Our global stocks: Reporting season roundup

Summary: It's time to revisit six of the companies in the Eureka Global Equity portfolio after their recent third-quarter reports for 2014. Overall, the results from maker of Xilinx and Intuitive Surgical topped expectations, while those from Facebook and Whiting Petroleum were pretty much as expected. Elsewhere, the reports from FireEye and Gilead Sciences were mixed – but their outlook is still sound. |

Key take-out: The investment proposition for these high-growth companies remains intact, particularly for Facebook, FireEye and Whiting Petroleum – which I would be aggressively buying at current share price levels. |

Key beneficiaries: General investors. Category: International Shares. |

A number of the companies in the Eureka Global Equity portfolio have reported third-quarter earnings for 2014. Here are the summaries, comments and recommendations.

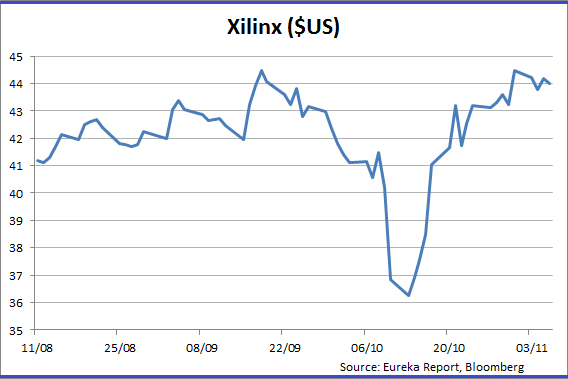

Xilinx

Xilinx, a maker of programmable logic devices which I first recommended as a “buy” in July this year, delivered revenue for the quarter that was reasonably in line with expectations, but better-than-expected margins propelled net income to a solid over-performance at $US171.5 million.

The earnings beat drove Xilinx stock up roughly 5.5% higher in after-hours trading.

Revenue beat the consensus estimates by 0.43%, while earnings per share (EPS) came in roughly 12.7% higher than expected. Compared to the same quarter in fiscal year 2014, Xilinx delivered operating income growth of 22%, and grew net income 21%.

While sales were in line with the company's guidance, its operating margins were better than expected, growing from 27% to 33% year-over-year. The company delivered on its projected rebound in its defence and aeronautics segment, which rose to 41% from 31% in the previous quarter, helping to offset the decline in communications.

Xilinx's latest quarterly report delivered solid results and our reasons for owning the stock remain intact.

The company managed to significantly grow its earnings per share thanks to improved margins, and the rebound of its defence and aeronautics sales gives the appearance of a more balanced business structure overall.

Guidance for the rest of the year was positive. The rollout of 4G LTE networks and the performance of its 28-nm chips will likely be the key points to watch for the remainder of the fiscal year. I expect more upside from 4G and 28-nm in the quarters to come – which is why we own the stock.

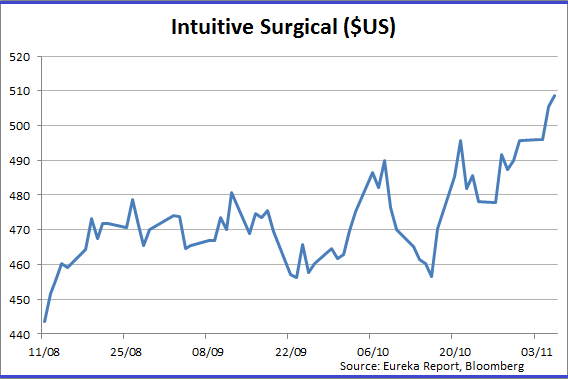

Intuitive Surgical

Robotic surgery company Intuitive Surgical reported a net profit of $US123.7 million, or $US3.35 a share, compared with $US156.8 million, or $US3.99 a share, a year earlier, as the market expected.

The system's average selling price (ASP) in the third quarter of 2014 was $US1.45 million, compared to $US1.56 million in the third quarter of 2013 and $US1.5 million in the second quarter of 2014. ASP decreased as a result of a greater number of trade-ins and products sold to cost sensitive customers, particularly in Europe

The company announced its third-quarter revenue rose 10% year-on-year as procedure volume and shipments of its da Vinci systems increased, ending a string of year-over-year revenue declines.

Intuitive Surgical said it is "pleased with our third quarter procedure and da Vinci system placement growth, the positive surgeon response to our da Vinci Xi System, and our progress in expanding our international business."

Results topped Wall Street expectations, and shares edged up 2.6% at $US508.50 in late trading.

