Is China a screaming buy?

Summary: The sharp fall on the Chinese stock market could create opportunities.

Key take-out: But even professional fund managers are viewing China with caution.

For global stocks portfolio managers, the market meltdown on mainland China is definitely cause for concern.

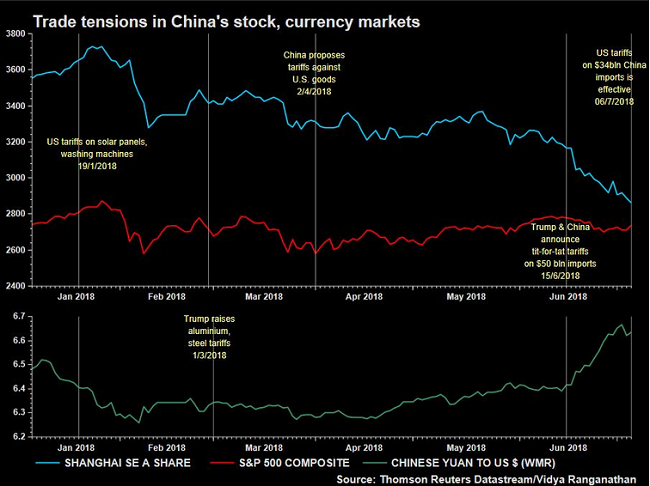

In just six months, the benchmark Shanghai Stock Exchange Composite Index has plunged close to 22 per cent, including 9 per cent since mid-June following an escalation in the trade tariffs war between China and the United States.

China is firmly in bear market territory. On Monday, Chinese smartphone maker Xiaomi Corp. fell 3 per cent on its debut, sending another strong signal to investors that it may be safer to stay out of the woods for now.

On top of the trade war are major domestic structural reforms that also have big implications for China over the medium term. Foremost among them is the Chinese Government's keynote program to deleverage many of its heavily indebted state-owned enterprises, which could place further strain on the country's already stressed financial system.

Chief Market Strategist Evan Lucas explains the deleveraging program in more detail in his companion article, China: Swapping debt for equity.

Yet, for all the financial and geopolitical concerns around China at this point, most fund managers are still seeing huge opportunities in the Chinese market over the longer term.

Those opportunities are primarily related to tapping into companies with an exposure to China's rapidly growing domestic consumption, and that includes enterprises in China itself as well as foreign corporations feeding goods into the nation.

Peter Wilmshurst, portfolio manager of the Templeton Global Growth Fund, says one of the key challenges from an investment perspective at the moment is finding good Chinese stocks at a reasonable price.

Wilmshurst says the value opportunities in China are better than they were a few months ago but “I wouldn't say we're jumping up and down saying there's the best bargains we've seen in years and years. Some stocks are still well up on where they were.

“Our focus is to buy companies that have exposure to Chinese economic growth, that have sensible balance sheets, decent businesses, and that pay either high single digit or low double digit multiples.

“We're not going for the really cyclical stocks with the exposure to leverage, and we're not going for the pure-play consumption exposures, because they are just too expensive. So, we're left playing the middle ground where you get some exposure to Chinese consumption growth, but hopefully at much more attractive multiples.”

Franklin Templeton Investments has been in the Chinese market for years, and has made solid gains from stocks including internet group Baidu and, indirectly, from the retail giant Alibaba. Those stocks are still trading on very high price to earnings multiples, making them unattractive from a value perspective.

Instead, Wilmshurst says stocks that still look attractive in China are telecommunications companies exposed to the huge domestic growth story, and even groups such as insurer China Life that are reaping the rewards of China's rising middle class.

“The three Chinese telcos are all growing their service revenues. A couple of them have reasonably generous dividend policies where you're getting 5 per cent yields. They'll deliver reasonable earnings growth, and the starting multiples are pretty attractive.”

Off the list are any stocks directly exposed to China's financial sector.

“You'd certainly be getting a can of worms there,” he says. “Whether or not that can of worms ever opens up is a different question, but you'd be getting a bunch of that."

Ben Smoker, Chief Executive of Saxo Capital Markets, says the recent announcement from global index group MSCI to include 224 Chinese stocks into the MSCI Emerging Markets Index is a significant move for investors around the world.

Last month Saxo added the China A-shares to its multi-asset trading platform, providing direct China market access for Australian investors.

“I think that the Chinese stock market now clearly can't be ignored,” Smoker says. “It's really heavily on the average investor's radar now and I think the market has been screaming out for a way to access these Chinese stocks. Now it's a question of what do you buy? I think the next challenge is to understand the components of those Chinese stock market listings and work out where one should invest their money.”

Wilmshurst says “there is still plenty of opportunity in China and elsewhere in the region right now”.

“Its economic impact, partly as the US retreats from its global role, leaves a bit of a vacuum, particularly in Asia, and China will fill it to a greater extent.”

Investing into the Chinese A stocks being listed, including many that are state-owned enterprises, will require extensive research, because most are completely unknown entities to investors.

“We will all be working out what's the right way to go about doing that, getting to know those companies. I think it will take a while, just because it is a whole new range of companies that haven't had much exposure to overseas investors, because they haven't had to," Wilmshurst says.

“Ultimately it's going to be incumbent on all of us who do global equities to increase our knowledge of those companies and work out which ones we think are attractive investments for our clients.”

Then it comes down to timing, and whether now is a good time to buy in, or to wait for the Chinese market to fall further?

“If you saw the Chinese mainland markets come down a fair way, then I think, yes, there would be an acceleration in foreign investors saying, ‘ok, this an opportunity for us to step in'.

“But I think the local market is going to drive things to a reasonable degree for the short term.”