Our first offshore stock pick

| Summary: The shale oil boom is taking the US closer and closer to oil self-sufficiency, and Whiting Petroleum is now on centre stage in announcing a $US6 billion acquisition of Kodiak Oil and Gas on Monday. |

| Key take-out: Whiting currently trades at a significant discount to its peer group. This should narrow over the medium term as production increases exponentially on announced operational improvements and increased drilling. |

| Key beneficiaries: General investors. Category: International shares. |

| Recommendation: Buy Price at call: $US83.80 Target price: $US131 Risk: High |

In choosing my first offshore stock pick for Eureka Report I considered my own investment strategy (which you can read more about by clicking here) and equally I considered the common experience of Eureka subscribers.

I'm always looking for stocks that will offer real growth and this often means disrupters, or those in disruptive industries. At the same time I know an Australian readership may have relied on the resources sector for much of its growth stock opportunities.

My colleague Tim Treadgold has consistently tracked the rise of the shale gas sector, particularly in the Cooper Basin (click here). It should be no surprise then it's the thriving US shale gas sector that has revealed an outstanding growth opportunity.

Putting some perspective on this sector: The US will remain the world's biggest oil producer this year after overtaking Saudi Arabia and Russia as extraction of energy from shale rock spurs the nation's economic recovery.

US production of crude oil surpassed all other countries this year with daily output exceeding 11 million barrels in the first quarter, according to a report issued by Bank of America. The country became the world's largest natural gas producer in 2010.

That America is on its way to energy self-sufficiency has long-term benefits for the US economy and changes the global geo-political landscape as well. There is also a compelling investment theme here as well, as I believe this production growth is still in the early stages and should continue well into 2015-2016.

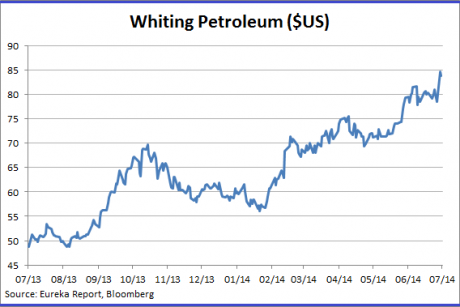

For that reason, at the beginning of the week, I was about to recommend Whiting Petroleum, a major player in the shale rich regions of the US. Whiting is a quality mid cap company that is trading at a discount to its peers, and is about to embark on a series of operational improvements that would significantly raise its production profile going forward.

Early Monday morning, however, Whiting announced it was acquiring Kodiak Oil and Gas in an all-stock transaction valued at $US6 billion. On the surface it looked like a smart deal, and after listening to management's conference call I'm convinced. Whiting is gaining some invaluable acreage and increased scale in the Bakken formation (one of the prime shale oil geographies in the US) and only paying a 5% premium to the market price. In fact, the deal would make the combined entity the largest Bakken / Three Forks producer with 107,000 barrels of oil equivalent produced per day and 855,000 net acres and an inventory of over 3,400 drilling locations. Exxon Mobil is now Number 2. As well, the deal will be accretive to earnings and cash flow in 2015.

Assuming shareholders and regulatory agencies approve, the deal will close in Q4 2104, so in order to understand the investment proposition more clearly I will first present the original background and detail on Whiting (as even without this acquisition it is attractive) and then summarise the benefits of the combined entity.

Whiting Petroleum (the 2014 Whiting: pre-acquisition)

Whiting Petroleum is an exploration & production energy company headquartered in Denver, Colorado.

Whiting is classed as mid cap (just barely) company with a $US9 billion market cap (in contrast Exxon Mobil has a market cap of $US444 billion).

I know the company well, have met senior management (Chairman and CEO Jim Volker and Senior Vice-President Exploration Mark Williams) numerous times over the past few years. Whiting was held in numerous global portfolios that I managed.

It's a good quality way to play rising US oil and gas production from unconventional (shale) oil and gas properties. Whiting's reserves are 79% oil (89% liquids) and has a R/P ratio of 13 years.

Whiting currently trades at a significant discount (EV/EBITDAX ratio of 6.2 times) to its peer group. I expect this to narrow over the medium term as production increases exponentially on announced operational improvements and increased drilling now that the Redtail gas processing plant is operational.

