Plan for past returns and you will lose

Olympic hurdlers have it pretty good. Every four years they race around in front of the cameras and everyone claps when they cross the line. It would be an utter disaster for them if they turned up on the day to find the hurdles were set twice as high as the rule book stated.

But that would never happen. (Sadly for us, because it would make great television.)

Investors, believe it or not, are a bit like hurdlers. If their expectations of returns are realistic, they will probably hit their savings targets.

But what happens when the rules change? That is where investors find themselves today, and if they don’t adapt they won’t make it to the finish.

DON'T LOOK BEHIND YOU

Anyone whose investment savings target relies on a return to the era of double-digit returns is deluded. To avoid disappointment they need to lower that expectation, rebalance their portfolio or push back their plans for spending, including retirement. Expectations have changed, particularly for defensive assets.

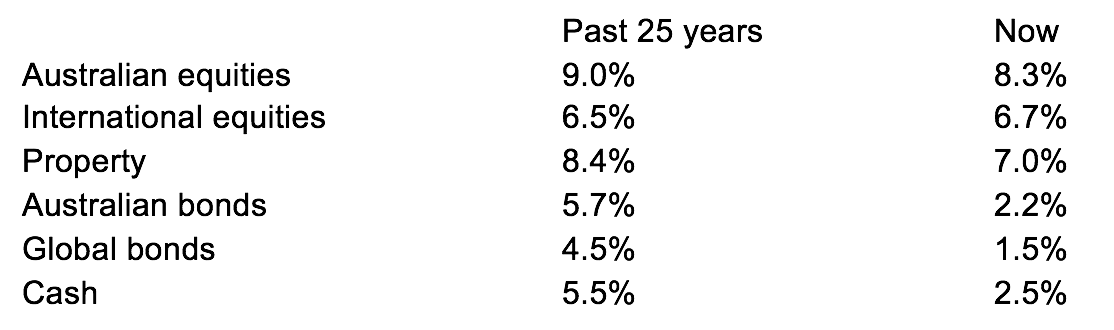

The table shows average returns for the major asset classes for the past 25 years compared with InvestSMART’s forward-looking estimates.

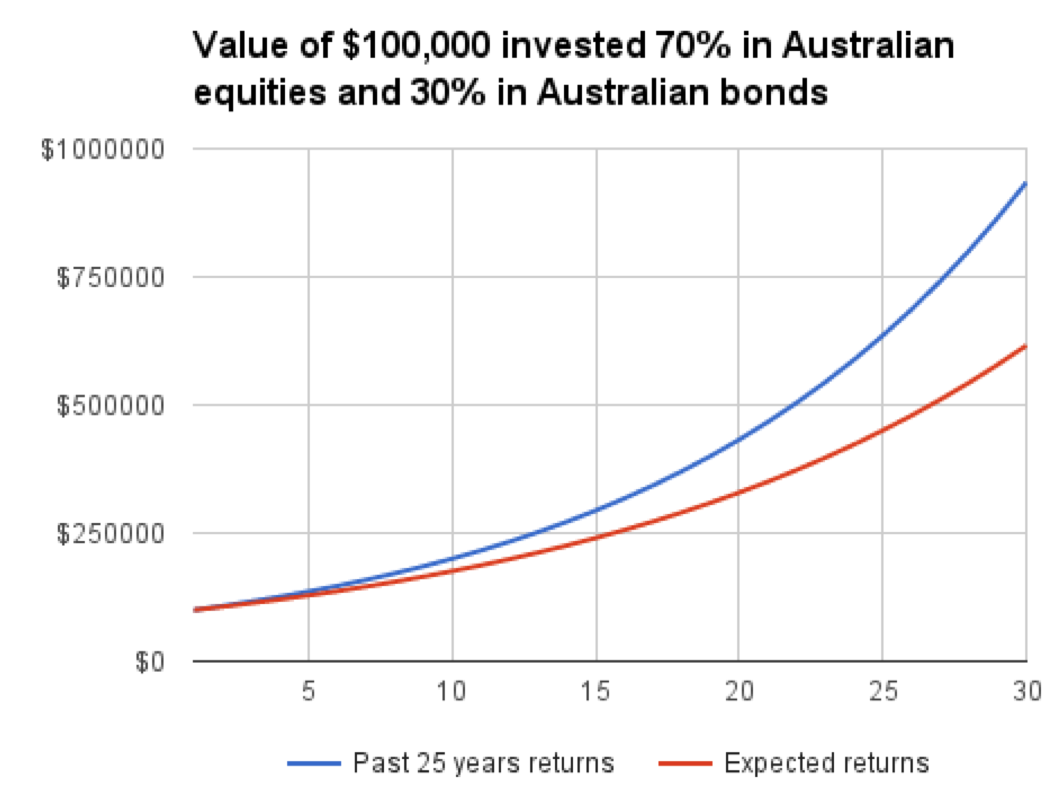

These subtle revisions in outlook will have a dramatic effect on possible future balances when the all-powerful variable of time is left to do its thing. Here is an example of how your typical portfolio split 70:30 between Australian equities and Australian bonds will track.

