Why you should hold more equities in retirement

There’s an old wisdom passed around the retirement planning industry between advisor and client which says the portion of a person’s wealth invested in shares should equal 100 minus that person’s age.

The logic is that younger folk have a long stretch before them. If there are market slumps along the way it won’t matter so much because they will keep investing as prices recover.

For those who live off their savings, a market slump is expected to be very bad news if they have a heavy allocation to shares. Regular withdrawals will erode a crippled capital balance, and any recovery will be less effective in boosting wealth.

A WEAK DEFENCE

The “100 minus your age” rule is of course the same as saying the allocation to defensive assets should equal your age. Returns from defensive assets such as cash and bonds are expected to be lower than growth assets such as equities and property, but lower levels of price volatility will make retirees feel more secure, the theory goes.

That’s all very well if an individual has accumulated plenty of capital and is realistic about his or her expected time in retirement. But men and women are living far longer than ever before — although the notion of retiring sometime in our sixties seems to have stuck.

Going on the latest data, half of men aged 65 will live past 84; half of women beyond age 87. For those who make it to 85, half of men will live past 91 and half of the women beyond 92.

The expected time in retirement is stretching, whether Australians are aware of it or not. Will their money last?

THE CASE FOR GROWTH ASSETS

The investment time horizon is slipping farther away and it would make sense that portfolios are tuned to put time on their side. That means it’s time to test the “100 minus your age” rule. Let’s have a look.

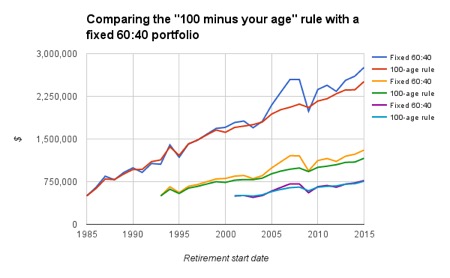

The chart compares the savings balances of two retirees aged 60, each with the same $500,000 starting balance and allowing for 5% annual withdrawals, but where one sticks to the “100 minus your age” rule, slowly increasing her allocation to global bonds away from Australian equities, and the other leaves the allocation at 60% Australian equities and 40% global bonds.

Three comparisons are made, for pairs of savers retiring in 1985, 1993 and 2001.

In each instance the retirees who stick to a fixed allocation of 60% in Australian equities and 40% in global bonds come out ahead.

The investors who applied the “100 minus your age” rule allocated 40% to shares and 60% to bonds on retirement, at age 60. At the start of each following year they withdrew 5% of funds for living expenses before increasing allocations to bonds by 1 percentage point and decreasing allocations to equities by 1 percentage point.

UPSIDE BEATS DOWNSIDE

The rebalancing strategy reduced the risk of losses, illustrated in the chart by a smoother line for those who followed the rule, but it also meant those investors missed out on growth opportunities from owning equities.

Where the real risk in investing for retirement might have more to do with living longer than you expected to, it would make sense to follow a strategy that isn’t designed to fit a use-by date.

A man who has just retired at 65 might expect his savings will need to support his lifestyle until life expectancy of 84 years, on the latest ABS estimates. But half of men will live longer. What happens if he reaches 85 and knows there’s a 50% chance he’ll live beyond 91, but he’s run out of money?

The best bet against such a terrible outcome is to plan for a longer-than-normal life (or spend less during retirement, which may not be feasible if an already frugal withdrawal rate has already been applied).

Equities can be relied on to deliver higher real returns than defensive assets over the long term, so it doesn’t make sense to steadily reduce holdings of such growth assets when the investment horizon is slipping further away.

Frequently Asked Questions about this Article…

The '100 minus your age' rule is seen as outdated because people are living longer, meaning their retirement savings need to last longer. This rule suggests reducing equity exposure as you age, but with longer life expectancies, maintaining a higher allocation to equities can help ensure your savings last throughout retirement.

Holding more equities in retirement can provide higher real returns compared to defensive assets like bonds and cash. This can help your savings grow over time, potentially outpacing inflation and supporting a longer retirement period.

Life expectancy impacts retirement investment strategies by extending the time your savings need to last. With people living longer, it's important to consider strategies that support a longer retirement, such as maintaining a higher allocation to growth assets like equities.

The downside of following the '100 minus your age' rule is that it may lead to missing out on growth opportunities from equities. As you age, this rule suggests increasing bond allocations, which typically offer lower returns, potentially reducing the longevity of your retirement savings.

A fixed allocation to equities and bonds, such as 60% in equities and 40% in bonds, can be more beneficial because it allows retirees to benefit from the growth potential of equities while still having some stability from bonds. This approach has historically resulted in better outcomes compared to gradually shifting to more bonds.

Retirees can manage the risk of outliving their savings by planning for a longer-than-expected life span and maintaining a higher allocation to growth assets like equities. This strategy can help ensure their savings continue to grow and support their lifestyle throughout retirement.

Defensive assets like bonds and cash play a role in providing stability and reducing volatility in a retirement portfolio. However, they typically offer lower returns than equities, so it's important to balance them with growth assets to ensure long-term financial security.

It's important to reconsider traditional retirement investment rules because they may not align with current life expectancies and financial needs. As people live longer, strategies that emphasize growth assets like equities can help ensure that retirement savings last longer and provide adequate support.