Have the Asian Tigers lost their roar?

Summary: With China at the crossroads, the four Asian Tigers (South Korea, Taiwan, Hong Kong and Singapore) plus India come under the spotlight.

Key take-out: Investment professionals talk through the particulars of individual markets within emerging Asia, which are bound by not much else other than geography.

China is the engine driving Asia, but that engine is under pressure, rattling other markets, and having serious ramifications for emerging Asia.

InvestSMART recently covered the China deleveraging issue in great detail and what it could mean for investors now that China is at the crossroads.

Now we explore emerging Asia ex-China, and weigh up the key themes that investment professionals and research houses have been tapping into.

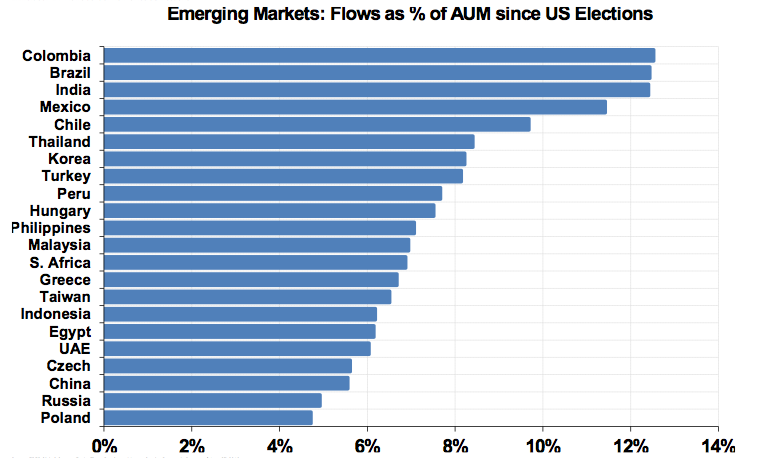

Around $8 billion of foreign money was pulled out of Asian sharemarkets in June, taking the total outflows for the calendar year so far to $25 billion. June marked the third month of solid outflows. We haven't seen recurring outflows of this magnitude from these markets since the end of 2016, around the US election. It bucks the trend of 2017.

Source: EPFR Global, Country Equity Flows Database, Morgan Stanley Research. Data as of June 27, 2018.

For the first half of July, there were no signs of a turnaround in these fund flows either.

After a lacklustre first quarter, the US dollar went from strength to strength over the second quarter, detracting from developing economies. And through trade tensions and tariffs, equity markets have felt much more of a crunch than their credit market peers.

Concerns appear centred around export-led economies, such as Korea, Taiwan, Malaysia and Thailand. Korea and Taiwan are classified as Asian Tiger Economies, while Malaysia and Thailand are Tiger Cub Economies.

And yet, besides borders and seas, these individual markets can have little in common.

We focus on the Asian Tigers for this instalment, plus India, as it's a major industrialisation hub.

India

Through its Asia ex-Japan model, Macquarie Research favours China, India and Korea, in that order, with Malaysia, Thailand and Indonesia ranking at the bottom of the list respectively.

Making the favourites are markets with “domestic structural agenda and strong corporates” where there are strong secular, not just cyclical, drivers. A strong tech sector is believed to give a secular edge, while “everything else” is considered “purely cyclical”.

Macquarie says there are at least a dozen Indian companies that qualify on most of its 'quality' criteria.

However, ANZ Research's Khoon Goh says there are concerns that higher oil prices will lead to a widening in the current account deficit and higher inflation. Indian equity funds recorded $US400 million in outflows for June alone.

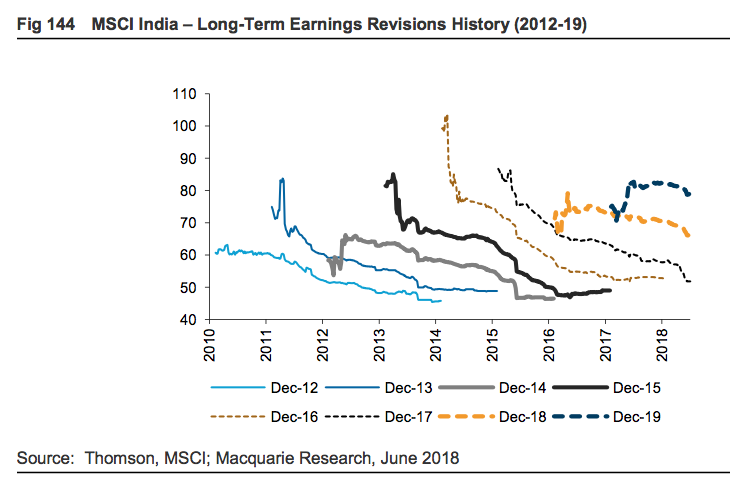

As well, Macquarie adds, India is looking a little lofty on an earnings expectations basis, and has for some time:

“While India is delivering the highest nominal GDP growth rates in the region, it is also an economy with rising inflationary pressures and limited structural tangible structural benefits thus far. It seems highly likely that downward revisions would continue through the balance of the year, as was the case in the 2015-17 period. Indeed, as can be seen below, India has had a consistent history of earnings downgrades since 2012.”