Whiting controls one of the largest acreages and 1,600 net wells in the Bakken shale play in North Dakota, substantial properties in the DJ basin in Colorado and has 120,000 net acres with over 3,300 gross locations to drill in the Niobrara trend. They are active in recovery plays in the Permian basin in Texas. Needless to say the major shale plays – the Bakken and Niobrara are driving the production growth.

Significant operational improvements are being flagged by management in recent calls. Whiting has successfully tested new coiled tubing unit conveyed fracking technology at Missouri Breaks acreage. Results are impressive: 70% more effective than the sliding sleeve method and 40% better than the cemented liner method.

A new improved cemented liner technique (with plug and perforation technology) is also being implemented in most of the Williston basin properties, with recovery rates 50% in excess of older technologies.

Planned drilling activities are also expected to increase production in 2014, with the company using a 32 well per spacing pattern at its Redtail locations that could result in over 6600 gross wells in a rich area (up from 3,300 at a 16 well pattern). In the Bakken (Hidden Bench) Whiting will be using 8 wells per DSU versus a previous 4 plus 9 wells per DSU (drill spacing unit) versus the original planned 3 in the rich Sanish field.

The “Old” Whiting pre acquisition

Price: $US78.50 as of July 11

Diluted Shares | 119,931,000 | |

Q1 Production | 100,065 boe/day | |

Q1 Production Growth | 27% | |

Proved Reserves | 438.5 million boe | |

Proved Reserves Per Share | 3.66 boe/share | |

Mkt Cap | $8.8 billion | |

LT Debt | $2.7 billion | |

Enterprise Value | $11.5 billion | |

2013 EBITDAX | $1.86 billion | |

EV/EBITDAX | 6.2 | |

EV/Proved boe | $26.2/boe | |

EV/Production boe | $114,925/boe | |

Q1 EPS | $0.91 | |

Q1 EPS yoy Growth | 26% |

Historical Financial Performance

Cash flow per share has grown at 26% since 2009.

Net debt to EBITTDAX down 21%.

EBITDA margins solid at 66-68% since 2010.

So if the “old” Whiting was attractive, what about the combined entity and what might it be worth?

- Being the dominant player in the Bakken is a big positive. The Bakken (Montana and North Dakota) is one of the most prolific and high production regions in the US, pumping out over 1 million barrels a day. That's second only to Texas and more than Qatar or Ecuador. Each new well produces over 500 barrels a day – the highest of any of the shale regions in the US including Eagle Ford.

- Whiting will apply its improved drilling and recovery technology to Kodiak's acreage which already has strong growth (production growth was 40 % 2012 / 2013). Some analysts now see over 50% growth in 2015 from Kodiak's properties.

- An enterprise value for Kodiak of 6 billion means Whiting is paying roughly 8.8 times Ebitda. Historically (since 2009) deals of this magnitude have been done at a median 11.6 times EBITDA. So they hardly overpaid.

- The combined entity should be able to reduce Kodiak's drilling costs from roughly 9.2 million per well to Whiting's average of 8 million per well. Other operating costs should fall as well.

- On 2014 numbers Whiting ex Kodiak is trading at a P.E. of 18 times. Consensus numbers for the combined entity in 2015 are now approaching $5.50 / share up from $5.00 pre- acquisition. That 2015 earnings number is likely to be revised upward in my opinion.

- I valued the old Whiting at 5.5 X 2014 EV/ EBITDA or $96.00 per share. Analysts are clamouring to put a 2015 value on the new entity and there are already some target EV / EBITDA multiples of 7.9 times or $122.00. As Whiting was already trading at a discount to peers, if it could attain close to a peer multiple in 2015 (8.5X) which I believe it can now with this additional scale this would equate to $131.00. Currently the stock is at $84.58 (close 15/07) having traded up 7.7 % during the day on the deal. There is still considerable upside.

Conclusion and Recommendation

Whiting is a Buy. The acquisition of Kodiak, assuming efficiencies are exploited, is a huge positive.

I would be happy to start building positions in the low $US80s, using the inherent daily volatility of the oil price to my advantage.

In terms of the oil price, I believe it's firmly underpinned by the uncertainty in the Middle East and an improving global economy although I don't expect an upward spike anytime soon.

Risks

Commodity prices, oilfield service cost inflation, exploration failures, technical problems with development wells.