Revenue rose to $US550.1 million from $US499 million. Excluding the impact of a da Vinci trade-out program, revenue rose to $US534 million.

Analysts polled by Thomson Reuters had expected per-share earnings of $US3.80 on revenue of $US518 million.

Overall it was a decent result and I believe Intuitive Surgical remains on track to meet (or beat) full-year estimates and resume its historical growth trajectory (see Intuitive Surgical: Buying into robotics, August 4).

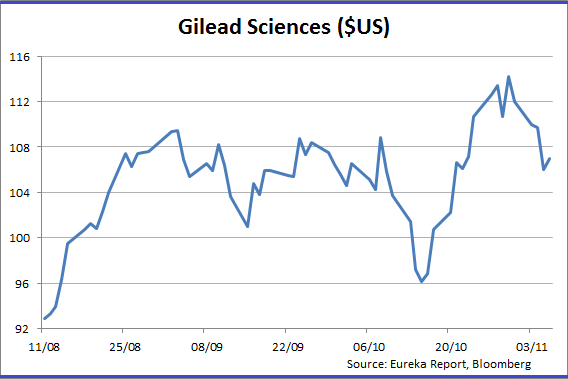

Gilead Sciences

Gilead Sciences reported earnings that surprisingly missed consensus estimates. EPS came in at $US1.84, which was US8 cents below what the street was looking for.

Revenue came in at $US6.04 billion, only $US50 million above estimates. The company did, however, raise revenue guidance for the fourth quarter.

Earnings rose 254%, and if not for a fee mandated by the Affordable Care Act, earnings would have beaten estimates by US13 cents.

An unanticipated shortfall in Solvaldi sales (hence the mild revenue beat) was mainly due to physicians delaying treatment during the third quarter in anticipation of Harvoni's approval. The decline in Sovaldi sales is actually a positive as it portends huge Harvoni revenues for the fourth quarter (see Gauging Gilead's superior growth, October 27).

There was nothing in the report that changes the long-term view on Gilead. The HIV businesses are doing well and the uptake on the Solvaldi variant Harvoni, with its one pill regimen and a potential eight-week treatment cycle, will lead to more earnings upgrades into 2015. Gilead is still a “buy”.

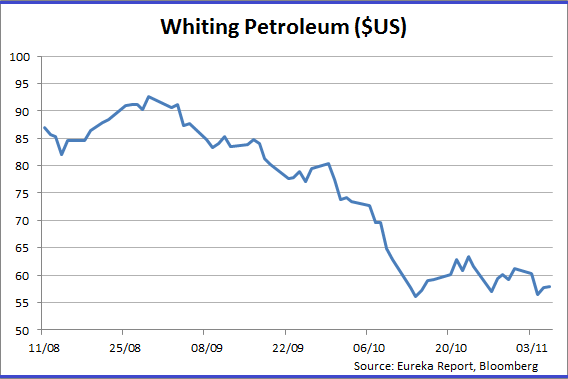

Whiting Petroleum

Whiting Petroleum's third quarter was pretty well as expected with no real surprises.

The company generated record production of 116,675 barrels of oil equivalent per day (BOE/d), up 6% over the previous quarter. Whiting earned $US1.32 per share and generated discretionary cash flow of $US538.2 million.

As for fourth-quarter guidance, the company expects volumes of 11.1-11.5 million barrels of oil equivalent (mmboe), or roughly 6% below current consensus expectations.

The pending acquisition of Kodiak is on track to close later this year so this year's results are not that material other than that the company is continuing to grow production in a measured manner in its own acreage, particularly in the Niobrara and Codell formations using improved fracking techniques mentioned in our initiation piece (Our first offshore stock pick, July 16).

Whiting's shares have been weak – not for any fundamental reasons or concerns – but on the back of declining oil prices. I would be an aggressive buyer at these levels. The oil price may trade into the low $US70 per barrel but not much lower in my opinion.

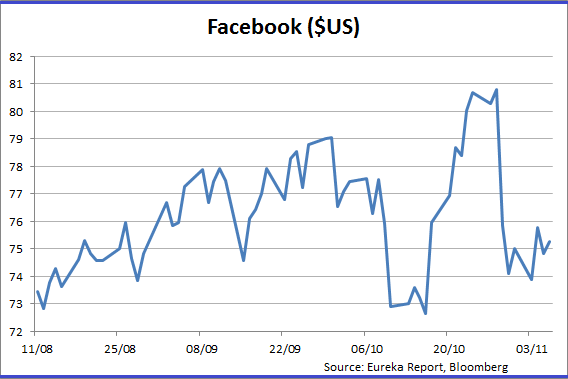

Facebook reported third-quarter earnings of US43 cents per share on $US3.20 billion in revenue, beating expectations for US40 cents per share on $US3.12 billion in revenue.