South Korea

In Korea, Morgan Stanley speculates that high performance computing companies, hypermarkets, packaged foods and department stores were likely to be most affected as Alibaba and Amazon continue ramping up.

Together with Taiwan and China, Korea was a 20th century beneficiary of manufacturing and trade, and now through tariffs, that path is being gradually blocked.

Foreign selling counted for $US1.1 billion in Korean equities outflows in June.

“Although we discount an outright trade war, we firmly believe that the liberal and globalised world order is dying,” wrote Macquarie analysts in their note titled ‘Rights, Wrong & Returns'.

“Emerging markets would need to find another business model and at the current juncture there is none in sight, certainly none of the power of manufacturing, globalisation and trade.”

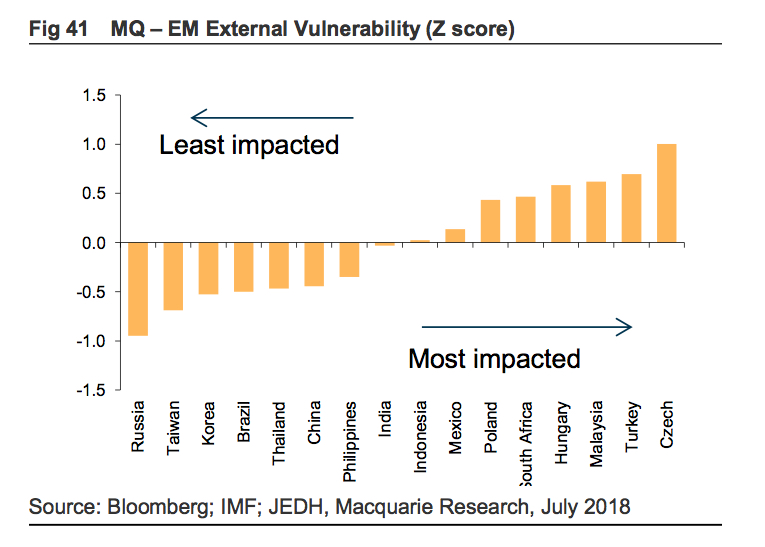

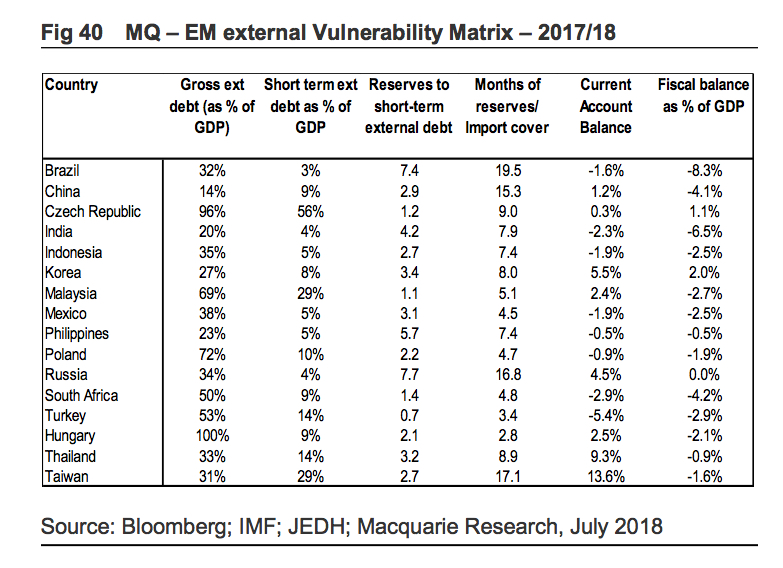

And yet, Korea's fate may hinge less on terms of trade than initially thought. Korea has a stronger economic position comparatively, cushioning the nation from external shocks.

Taiwan

Morgan Stanley has upgraded Taiwan as a region, and dramatically at that.

In the equities space, the East Asia island state has been upgraded from number 18 to number five against its peers, with the bank taking an overweight tilt here.

