The LIC model portfolio: Where to from here?

Summary: The LIC model portfolio has been running for almost four months and is 80 per cent invested. The portfolio is underweight financials and dramatically underweight materials, with 34 per cent cash (when the cash holdings of the individual LICs are taken into account). I am not in a hurry to deploy capital but when I do I will be happy to be 100 per cent invested and let the managers take care of the cash weighting. |

Key take-out: From here, I would like to increase the exposure to BKI, WAX and MFF. My goal is to select a handful of the best managed LICs at the right price. |

Key beneficiaries: General investors. Category: LICs. |

On July 13 the LIC model portfolio opened its doors and splashed some cash for the first time picking up $10,000 of the Magellan Flagship Fund (MFF) (see Our first LIC call: Magellan's MFF). Since then I have added six other names to the stable and have topped up on a couple too. There have been some ups and downs and some dividends along the way too.

Now that 80 per cent of the cash has been deployed it's time to sit back, take stock and see what gaps may need filling and where I can look to add further value. As the graph below shows, the portfolio has gained 3 per cent since we began investing back in July.

The LIC model portfolio is different to my colleagues' Growth First and Income First model portfolios. It is more like a fund of funds. I invest in a process instead of in individual companies. Because of this, it is important to stand back and assess what the portfolio is exposed to. As you can see my well diversified portfolio has weathered the storm over recent months well.

The following graph is a scatter plot of the daily returns of the LIC model portfolio vs the All Ordinaries. Each dot represents one day. For example, you can see that on the worst day so far, the LIC model portfolio was down less than 2.5 per cent, while the market was down around 4 per cent. Looking at the “line of best fit” on a graph of this type, the steeper the slope, the more volatile the portfolio relative to the market. This portfolio is far less volatile than the market.

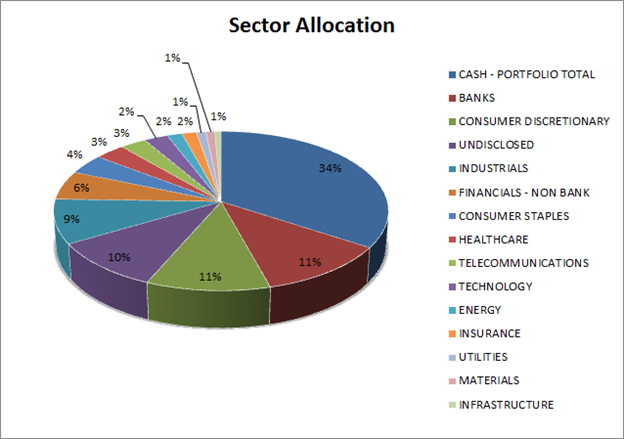

Before we get into the breakdown of the portfolio's asset allocation it is important to note we can only go off the material each manager has announced to the market. For some LICs this is very close to if not all of their portfolio. For others we can only get a look through to 50 per cent of the portfolio. Therefore the data needs to be taken with a grain of salt.

This highlights another element of investing in LICs or any managed investment: it takes trust. Even though you can come and go freely in LICs you still have no control of the underlying investment.

The next graph shows how exposed the portfolio is to different sectors, including cash held by the model portfolio and cash held within the individual LICs.

The glaringly obvious

The stand out exposure for the portfolio is cash. There is a lot. If you combine the cash in the portfolio and the cash each individual LIC holding has, cash makes up 34 per cent of the portfolio. The cash holding per LIC in the portfolio is 20 per cent on average with MFF the lowest at 1 per cent and WAX the highest at 40.6 per cent. Note TOP has deployed some more capital recently, increasing – or becoming a substantial shareholder in – three of its positions. This means the current cash balance is not 100 per cent clear.

This gives me comfort that if I were to take the portfolio to 100 per cent invested I would still have a buffer to the market gyrations and the managers would be able to take advantage of the pullbacks. And this is a major reason why the portfolio has been as stable as it has during the first three months: We have taken our time. In hindsight it would have been great to pick up more BKI when we added to the position in September but alas. I'm not losing sleep over this. It's a long game and it's a volatile market. Our chance will come again.

Where the managers differ from the market

Comparing the portfolio's exposure to the S&P/ASX200 composition the big points of difference for the managers in the portfolio are the underweight positions in financials/banks and the dramatically underweight positions in materials. Financials make up 47.4 per cent of the S&P/ASX200 and materials make up 13.9 per cent. From what we know in the LIC portfolio they only make up 17.38 per cent and 0.95 per cent respectively – although this could be slightly higher given that some holdings are undisclosed. (For more on the composition of the Australian market, see The ASX200: A concentrated mix, September 16.)

The read through here is the underlying managers are avoiding the materials space. As you may recall when selecting the managers we opted for stock pickers. This means they select stocks with the strongest fundamentals, competitive advantages and relative upside potential. These characteristics are not shining through in the materials sector.

What's not there matters just as much as what is

None of the LICs have exposure to property. Vince Pezzullo of PIC commented: “I think cap rates [operating yields on properties' market value] are going up very soon in the US and given that the Australian yield trade has a higher correlation to US 5-10 year rates than to Australian rates long duration assets will struggle in that environment.”

The view from Cadence Capital was much more straight down the line, stating the stocks in that sector do not currently meet their fundamental requirements.

Common ground

It is interesting to look across the top holdings of the LICs to see the similarities. Besides the banks, two stocks stand out to me. TPG Telecom Limited (TPM) is held in the top holdings for BKI, CDM and WAX which shows you the consensus on the telecommunications stock. Additionally in the small cap space intellectual property lawyers IPH Limited (IPH) (see this recent interview with MD David Griffith) is held by both CDM and WAX. Outside the LIC model portfolio, Glennon Small Companies Limited (GC1) who we spoke with last week (catch up here) also includes the patent lawyers in its top holdings as well.

Where to from here?

As mentioned I am not in a hurry to deploy the capital but will be happy when I do to be 100 per cent invested and let the managers take care of the cash weighting.

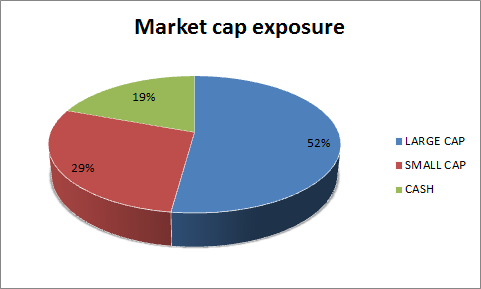

I would like to increase the large cap exposure further through the BKI holding and take it to 25 per cent. Additionally I would like to increase exposure to WAX. Both are well performing LICs compared to their peers and pay a decent dividend, which will help cash flow in the portfolio. I am aiming to increase the international exposure too. Currently this would be via MFF due to the high quality nature of the holdings.

From talking with numerous managers in recent months it is clear after the ASX's pullback they see the Australian market as better relative value when compared to international markets. This is why I am content to increase the Australian exposure in the portfolio via BKI and WAX. Additionally I am happy to increase the WAX exposure as many have commented about the low growth nature of the Australian market. It is my thought process that growth will be found in targeting mid- to small-cap stocks and carefully selecting them rather than taking a blanket approach.

My goal is to select a handful of the best managed LICs at the right price in the portfolio to generate returns above the market and above the standard market tracking LICs such as AFI. With the right mix I want to beat these over time and not have to be too hands on to do it. Remember the managers take a nice clip to worry about it all for us. So far I've accomplished this – and with minimal volatility as well.

My concern going forward will be if the portfolio can keep up in a bull market but time will tell.