Daily active users, which represents the company's most engaged fans, increased 19% year-on-year to 864 million, compared with StreetAccount estimates for 852.5 million.

Total monthly active users rose 14% year-on-year to 1.35 billion, while mobile monthly active users rose to 1.12 billion during the quarter, up 29% year-over-year. Both figures were in line Wall Street projections.

Revenue generated from advertising came in at $US2.96 billion, up 64% from a year ago, with about 66% coming from mobile ads. Monetisation of the mobile space continues unabated.

The firm projects that costs and expenses will increase between 50% and 70% next year as it looks to invest in talent, and new areas like video and chat, chief financial officer David Wehner said on the company's conference call.

In addition, the company sees fourth-quarter revenue growing between 40% and 47% in comparison to the same quarter last year. Wall Street was looking for year-over-year revenue growth of 45%.

Typically, Facebook stock shed 10% in after-hours trading as the market always wants upside surprises from high-profile, high-growth names like Facebook. For nimble investors this was a buying opportunity.

Overall, it was a very strong quarter for the company and while the quantum of spending took a few investors by surprise, this is not unusual for a company like Facebook as it develops new growth initiatives. I would be buying Facebook aggressively at these levels (see Why we like Facebook, October 20).

FireEye

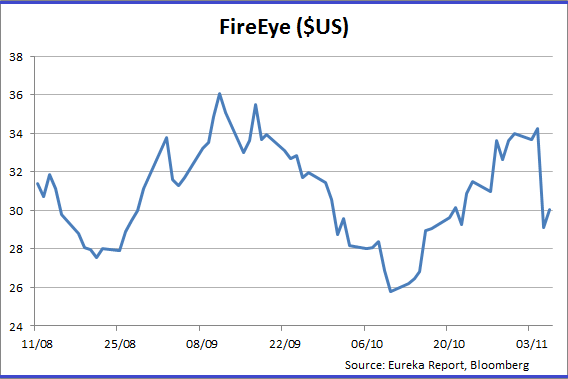

FireEye beat earnings estimates by $US5 cents but missed on revenue, generating $US114.2 million (up 167% compared to the previous year) when the street was looking for $US116 million.

Despite the revenue miss, third-quarter billings totalled $US165.1 million, an increase of 45% quarter-on-quarter and above guidance of $US150-155 million.

FireEye provides a technology solution that enables its customers to detect and prevent cybercrime attacks, as described in my first article on the company in August this year.

Fourth-quarter billings guidance is for $US195-210 million, and full-year guidance has been hiked to $US573-588 million from $US560-580 million – a good sign.

Third-quarter product revenue lifted 104% to $US48.4 million, while subscription/services revenue surged 248% to $US65.8 million. Both figures were boosted by the Mandiant acquisition.

Spending remains aggressive: excluding restructuring charges, operating expenditure – also prodded up by Mandiant – rose 157% to $US196.5 million. This will decrease somewhat over subsequent quarters but will remain at high levels.

FireEye shares sold off sharply in after-hours trade, down 20% at one point, which in my view is a great buying opportunity. At the time of writing the stock has clawed back 10% of that fall. I expect the share price to return to its recent highs of $US34 and beyond.

In the conference call chief executive David Dewalt said the switch to a new subscription-based cloud service, which launched in the third quarter, has put “near-term pressure on revenue.” But the billings, he said, indicate a healthier view of the company.

Billings over the quarter, which Dewalt said represent a “forward metric,” grew 45% from the second quarter to $US165.1 million. That topped the company's expectations of between $US150 million and $US155 million.

In the fourth quarter, FireEye sees total billings growing to between $US195 million and $US210 million, which would mark a sequential improvement of 27% at the high end, though a slowdown from 45% last quarter.

FireEye does expect to meet expectations on the top line next quarter, forecasting fourth-quarter sales between $US135 million and $US147 million, which brackets the consensus view of $143.8 million.

Investors should expect share price volatility around earnings announcements with high growth companies such as FireEye. In this case it is a buying opportunity as the growth thesis remains impressively intact.

Note: Next week I intend to broadly discuss the U.S. earnings season so far AND list the relevant (and not so relevant) information that these quarterly announcements provide for investors and how to take advantage of them.