Nathan's View: An easy way for retirees to make more from dividends?

You’ll have heard the stereotypes: retirees busy spending their children’s inheritance on opulent homes and luxury holidays. But there’s increasing evidence that many retirees are so worried about running out of money and relying on the pension that they’re dying with large pots of savings. Many are reportedly spending even less than the weekly pension despite large asset balances.

No doubt many retirees are so frightened to have their money invested in the sharemarket currently that they’re hiding it in the bank earning next to nothing while it’s being eaten away by inflation. Changes to franking credits won’t help dividend investors, either.

While there might be good reasons to scrooge in retirement, this seems to be a massive wasted opportunity for many.

Let’s look at some basics of dividend investing to see if (1) there is a better way to invest and (2) whether your fears might be costing you a small fortune or, at the very least, a much more comfortable and enjoyable retirement unnecessarily.

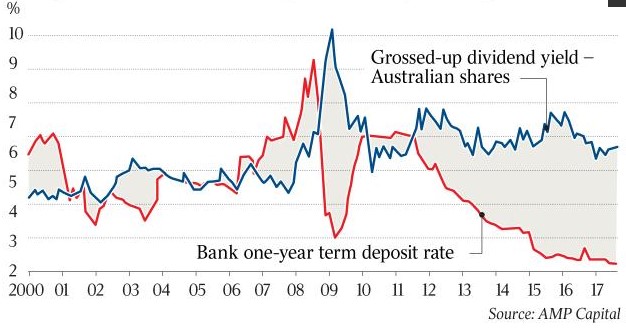

1. The dividend yield from the Australian market remains fairly steady outside crises.

As you can see from Chart 1, the dividend yield of the Australian market is fairly steady over time.

Chart 1

During a crisis like the GFC, which I expect was of such severity and so widespread globally that we’re unlikely to see anything similar in our lifetimes, the dividend yield can increase dramatically as share prices fall.

There are two important things to note. First, downturns are there to be taken advantage of, not feared. They usually only run for a year or two before the sharemarket recovers, so it’s important to make the most of these unusual periods of opportunity.

Second, the sharemarket always recovers. Sometimes it may take longer than other times, but it does eventually recover. That means as long as you don’t panic and can wait out the downturns, you can keep collecting your dividends while you wait for the capital gains.

In contrast to what the headlines would have you think, the stock market spends most of its time going up.

We don’t pretend we can time markets, which is why we’re busting this myth during our current national roadshow.

Investors should fear the most when stock prices are highest. But looking at the Australian stock market today, it’s arguably at a level only slightly above its long-term average.

Given that we expect the market to provide a long-term return from current levels of around 8% before franking credits – with most of that return derived from dividends – there is less to fear than many think.

The problem is that we don’t know what path those returns will take. It won’t be a consistent 8% per year, even if that figure is correct. If the housing market rolls over, we could have a couple of bad years before the market recovers.

But, again, as long as you can wait it out – and you shouldn’t invest in the market if you’ll be forced to sell your shares during that period anyway – then market cycles shouldn’t worry you too much. Particularly if you’re invested with a good fund manager who can maximise the opportunities during the downturns.

As value investors we live for those periods, because they create incredible opportunities to make big gains without taking large risks. The opportunity arises because most people are either panicking, as they don’t understand the value of what they own, or are using the sharemarket as a piggy bank to smash in order to repay debts, like mortgages, margin loans, and car loans.

That’s why avoiding debt where possible is so advantageous. It also helps you keep a level head during tough periods.

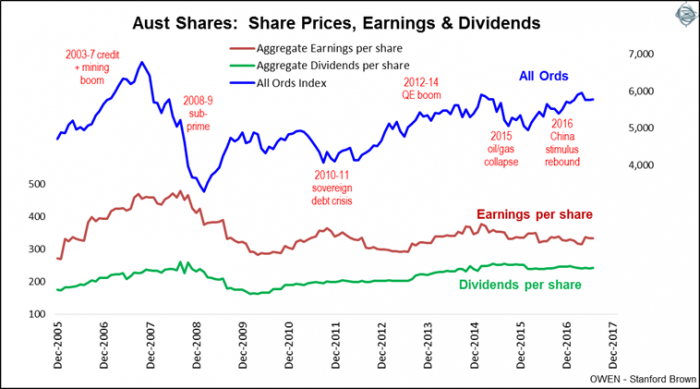

The following chart also gives you a good idea how dividends, company profits and share prices behave over a full cycle – albeit we haven’t had a recession in Australia for almost 30 years.

Chart 2

2. A diversified income portfolio looks good compared to most alternatives

In the chart below you can see how much higher the market’s dividend yield is compared to deposit rates. Given interest rates could fall back to zero, the gap could get wider if house prices continue to fall.

Chart 3

Keep in mind that shares are likely to outperform house prices over the next decade, so the capital gains should be better, too.