Morgan Stanley is slanted to domestic rather than exporter exposures within Taiwan, “thanks to attractive relative trailing price-to-book ratios and dividend yield scores, improving return on equity relative and net margin scores in our model”. Add to the mix, Taiwan runs a large current account surplus and has a strong reserve position, which the analysts think should limit forex vulnerability.

Could the worst be over for Taiwan?

Outflows over the five months to June exceeded those seen during China's equity market correction and renminbi devaluation in 2015, totalling $US2.6 billion, or the lion's share of the Asian sell-off.

However, Citi directly implicates Taiwan in the trade tensions. Taiwan exports to China are worth about 8.2 per cent to GDP, and for this reason, it's highlighted as the most vulnerable economy in the region should tensions escalate.

Hong Kong & Singapore

Similar to Australia, housing market concerns seem to plague Singapore.

To curb lending, the government earlier this month announced fresh cooling measures.

“Overarching policy intent is to lower risks of market destabilisation over the medium term when a flood of new units come on-stream, driving rental yields lower at a time when mortgage rates will likely be northwards of 3 per cent, in turn driving debt service ratios for investors to punitive levels,” explained Citi analyst Kit Wei Zheng.

Like its neighbouring indices, Hong Kong's Hang Seng has a liquidity outflow problem against a backdrop of rising interest rates. Even more so though, it's historically a very volatile market.

Although, while household leverage in Hong Kong has grown, the quality of these loans is sound. For instance, since 2000, the highest mortgage delinquency rate in Hong Kong over a three-month period is 1.43 per cent — that's lower than home loan arrears rates for half of Australia over the last quarter.

Hong Kong households are also far less leveraged than those in Singapore. The average loan-to-value ratio for new mortgages in Hong Kong is 48.8 per cent, down from 55 per cent six years ago, while that ratio for outstanding mortgages in Singapore has ticked up from 42 per cent to 53 per cent over the same period.

In Hong Kong, there has already been eight rounds of macro-prudential measures. Citi analysts think that's substantially lowered the risk to households as well as the banking sector.

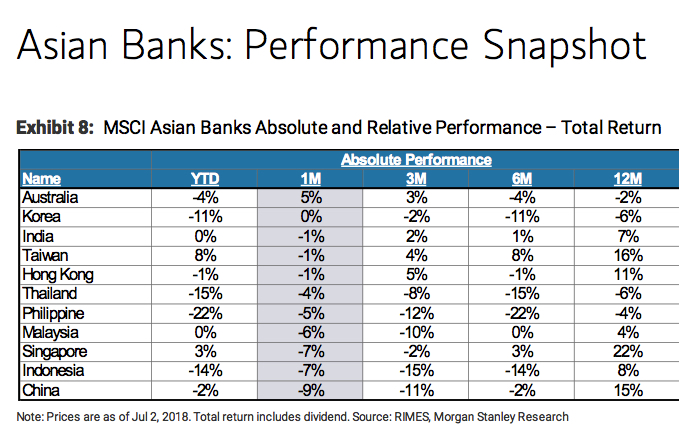

One of the best barometers for Asian sentiment could be the strength of the financials sector — and the big banks of the East haven't been faring all too well.

Steeper than 2013

It has been a steep sell-off. Although, the Head of Asia Research for ANZ adds, emerging Asia selling has already surpassed that seen during the 2013 taper tantrum episode.

“Typically, we can expect to see a halt to the selling after the magnitude and duration that has been experienced so far this year,” says ANZ's Khoon Goh.

“Cumulative outflows year-to-date have surpassed even that seen during the 2013 taper tantrum episode. But data over the early part of July suggests that outflow pressures remain, with equities recording $US1.4 billion of outflows in the first week though bond markets are showing signs of inflows returning.”

Macquarie cautions over the temptation to trade “occasional relief rallies” and maintains it's merely a question of whether emerging market equities are facing a sharp correction, like the taper tantrum, or a gradual erosion.

“Emerging markets have already given up around 50 per cent of the relative gains of '16-17 (underperformance of ~12-13 per cent since the high in the early 2018), while emerging markets funds flows have gone from being overbought to being slightly oversold. As long as our core view — that the world is not disintegrating today — is correct, we expect a gradual erosion (~50bps per month) rather than a collapse, intermingled with occasional relief rallies.”

Something else to consider is the steep cost of brokerage when dabbling in Asian markets. It's much more expensive than trading Australian shares, and typically more expensive than trading Europe and the US. The costs of taking what's a stab in the dark, in many respects, may outweigh the positives.

Our next article in this series will focus on the so-called "tiger cubs", the second-tier emerging and frontier markets in Asia.