The blue line shows the outcome based on the hope that what’s gone before will happen again, but the red line accounts for returns for Australian bonds being 2.2% for the future, instead of the 5.7% a year on average enjoyed over the past quarter century.

Some investors may need to sit down and question their allegiance to defensive assets.

SELF-MANAGED AND FINGERS CROSSED

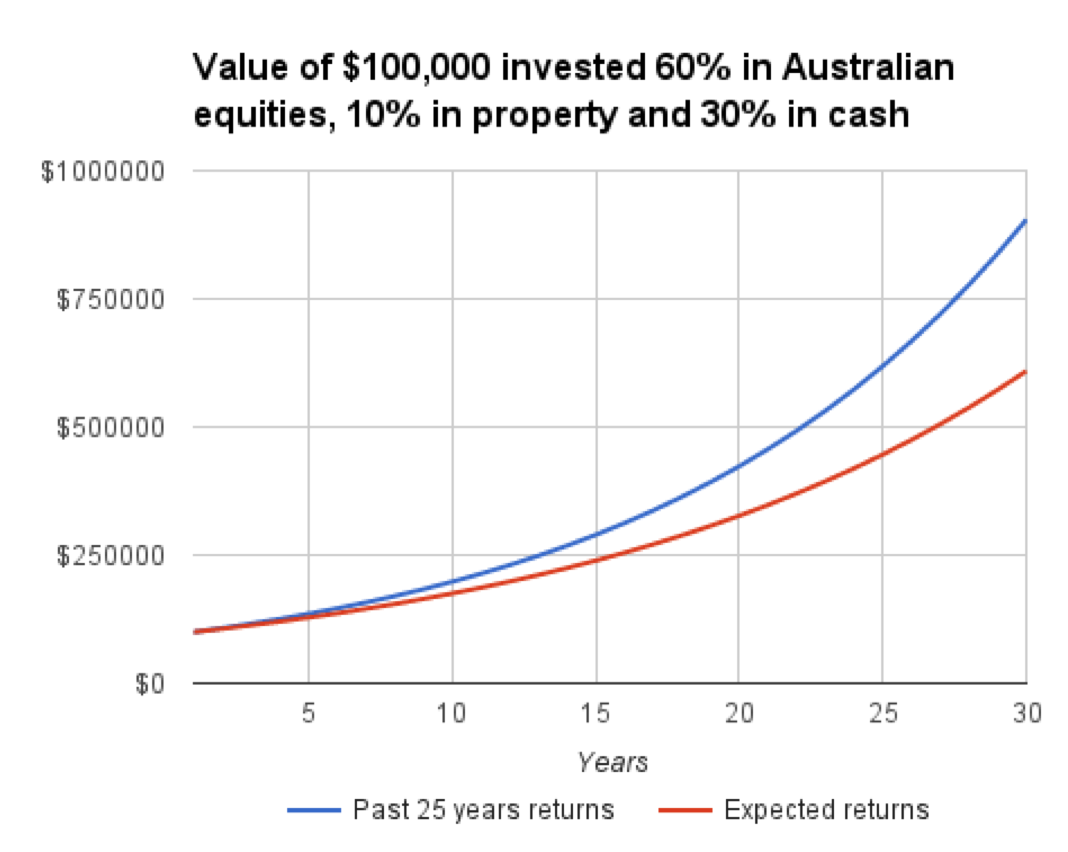

Now let’s look at the allocations for your average self-managed super fund with a balance around $500,000. Using a broad brush, such a DIY super fund would be expected to have 60% in Australian equities (where direct shares and managed investments are included), 10% in property and 30% in cash.

In this case lower expectations for all three asset classes are bad news for any backward-looking investor. More than anyone else SMSF trustees have to be honest with themselves. They are planning for future income at whatever appropriate level, but that can only be generated by an appropriate amount of capital. If expectations for returns are lower than their personal estimates, they have to ask whether they are hoping for too much — and why.