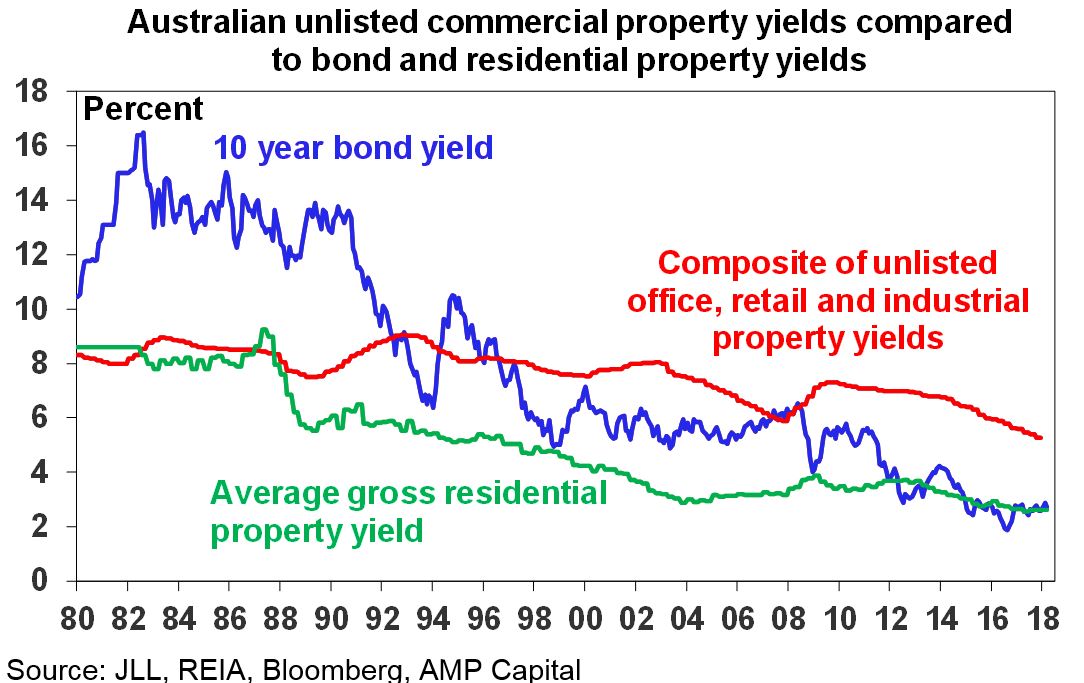

Ultra-low interest rates have shrunk returns from virtually every asset, from art to Australian homes. You can see how far Australian residential property rental yields have fallen in the following chart.

Chart 4

While the residential property market is offering record low future returns, the Australian stock market is much closer to its long-term average, as it’s performed quite poorly over the past decade or so.

Low expectations and low valuations are the key source of higher future returns, and there is anything but low expectations embedded in property prices despite recent falls.

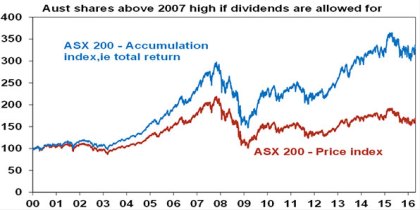

3. Reinvesting dividends provides incredible returns

Albert Einstein called compound interest the eighth wonder of the world, warning that ‘He who understands it, earns it; he who doesn't, pays it.’

Although Einstein was a physicist, he understood the power of compounding your wealth when you reinvest dividends over the long term, as you can see in Chart 5

Chart 5

If the average retiree is dying with a large percentage of their savings intact (one article suggested the average savings balance was one third of the balance at retirement), then it seems many people are not maximising the opportunity to reinvest their dividends and live more comfortably over time or leave a bigger donation to their family or favourite charity.

For those in this situation, that seems a sensible way over the long term to help offset what might be taken away by the Labour government’s change to franking credits.

The stock market seems like a scary place if all you see is the headlines in the newspapers and on TV. But it needn’t be if you approach it sensibly, think long term and invest with a trusted fund manager that’s performed over many cycles.

If you want to understand more about our investment process for the Intelligent Investor Equity Income Portfolio, and the stocks currently in the portfolio, please read the fund’s latest monthly and quarterly report.

If you have any questions, please feel free to contact us on 1300 880 160 or email us at support@investsmart.com.au.

Frequently Asked Questions about this Article…

Many retirees are hesitant to invest in the stock market due to fears of losing their savings and the volatility of the market. They often prefer to keep their money in the bank, even though it earns very little interest and is eroded by inflation.

Retirees can benefit from dividend investing by taking advantage of steady dividend yields from the Australian market. This approach can provide a reliable income stream and potential capital gains over time, especially if they reinvest dividends to harness the power of compounding.

During market downturns, investors should avoid panic and consider them as opportunities to buy shares at lower prices. The market typically recovers, allowing investors to benefit from both dividends and eventual capital gains.

Yes, the Australian stock market can be a good investment option for retirees. It offers a steady dividend yield and potential long-term returns, especially when compared to low-yield alternatives like bank deposits and residential property.

Reinvesting dividends can significantly enhance long-term returns due to the power of compounding. By reinvesting, retirees can grow their wealth over time, potentially leading to a more comfortable retirement or a larger inheritance for their heirs.

Franking credits can enhance the returns from dividend investing by reducing the tax burden on dividends. However, changes to franking credits policies may affect the net returns for dividend investors.

Diversification is important in an income portfolio because it spreads risk across different assets, reducing the impact of any single investment's poor performance. A diversified portfolio can provide a more stable income stream and better long-term returns.

Retirees can overcome the fear of stock market investing by focusing on long-term goals, understanding the market's historical recovery patterns, and working with a trusted fund manager to navigate market cycles effectively.