Our first LIC call: Magellan's MFF

I‘ve chosen Magellan's MFF as the first Listed Investment Company (LIC) for my Eureka Report model portfolio.

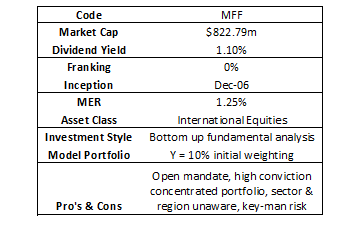

This LIC was established in December 2006 and over time the portfolio returns have put light years between the portfolio and its benchmark, the MSCI. Net of fees, the portfolio has returned 9.66 per cent per annum compared to the MSCI which has returned 2.20 per cent pa. The fee is 1.25 per cent; it's not the highest and it's not the cheapest but I am willing to pay up for performance.

Many moons ago when I was starting out on my investment journey I was fortunate enough to become involved with a group of people whose investment foundations were built off the back of Security Analysis by Ben Graham and The Essays of Warren Buffett. Such devotees were they, one even named his son Benjamin Graham. His wife wasn't too keen on the other choice of Warren. It was here I first heard the term, ‘a wonderful business at a fair price', an abbreviated version of a well-known Buffett quote.

The complete quote goes, “it's far better to buy a wonderful business at a fair price than a fair company at a wonderful price”. And it is this investment rationale that flows through the work and portfolio of Chris Mackay, portfolio manager and director of Magellan Flagship Fund (ASX:MFF). Mackay came to prominence as a fund manager with Hamish Douglass when they built Magellan Financial Group in recent years: Douglass today focuses on running the unlisted side of the Magellan business, now known as Magellan Financial Group (MFG). He will be the doing a Eureka Live interview with Alan Kohler tomorrow (Tuesday) at 2 pm.

When investing in MFF you are investing in a portfolio of international shares managed by one man. Yes, Mackay has the support of the research from Magellan Financial Group and the support of a well experienced board, but at the end of the day the investment decisions fall on his shoulders. But don't fret, Chris has plenty of incentive to keep focused on the portfolio and the task at hand with an equity holding in the fund valued at $83 million.

Looking at the portfolio through the years I go back to the Buffett quote above and also to the two core objectives stated by MFF: quality and value. The investment mandate for MFF is fairly unrestrained. It must hold a minimum of twenty stocks, there are no restrictions on the level of cash it can hold and on top of this it has a borrowing capacity of 20 per cent. There are no minimums or maximum limits to certain sectors or regions and there is no set policy when it comes to currency hedging. What this allows Mackay to do is fully align himself with the core objectives and focus on the best quality businesses he can find.

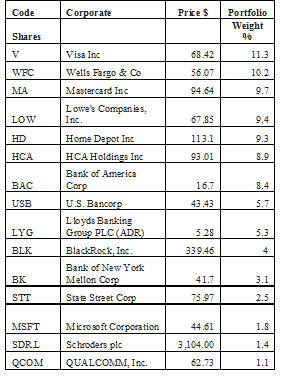

Right now this would point to a highly concentrated portfolio, with the current top fifteen investments making up 92 per cent of the portfolio and 6.3 per cent in cash, leaving 1.7 per cent of the portfolio spread amongst at least five other stocks.

Looking through the holdings (see table below) commentators may say the portfolio is too heavily skewed towards the US and towards financials but, for me, this goes to highlight the investment philosophy in action, investing in the highest quality names to be found that are trading at sufficient prices.

For this MFF is completely unapologetic and so they should be. It shows conviction in the house methodology. In terms of quality, what stands out to MFF is the competitive advantage of the businesses distinguished by the barriers to entry, margins and ability to grow. Return on equity and sensible capital management and the ability to grow organically and not from debt or new capital and acquisition.

In his commentary in the April monthly NTA update, Mackay notes MFF “remain very reluctant to move far down the quality curve or to pay up through these phases; low quality and expensive are not favoured investment categories over time.”

