From the Bunker: The "Other" Asset Classes

- Gold and Gold ETFs are volatile and subject to risky market moves. Always match any investment to your goals, timeframe, and risk profile.

- Returns from cash and fixed interest assets likely to remain low for sometime

- Consider how liquid some assets are like Art and Vintage cars before you invest

The From the Bunker webinar series is back, and this week it signed up to InvestSMARTs new investor Bootcamp course.

Not sure what Bootcamp is?

The InvestSMART Bootcamp is an online course designed to provide an introduction to investing. There are a total of six modules delivered over a four-week timeframe.

You can start anytime and go at your own pace as you have three months of access to the course material.

Here are the modules covered:

- Investment Planning

- Diversification

- Investment Vehicles

- Investment Strategies

- Investor Psychology

- Next steps (Putting this into practice)

Each Thursday, a live webinar is held covering the learning content for that week. The weekly webinars are an opportunity to follow up course concepts you need more help with or to reinforce your learning. If you can’t make that week’s webinar don’t worry. The webinars are uploaded into the Bootcamp platform so that you can re-watch at your own pace.

The InvestSMART Bootcamp is $49 and includes one-month complementary access to both Eureka Report and Intelligent Investor, which both assist in supercharging your learning experience.

Enrol Now and start your investing journey.

This week’s From the Bunker was designed to compliment Bootcamp’s Module 3 – Different Investment Vehicles.

In Bootcamp, we look at shares, managed funds, ETFs, managed portfolios, and cash & bonds.

We get many questions on other asset types and whether they are suitable as part of your investment plan.

Gold and Gold ETFs

One asset class we’re asked often about is Gold or ETFs that provide exposure to gold. Evan began by running through all the different ways gold is priced and can be accessed.

Remember that you can filter through ETFs here.

Evan covered off this question and started by bringing attention to the fact that the InvestSMART diversified capped fee portfolios don’t include gold as an asset class. The reason is that we scan through 3,356 Balanced funds, and gold doesn’t make up much of these investment portfolios. Our funds will mimic the average of these asset allocations, which means gold doesn’t get a look in.

However, there are a large number of Exchange Traded Funds (ETFs) you could consider in regards to gold. Evan highlighted one such example as BetaShares Gold Bullion Currency Hedged (ASX:QAU) - Backed by gold bullion with a currency hedge.

You can read Elizabeth Moran’s article here outlining others.

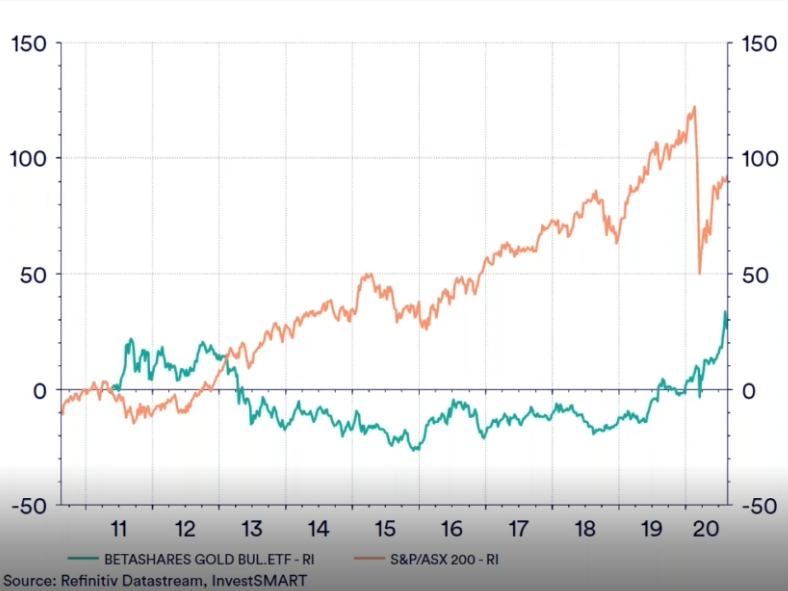

Evan compared the performance of QAU and compared it to the S&P/ASX200 as per the chart below.

There is no doubt that gold has had an incredible run.

Should you have gold as an asset class in your portfolio or use it as a hedge? Possibly.

However, taking a look at the price movement of spot gold, over the last 20 years, there have been some very volatile movements, as shown in the chart below.

You can watch the recorded video of this webinar below to hear Evan’s detailed explanation.

Ultimately, gold is speculative, and a complex asset that is subject to risky market moves. Our approach at InvestSMART is to follow the diversified path that aligns with your financial goals, timeframe, and risk profile. The Bootcamp course explains these concepts in Module 1 – Investment Planning.

Another asset that we explored was cash and cash type assets, but mainly how they provide a buffer during the retirement phase. Again, we were fortunate to have Elizabeth Moran only recently write about A quest for the best deposit rates, where she investigates which banks are currently offering the best deposit rates.

Evan followed this up by explaining that interest rates will likely stay low for an extended period as the RBA attempts to restart economic growth. The RBA’s strategy to keep interest rates low may make it difficult to expect cash and fixed income type products to offer higher returns any time soon.

Evan also explained how bonds are priced and the differences between cash and fixed interest assets.

Finally, Evan covered off energy stocks and a basic look at options.

We finished up with a question on whether assets like Art and Vintage Cars are possible assets to consider.

You can watch more detailed responses to these topics in the video below.

Next week join us again for From the Bunker: Finding a strategy that suits you.

You can register for free here.

Frequently Asked Questions about this Article…

The InvestSMART Bootcamp is an online course designed to introduce you to investing. It consists of six modules delivered over four weeks, covering topics like investment planning, diversification, and investment strategies. You can start anytime and have three months of access to the material, making it a flexible way to learn at your own pace.

The From the Bunker webinar series complements the InvestSMART Bootcamp by providing live weekly webinars that cover the learning content for each module. These webinars offer an opportunity to reinforce your learning and ask questions about the course concepts.

Gold can be a speculative and complex asset, subject to volatile market moves. While it has had an incredible run, it's important to align any investment with your financial goals, timeframe, and risk profile. The InvestSMART Bootcamp covers these concepts in its Investment Planning module.

The Bootcamp covers a variety of investment vehicles including shares, managed funds, ETFs, managed portfolios, and cash & bonds. It also explores other asset types like gold, art, and vintage cars, providing a comprehensive overview of different investment options.

InvestSMART's diversified capped fee portfolios mimic the average asset allocations of 3,356 Balanced funds, and gold doesn't make up a significant portion of these portfolios. Therefore, gold is not included as an asset class in these portfolios.

Returns from cash and fixed interest assets are likely to remain low for some time as the RBA keeps interest rates low to stimulate economic growth. This makes it challenging to expect higher returns from these types of products in the near future.

Art and vintage cars can be considered as investment options, but it's important to assess their liquidity and how they fit into your overall investment plan. These assets may not be as liquid as traditional investments, so careful consideration is needed.

If you miss a live webinar, don't worry. The webinars are uploaded to the Bootcamp platform, allowing you to re-watch them at your own pace. This ensures you can catch up on any content you may have missed.