A better way to play small caps

Summary: As we embark on the new financial year, we take a look at how our stock recommendations have performed – with updates on Azure Healthcare and AMA Group – and how we are improving our service to equity investors through our new model portfolios. |

Key take-out: Our “Growth First” portfolio enables investors to maximise the value from our share recommendations by following its weightings and changes. |

Key beneficiaries: General investors. Category: Shares. |

Given we are into the new financial year, it is a good time to review the past and also some of the reasons behind our transition to model portfolios.

Our share recommendations have previously provided no guidance around weightings and what our best picks are.

There is also the issue of subscribers taking large positions in a small number of stocks, rather than spreading their exposure to a more appropriate 10-20 stocks.

If you follow the model portfolio weightings and changes, it will give you the best chance of maximising the value from our share recommendations.

“Growth First” portfolio

Our Growth First portfolio, which we started on July 1, contains ten of the stocks from the table below. This combines to be 60 per cent of our hypothetical $100,000 starting amount. We will be looking to add more stocks to the portfolio in coming weeks. While we aren't too focused on short-term performance, after nearly two weeks the portfolio is up 0.5 per cent.

“Growth First” weightings

Even the highest conviction stock pick still requires investors to take on risk when buying that stock. Our weightings attempt to make an assessment on the upside opportunity relative to risk. With a minimum 10 stocks in the portfolio our individual weightings will typically be less than 10 per cent, and often at least 5 per cent.

Past recommendations

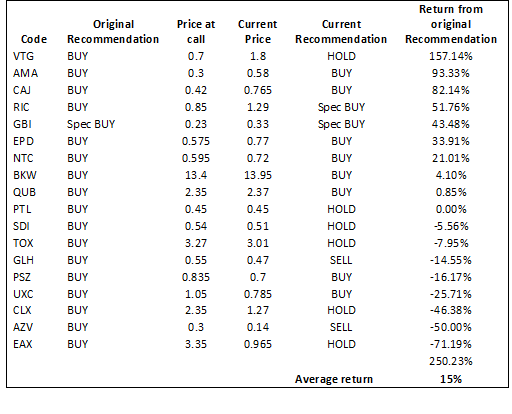

I have done a review of my past recommendations, as shown in the table below.

My first Eureka recommendation was on the December 19, 2013 when the All Ordinaries index was trading at 5250. Today some 18 months later the index is only up approximately 3.5 per cent. The average return of my recommendations is well above this at 15 per cent.

Many of these stocks were downgraded to “hold” at higher prices, presenting the opportunity for a return far greater than 15 per cent.

For example, the worst performer has been Energy Action (EAX) which is currently at $0.95. But I did downgrade it to “hold” at $2.03 and in hindsight our commentary provided more reasons to sell at that price than hold.

The same thing occurred with CTI Logistics (CLX), which we downgraded to “hold” at $1.76. It is now $1.26.

These two situations would have been sold out of a “Growth First” portfolio, and this is another reason we are looking forward to presenting the model portfolios rather than solely from our share recommendation page.

All of the 18 stocks that I have initiated a “buy” recommendation on are still covered today, shown in the table below.

Ten out of my 18 stocks are in positive territory (or 56 per cent). The best two performers are Vita Group (VTG) up 157 per cent and AMA Group up 100 per cent.

With the market recently having a 9.5 per cent correction, clearly this list was in better shape a few weeks back.

At its peak of $1.10 Capitol Health (CAJ) was up 161 per cent from our original recommendation. But after a recent pull back it is now at $0.765 and up 82 per cent.

Stock Updates – Azure (AZV)

As expected there have been a number of letters and queries about Azure and I would just like to answer some of the common questions.

The main question has been why we have moved to a “sell” recommendation when a lot has potentially already been priced in.

It is possible that Azure doubles from here over the next 1-2 years as the US expansion is rolled-out. We understand that some investors may wish to hold on for this.

But the reason for our “sell” call is due to the company failing a few non-negotiable requirements that companies must meet for us to have a “hold” or “buy” recommendation.

In particular, corporate governance, continuous disclosure and the track record of management all fail to meet our minimum requirements.

It is our view that Azure has broken ASX listing rule 3.1 around continuous disclosure requirements and that is not something we are willing to ignore.

It has been announced that executive chairman Robert Grey will step down from his chairman position but will remain the managing director. Clearly there are independence issues with the board and it is a small step in the right direction to appoint a new non-executive chairman in Greg Lewis.

It is a start, but this move alone doesn't go far enough in addressing the issues within the company.

AMA Group (AMA)

AMA Group has a 7 per cent weighting in our “Growth First” portfolio.

I have been waiting for the company to announce further details around how they will utilise the funds from the recent $45m capital raising.

The $45m capital raising was completed at a price of $0.60, which was a relatively small discount to the $0.65 share price at the time.

Ray Malone stated to the market that the funding will assist with future acquisitions and we are anticipating that there will be some news flow around this shortly.

Most of the prior acquisitions have been of a small enough size that could be funded from free cash-flow, so it will be interesting to see if the relatively large raising was in fact for a larger acquisition.

We continue to like the stock and have a “buy” recommendation.