Why you need a portfolio plan

That’s why portfolio planning is just as much about goal setting as security selection.

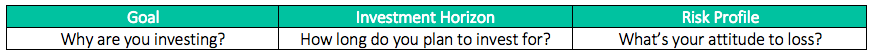

It starts with determining three key things – your investment goal, your investment horizon, and your attitude to loss. For example, as a younger investor, you may keep a high-growth risk profile as you save for a house over a period of five years.

Understand where you stand

Setting this straight with InvestSMART’s free Portfolio Manager is easy, which encourages you to check where you stand financially too. It’s important to determine if your existing asset mix can help achieve your objectives, and if not, what can be done to align the two.

Determine your asset mix

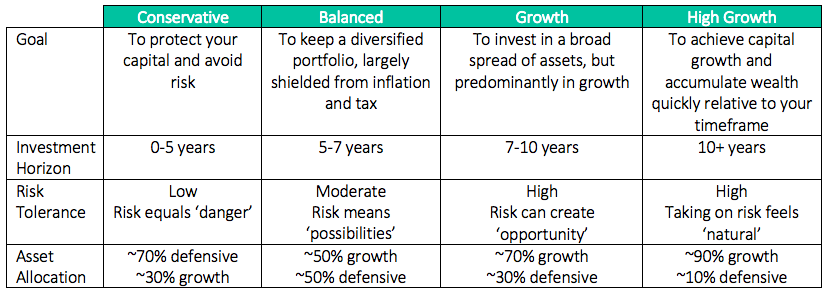

Now that’s sorted, you’re ready to shake up, or work out, your asset mix. Specifically, that means working out allocations across the key asset classes of equities, property, cash, fixed interest and alternatives. We can categorise these as growth or defensive assets.

Generally speaking, a portfolio with a wider mix of assets will better protect against volatility – but the Portfolio Manager is much more specific than this, working out an optimal mix for you based on how you identify. You probably fit a conservative, balanced, growth or high growth profile.

You’re halfway there, but probably yet to reach the hardest part – parting with your money.

Construct your portfolio

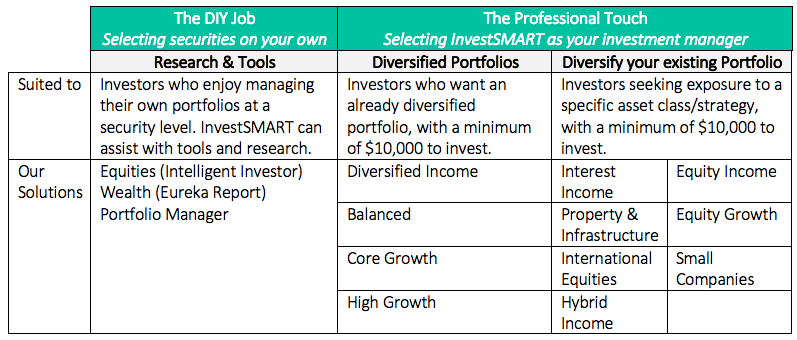

The next step is selecting the securities yourself or hiring an investment manager to do it for you.

Some like it half-half. You may enjoy managing your own portfolio at a security level, and in that case, the research and tools provided by InvestSMART will help. Or you might like to leave it all to the professionals.

Keep in mind, portfolio construction requires a finer touch than asset allocation. It’s a much more detailed process, where the investment manager will have to deeply consider the assets at every level. Just for starters, some early considerations may be domestic or international assets, small or large cap equities, and commercial or residential property.

We all change with time, and so does the market.

Measure your performance

Maybe you’ve withdrawn some funds for a holiday, maybe you’ve contributed something extra to your high growth fund in hopes of supercharging towards your goals. Plus, a portfolio can easily ‘lose its balance’ in extended bull and bear markets. There will come a time that you should be clipping or cutting underperforming, and even outperforming, investments.

InvestSMART recommends reviewing your objectives and performance every year, but more often when major life changes occur – anything from births to deaths, marriage to divorce, or even a job change. Naturally, a major change may affect your risk-return profile, and potentially your time horizon too.

Frequently Asked Questions about this Article…

Portfolio planning is crucial because it helps investors set clear goals, determine their investment horizon, and understand their attitude towards risk. This ensures that their investment strategy aligns with their financial objectives and risk tolerance.

Start by identifying what you want to achieve with your investments, such as saving for a house or retirement. Then, decide on your investment horizon, which is the time frame you have to reach these goals. This will guide your risk profile and asset allocation.

The asset mix is crucial as it involves allocating your investments across different asset classes like equities, property, cash, and fixed interest. A well-diversified asset mix can help protect against market volatility and align with your risk profile.

InvestSMART's Portfolio Manager helps you assess your current financial standing and determine if your asset mix aligns with your investment goals. It provides specific recommendations based on your risk profile, whether conservative, balanced, growth, or high growth.

It depends on your preference and expertise. Some investors enjoy managing their own portfolios using research and tools, while others prefer to hire professionals for a more detailed approach to portfolio construction.

Portfolio construction involves detailed decisions about asset selection, such as choosing between domestic or international assets, small or large cap equities, and commercial or residential property. It's more intricate than just asset allocation.

It's recommended to review your portfolio annually, but more frequently if you experience major life changes like marriage, divorce, or a job change. These events can affect your risk-return profile and investment horizon.

If your portfolio becomes unbalanced, consider rebalancing by clipping or cutting underperforming or even outperforming investments. This helps maintain alignment with your investment goals and risk tolerance.