply in reserve. But that’s long enough to hurt the futures market and speculative investors – and that’s ultimately who those comments are aimed at. Don’t forget the Saudis promised to ramp up production unless price comes down.

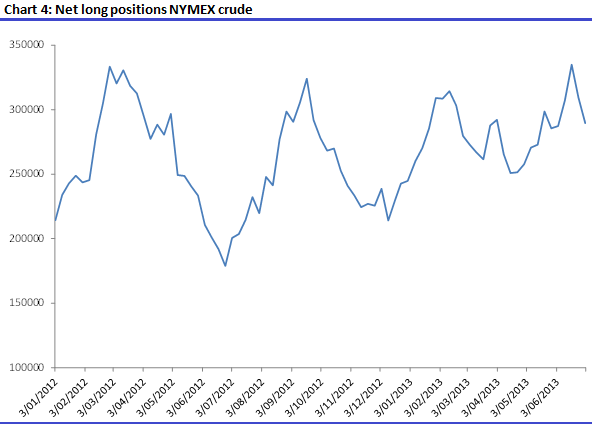

Which brings me to my next point. The key swing factor in this market is speculative sentiment, and this is what the G7 was targeting late last year with some success. Take a look at chart 4 below.

Source: Iress

This shows the net long positions on NYMNEX crude. The market is certainly long, but you can see the saw-tooth pattern. The market only pushes it so far and at the moment net long positions are being reined in. That’s not a bullish signal. It’s not a sign that market sentiment is prepared, I think, to push crude too much higher.

Conclusion

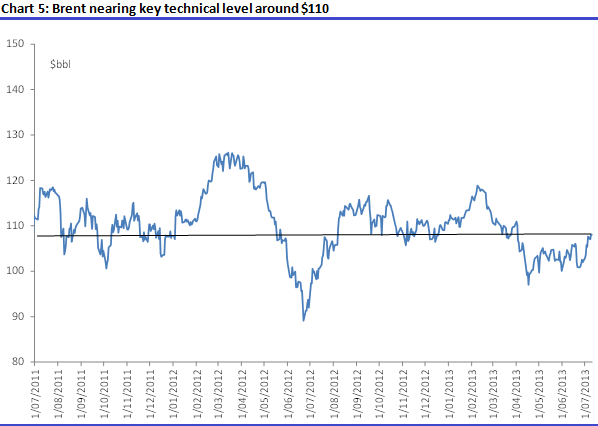

At best then, I think we might see another 6-7% before we get to a level where policymakers might again become afraid. It’s one of the biggest frustrations I have at the moment though, trying to second guess bureaucrats. Certainly the level of government interference in markets – from bond buying programs or QE, currencies, crude and other commodities – makes things very difficult. But to get there we would need to push through another current key technical level at $110 (on brent). And with so much concern over a Chinese growth slowdown that might be tough.

Source: Iress

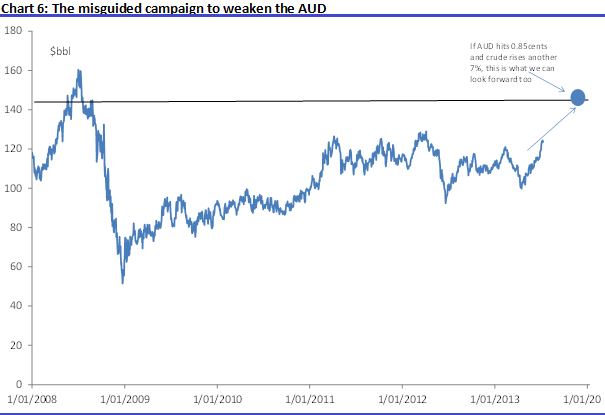

This of course is good news for the Australian economy. With the currency down 12% so far, the last thing we need is crude prices to shoot up. Already the NRMA is talking petrol prices at a five year high in Australia. The price of the Asian oil benchmark, Tapis, in AUD terms, is already up around $123, which is high. If crude prices rise and the AUD hits 0.85 cents, as many project, we’ll be paying over $140, which takes us back to the oil high of 2007-08. At 0.75 cents we’ll exceed it (with prices over $160) – and that’s not good for the Aussie economy.

Source: Iress