Global shares: Winners and losers

Summary: Global shares are off to a good start so far in 2015 despite the slide in oil, the possibility of Greece exiting the EU and ongoing concerns surrounding Ukraine and the Middle East. Australian investors would have particularly benefited thanks to the falling Australian dollar. So far, some of Eureka's best performing stocks have been FireEye, Celldex, Splunk and Amazon. |

Key take-out: Given the rather perilous state of world affairs, an industry that should be on investors' radar screens right now is aerospace and defence. These companies are big, attractively valued, have healthy balance sheets and incredibly valuable proprietary technology. |

Key beneficiaries: General investors. Category: International investing. |

Global equity markets are off to a good start in 2015. In spite of a precipitous fall in the oil price, the possibility of a “Grexit” (Greece leaving the EU), and ongoing geopolitical concerns over the Ukraine and the Middle East, most markets have generated solid returns.

Central banks have underwritten a good part of this share rally with rate cuts (Australia, Indonesia, Canada, Sweden, and India), ‘dovish' posturing towards future rate rises (the US), and of course a long overdue, full blown, quantitative easing in the Eurozone.

Year-to-date (to Feb 27, 2015) and in local currency terms, the S&P 500 is up 2.2 per cent, the FTSE has gained 5.8 per cent, the Nikkei rose 7.6 per cent, and European stocks have jumped 13.6 per cent – their best start to a year since 1997. In Asia Pacific, India is up a solid 4.5 per cent, Hong Kong 5.5 per cent, and Indonesia 4.2 per cent.

To the surprise of a number of commentators and analysts who were uniformly bearish at the end of 2014, the local Australian market got its mojo back (with a bit of help from the RBA) rising some 9 per cent so far this year.

If you were investing overseas in Australian dollars (and I hope a number of Eureka subscribers took our advice last year) you received a significant extra boost from the weakening Aussie dollar. For an Aussie dollar investor, the S&P 500 is up 7.2 per cent, the FTSE 9.7 per cent, the Nikkei 13.24 per cent, Hong Kong 10.6 per cent, and India 12 per cent. The MSCI All Country index is up some 8.8 per cent in $A terms.

How have our recommended stocks done in 2015? Best performers (in local currency) with double-digit returns to Feb 27 include FireEye ( 40.3 per cent), Celldex Therapeutics ( 36.7 per cent), Splunk ( 25.62 per cent), Amazon ( 24.2 per cent), Tata Motors ( 15.3 per cent), Ambarella ( 14.4 per cent) and Gilead ( 10 per cent).

Techtronic ( 8.4 per cent), Dow( 8 per cent) and Google ( 5.7 per cent) provided single-digit but market-beating returns.

Laggards include Sierra Wireless (-17 per cent) and Xilinx (-3.3 per cent), both on tepid guidance. Also, Harley Davidson has slipped 3 per cent and Intuitive Surgical has fallen 3.3 per cent for no particular reason.

Schlumberger is off on the oil price but seems to have found buyers in the low $US80 area.

Again, for $A investors, you have to add roughly 5 per cent to these local currency returns due to $A depreciation since December 31.

EUREKA GLOBAL STOCKS YTD Performance | Dec 31, 2014 | Feb 28 2015 | % Change* |

Amazon Sierra Wireless DOW Harley Davidson Gilead Celldex Ezion Ambarella Techtronic Tata Motors Schlumberger Splunk FireEye Intuitive Surgical Xilinx Whiting Petroleum | 524.8 310.3 47.4 45.6 65.91 94.6 78.02 18.25 1.12 50.72 25 42.28 85.41 58.95 31.58 528.9 43.29 33 | 555.91 384.9 39.14 49.3 63.8 104.19 80.4 24.94 1.14 58.01 27.10 48.62 83.9 74 45.4 606.3 41.8 34 | 5.7% 24.2% (-17%) 8.0% (-3%) 10% 3% 36.7 1.8% 14.37% 8.41% 15% (-1.78%) 25.6% 43.8% (-4.2%) (-3.3%) 3% |

In a recent year-ahead piece Investing Offshore in 2015, I said that we should be selectively moving beyond the US market in order to get a bit more diversity and that process is underway. We have recently added a European name LVMH, and a Japanese pick, Fanuc.

I say “selectively” because I am spending a lot of time looking at Europe, Japan, Asia, and other regions of the world including Latin America and at this point I'm not finding that much. The most attractive names are global not local. That could change later in the year, however, when (and if) European and other global economies start to recover.

Moving beyond global macroeconomic realities, there is an industry that, given the rather perilous state of world affairs (the rise of ISIL, Russian aspirations in Eastern Europe, and ongoing conflicts in most of the Middle East), should be on investors' radar screens: the aerospace and defence industry.

Aerospace and defence are actually two industries with some overlap. Aerospace covers companies more involved in air transportation such as Boeing, Airbus, Rolls Royce, AviChina, Embraer, and United Technologies.

The defence industry, as the name implies, manufactures mostly (but not exclusively) military equipment and, for the most part, is US based. Companies such as General Dynamics, Northrop Grumman, Lockheed Martin, and Raytheon have a long history supplying the US and other friendly governments with state-of-the-art aircraft, ships, tanks, missiles, electronic warfare and communication systems.

Aerospace companies have had a great run. Boeing has lifted 16 per cent and Airbus has gained 25 per cent so far this year. The return to health of many of the major airlines and strong traffic growth both in the developed and developing world is driving a strong order cycle. We may revisit these names later and also some of their component suppliers such as BEA Aerospace and Spirit Aerospace.