Investors also need to remember the portfolio is not static. It's an ever evolving series of ideas. Just because the portfolio is currently exposed to US financials (there are a number of multinationals in the portfolio as well) does not mean the portfolio will be in the future. Any investment involves trust, especially one with such a wide open mandate and I am inclined to trust someone who has performance and significant skin in the game.

Saying this you can see a macro element in his thought process when selecting individual equities. For example, in Visa and Mastercard he is clearly targeting the trend towards a cashless society by holding the highest quality companies exposed to this. Also, you can see a play on the theme of recovery in US housing with his holdings of Home Depot and Lowe's.

Another issue for investors to consider is currency; the Australian dollar is currently trading near a six-year low with the US. Selecting this stock I am not trying to pick the currency even though it is my belief it will continue to head lower. MFF has an open mandate on the currency and their position at the moment (as it has been for a long time) has been ‘long' AUD.

Saying that he does remain acutely aware of the impact of the currency on shareholders: “We cannot simply ignore currency as our shareholders are mostly investors from Australia with a currency that has been popular (expensive) almost since MFF's inception.”

Still on currency in the same portfolio update Mackay goes back to reaffirm his stance on purchasing quality stocks rather than picking larger macro-economic factors:

“In current conditions we will continue to concentrate on the companies in our portfolio and accept their currency realities, with cash currently being of secondary importance. At current market prices for our portfolio equities we expect average returns over many years to be multiples of cash, and we have almost total liquidity to sell if individual (or general) market prices or risks become too hot. Our portfolio companies have their own currency positions and strategies, and over time our choices of companies are far more important than current decisions on cash balances/borrowing.”

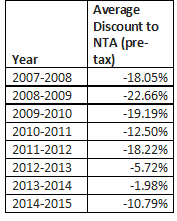

Ideally I would have loved to have started this model portfolio a while ago as MFF's share price, when compared to its NTA, was trading cheaper. Historically, MFF has traded at an average discount to NTA of approximately 12 per cent (see table below) but the gap is closing as investors look outward for opportunity and quality performance is recognised. At the time of writing (taking into consideration the dilution for the options expiring in 2017) the discount to pre-tax NTA stands at 4.99 per cent (it is trading at the moment in line with its post-tax NTA) and I am happy with that discount for my first purchase in the LIC model portfolio.

On the topic of purchasing I am not going to focus too much on finessing my entry points, especially whilst getting the portfolio set. As I have mentioned in the introduction email, LICs are effective for investors as they are passive investments which will add value to your portfolio over time. Your job as an investor is to have a long term view and to pick the right manager and investment process and let them worry about the Greeces of the world because inevitably in the next ten years there will be issues just as challenging ahead.

My outlook for MFF is not for it to continue to put the runs on the board as it has in the past as more challenges mount globally but I am buying it with a five-year view in mind. If the price materially exceeds NTA I will trim and potentially exit the holding. My initial purchase on MFF will be to 10 per cent of my portfolio and I will look to add further on share price weakness combined with a discount to NTA. All up at this point in time I am looking for approximately 30 per cent direct international exposure. Could MFF's share price slide back from here in the next six to twelve months? Quite possibly. But over the next five years could they continue to provide shareholders with great growing value? Absolutely.

One of my main concerns investing in MFF is also why I am attracted to it. The buck stops with Chris Mackay. This represents key man risk and we will monitor it as best we can. I attempted to get in touch with Chris for this article but I was unable to. But reading through the history of market updates you get a strong sense of the type of rational investor he is and I am certain a well-worn copy of The Essays of Warren Buffett sit on his bookshelf.

A note on the construction of the model LIC portfolio: 80 per cent of the portfolio will be made up of my core holdings. This will be spread across five to seven LICs weighted between 10-20 per cent. The other 20 per cent of the portfolio will be made up of smaller positions that present interesting opportunities e.g. exploring a specific thematic.