A capital surprise gives the RBA room not to move

Capital expenditure was surprisingly strong in the September quarter and the investment outlook has been revised up. But the rebalancing of the Australian economy still has a way to go yet before it becomes sustainable and the Reserve Bank will likely leave rates on hold for some time.

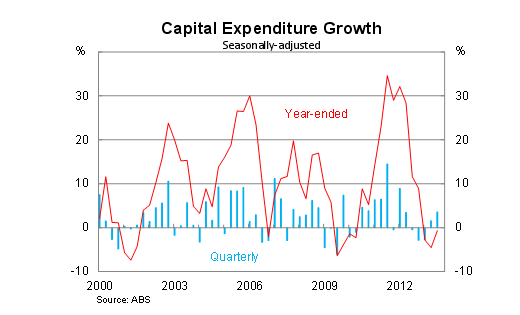

Capital expenditure in the September quarter was much stronger than the market expected, rising by 3.6 per cent to be 0.7 per cent lower over the year.

I flagged yesterday that capital expenditure might surprise on the upside, based on some surprisingly strong construction data (The mining sector’s last hurrah, November 27). But I certainly did not think that the result would be as strong as it turned out to be.

In real terms, buildings and structures investment drove growth in the quarter, rising by 6.3 per cent, while equipment, plant and machinery investment declined for the fourth consecutive quarter and is now 8.8 per cent lower over the year.

The total level of capital expenditure was revised down by 1.4 per cent for the June quarter, which also pushed the growth rate in the September quarter higher.

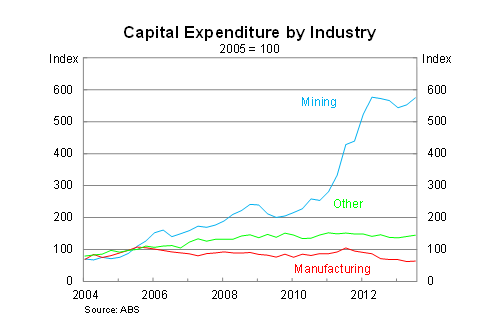

The mining sector experienced what is likely to be a limited reprieve, rising by 4 per cent in the September quarter. Manufacturing investment rose by 2.5 per cent to stop a run of seven consecutive quarterly declines, while investment in other industries rose by 3.1 per cent.

At the state level, it comes as no surprise that Western Australia continues to drive investment growth. Capital expenditure rose by 4.2 per cent in Victoria and 12.5 per cent in South Australia. Expenditure in both New South Wales and Queensland rose only modestly. There was also a sizable contribution from Tasmania, Northern Territory and ACT, though the data itself was unavailable for those regions.

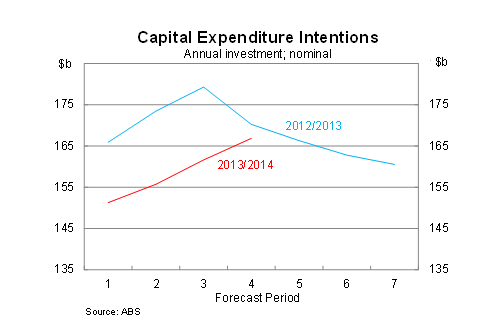

The survey also features investment intentions for businesses. This is usually the most interesting section of the report, but also difficult to interpret.

Each quarter, the ABS asks businesses about their investment intentions for the year ahead. This is the fourth quarter where businesses have been asked about the 2013/2014 financial year. There are seven quarters of estimates for each financial year.

Expectations for total nominal capital expenditure in 2013/2014 are 3.2 per cent higher than expectations three months ago. Current expectations are also higher than actual investment for the 2012/2013 financial year, but 2.2 per cent below the fourth estimate for the 2012/2013 financial year.

It can perhaps be better explained by the graph below. Forecast period seven is entirely actual data, while forecast period four is the first period that includes some actual data (the September quarter data). With each successive period, the forecasts will usually become more accurate, particularly once you get to the fourth forecast period.

As the graph shows, businesses will often have investment intentions that are either not realised or delayed. The realisation ratio is important for understanding what capital expenditure might do in the year ahead. Based on the average realisation ratio over the past five years, I estimate that total nominal capital expenditure will decline by 1.6 per cent in 2013/2014.

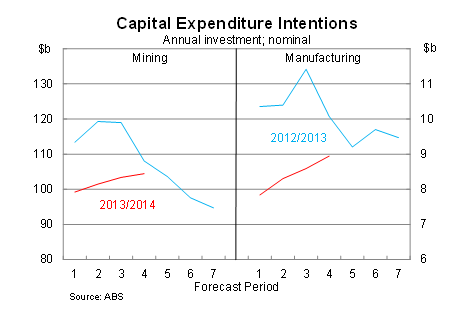

The same analysis can be done at an industry level. I estimate that capital expenditure in the mining sector will fall by 3.4 per cent in 2013/2014, which is due to a 30 per cent decline in equipment, plant and machinery investment. As the graph below shows, mining firms are always a bit too optimistic about the outlook and capital expenditure will almost surely be revised downwards in coming quarters.

For manufacturing firms, capital expenditure will continue its downward trajectory in 2013/2014, falling by around 10 per cent. For the remainder of the economy, capital expenditure is expected to pick up by between 2 and 3 per cent.

Although capital expenditure is set to fall next year, today's result is undeniably positive and will certainly shift viewpoints about the economy.

The decline in mining investment looks like it will be slower than most people expected. That will give the economy more time to shift away from relying on the mining sector. There is now less pressure on the Reserve Bank to provide relief to the non-mining sector or as much immediate concern about the dollar. I expect the Reserve Bank to leave rates unchanged for a while, as they wait to see whether some of this investment is realised.

But it is important to recognise that the expectations that mining investment would fall sharply were not unreasonable. Even if it does not happen by June 2014, it will still happen at some stage. The data today will prompt some analysts to say that the Reserve Bank should look at increasing the cash rate, but that would be premature. Low rates appear to be gaining traction but investment intentions can easily become unrealised if firms get spooked. A combination of rising interest rates and a persistently high Australian dollar might be enough to put them into hiding.