IN BALANCE

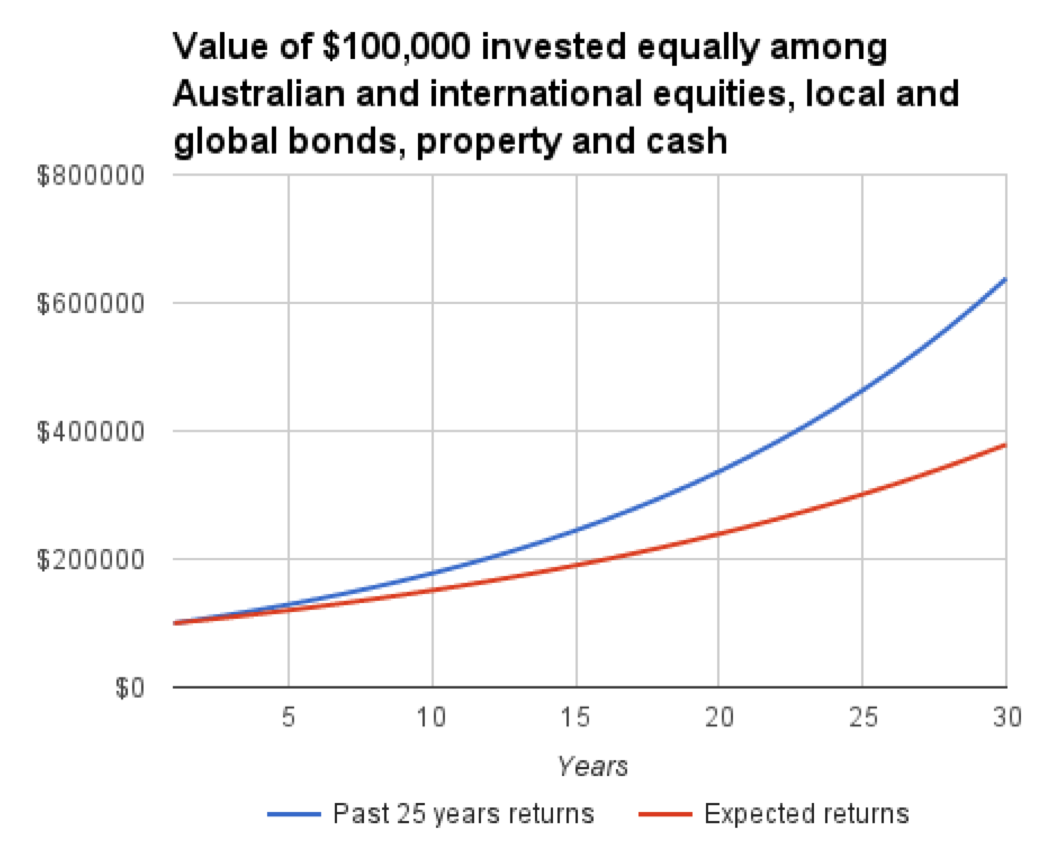

Finally, how would a portfolio equally weighted between the six investment classes be affected by shifting from historical returns to forward-looking estimates? It’s not good news.

BACK TO THE DRAWING BOARD

Hopefully most self-directed investors will have realistic expectations for whatever lurks within their portfolios. If it turns out their hopes are a little high, however, all is not lost — maybe it’s time to accept a little more risk in your strategy. As we’ve written about here before, it turns out the case for increasing allocations to defensive assets as you grow older isn’t as strong as many believe.

If it looks like reaching your goal will require you to take on a little bit too much risk, it would then make sense to ask yourself if that target of yours is a little too high. Maybe you can get by on a little less when the time comes? Either that or push back your plans by a few years. Enjoy the present. It’s a gift!

Frequently Asked Questions about this Article…

Investors need to adjust their expectations for future returns because relying on past double-digit returns can lead to disappointment. The investment landscape has changed, particularly for defensive assets, and realistic expectations are crucial for hitting savings targets.

Changes in return expectations can dramatically affect your future balances. For example, if you expect Australian bonds to return 2.2% instead of the historical 5.7%, your portfolio's growth will be slower, impacting your financial goals.

SMSF trustees should be honest about their return expectations. If future returns are lower than expected, they need to reassess whether their income goals are realistic and consider adjusting their investment strategy accordingly.

The case for increasing allocations to defensive assets as you age isn't as strong as many believe. It's important to evaluate your risk tolerance and consider whether your financial goals require a different strategy.

Maintaining high return expectations can lead to unmet financial goals. If your expectations are too high, you might need to accept more risk, adjust your target, or delay your plans to ensure financial stability.

Balancing your portfolio involves reassessing your asset allocations and considering forward-looking estimates. An equally weighted portfolio across different asset classes may need adjustments to align with realistic return expectations.

If your investment goals seem too ambitious, consider whether you can achieve them by taking on more risk or if you need to lower your expectations. Alternatively, you might decide to push back your plans by a few years.

To align your investment strategy with realistic expectations, regularly review your portfolio, stay informed about market trends, and adjust your asset allocations based on forward-looking return estimates rather than past performance.