Defence stocks may have lagged the broader market year-to-date but they have a lot of attractive attributes, in my opinion. They are big, attractively valued, have robust cash flows, healthy balance sheets and have some incredibly valuable proprietary technology.

As the military moves more towards smart weaponry, utilising technology rather than brute force and firepower (fewer battleships more drones), these companies are extremely well placed. They have little or no sensitivities to the economy. Uncertainties over the future direction and growth of Department of Defence (DoD) budgets are creating an opportunity for patient investors.

Three of the main players are Lockheed Martin, General Dynamics and Northrop Grumman.

I am not issuing recommendations on these companies for the moment and they won't be included in the Eureka Global portfolio. However, they are worth watching.

Lockheed Martin (market cap $US65.2Bn)

Lockheed Martin Corporation (NYSE: LMT) has significant presence in almost every aspect of the US defence industry including research, design, development, manufacture, integration, operation, and sustainment.

The company operates in five business segments: aeronautics, information systems & global solutions, missile and fire control, mission systems and training, and space systems.

Its primary customer is the US government, although international sales (17 per cent of 2012) are picking up and set to represent 20 per cent of sales within the next few years.

Formed by the 1995 merger of Lockheed Corporation and Martin Marietta, Lockheed is the largest dedicated defence contractor by market capitalisation.

One of its flagship products is the F-22 Raptor, a stealth fighter currently used in campaigns against ISIL and currently the world's most advanced combat aircraft.

General Dynamics (market cap $US47bn)

General Dynamics (NYSE: GD) has four main business segments: aerospace, combat systems, marine systems and information systems and technology.

Aerospace designs, manufactures and provides services for mid-size and large-cabin business aircraft.

Combat systems provides land-based and amphibious armoured vehicles, power trains, turrets, munitions, and gun systems.

Marine Systems designs and builds submarines, surface combatants, auxiliary ships and large commercial vessels.

Information systems and technology (IS&T) provides specialised data acquisition and processing, advanced electronics, battlespace information networks, and management systems.

Approximately 70% of the company's sales are to the US government.

Northrop Grumman (market cap $US33.8bn)

Northrop Grumman (NYSE: NOC) is a major defence contractor, providing electronics, aerospace engineering, radars, and cybersecurity solutions.

While the US government accounts for 85% of sales, the company is diversified with no single product or service accounting for over 10% of total revenue.

The investment case is a top line driven by sales of fighter jets (F-35 and F/A-18) and global UAV (Drone) sales especially the Global Hawk.

Over the near term investment sentiment toward the group will be defined by the “tug of war” in Congress between deficit reduction hawks and calls to strengthen the US military.

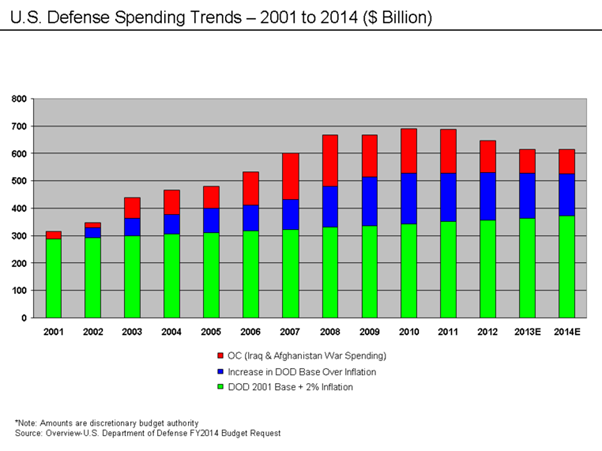

Still, 2015 looks like a trough year for defence budgets and the “base” (in green) is still growing 3% per annum, as shown in the graph below, so this is a group to watch.

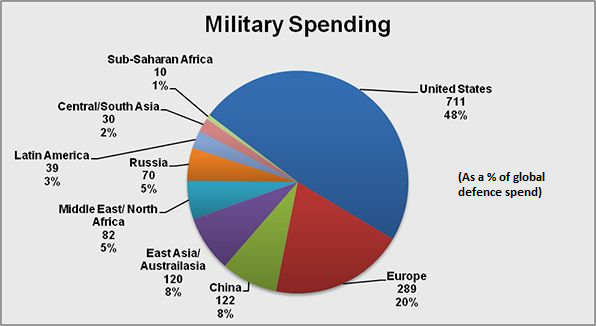

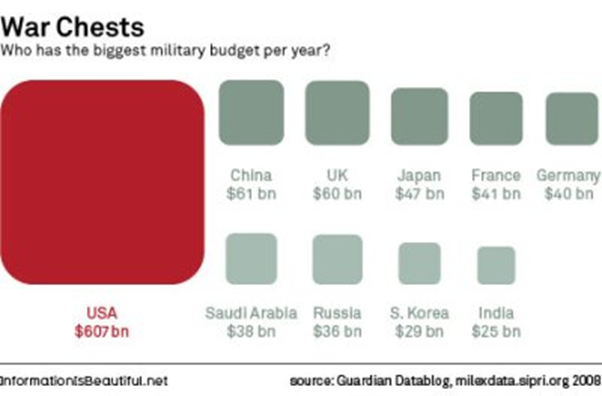

What's shown in the chart isn't surprising. Even if Afghanistan and Iraq spending go to zero, the US is the 800 lb gorilla of global defence spending and will be for the foreseeable future (see below).