Cashed-up Fanuc

What do you get when you combine one of the most successful activist hedge fund managers and one of the world's largest and most dominant robotics companies? An investment opportunity.

Fanuc, headquartered in Japan, is one of the world's great industrial franchises. It has a 60% share of the global market for computerised numerical control systems (CNCs) and servomotors used in machine tools, a 20% share in industrial robots, and operating margins in excess of 40%. It accomplishes all this with only 5,500 employees.

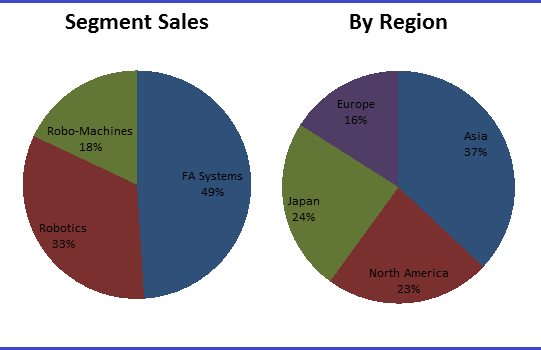

Source: Fanuc

It also has an incredibly inefficient balance sheet holding over 11 trillion yen ($US8.5 billion) in cash – roughly a third of its enterprise value, and some 44 million treasury shares equivalent to 18% of shares outstanding.

The company has no debt and seldom meets with investors. This is what is attracting the activist investor.

Business structure

Fanuc has three main divisions: Factory automation, industrial robots and robomachines.

Factory automation (49% of sales)

Its most important products, providing over 50% of operating profit, are the CNC systems and servomotors, which dominate the machine tool control software market and have a worldwide market share of 60%.

The Company has also built a global service/aftermarket support organisation that is far ahead of competitors in a business where switching costs are prohibitively high.

Factory automation's revenue correlates closely to Japanese machine tool orders, which are expanding smartly on the back of strong demand from the auto industry in the US, a depreciating yen, and a surge in orders from Korea and China for machine tools used to manufacture smartphones

Industrial robots (33% of sales)

Sales from this division are growing at 25% year-on-year. Main growth drivers are from China, where automotive industry robot density is still at less than 15% of the levels seen in other industrialised countries like Germany and Japan. Non-automotive robotics is less than 5%.

Japan is also a strong market where capital equipment is in a replacement cycle and domestic labour shortages are fostering a higher level of automation.

The resurgence in US manufacturing is also underpinning strong demand, as automotive and general industry customers are increasing orders for robots that can lift, sort, weld, and paint. Fanuc's robots are present in every large manufacturing expansion in North America – from Airbus to Ford and Tesla.

Robomachines (18% of sales)

Robodrill has grown sales six-fold over the past five years.

Apple is now using the Robodrill for all of its products and has driven many of its competitors (Samsung, Xiaomi, etc.) to do the same. More and more smartphones now have metal cases rather than plastic, even at the low end.

This trend is unlikely to reverse although the rate of growth may moderate to more sustainable levels over time.

Delving into the latest results

Looking at Fanuc's most recent earnings release, one can see the attractiveness of the business.

Total orders rose 56% year-on-year to 195 billion yen and lifted 12% quarter-on-quarter. Sales surged ahead of expectations, driven by higher than expected robomachine and industrial robots sales, which were up 256% and 34% respectively. The operating margin came in at an impressive 45%.

Company guidance (such as they offered) cited strong machine tool demand in Japan, China and even Europe.

On February 16, 2014 the company announced a 130 billion yen ($US1.08 billion) capital investment program to build additional production and research facilities. All will be built in Japan. The bulk of this investment will fund four new facilities to manufacture computerized numerical control (CNC) systems and other machine tools.

This will boost capacity by 40%. Clearly the company is confident in its end markets and believes a combination of higher wages and more sophisticated home electronics and automotive products will continue to drive growth in China, where Fanuc is well placed.

An activist investor

It is unlikely that the publicity around Dan Loeb and his Third Point investment precipitated the capital investment program.

Earlier this month, the activist investor disclosed to his investors that he bought a stake in Fanuc.

Activist investors target usually underperforming and inefficient companies. Fanuc is not one of those. Certainly, its relationship with its shareholders (especially foreign ones) could improve, however, and that's where Dan Loeb comes in.

Now to be perfectly clear, I would never follow anyone no matter how famous or successful into an investment before looking into the investment merits myself.

Hostile activism has a bad reputation and dismal track record in Japan, dating back to fabled US corporate raider and investor T. Boone Pickens' foiled 1989 bid to win seats on the board of a Toyota Motor Corp. supplier.

Of 23 hostile takeover bids by locals and foreigners alike, only two have been completed since 2000. Normally successful activist investors such as Steel Partners, the Children's Investment Fund and Cerberus Capital have been stymied in various attempts to overhaul managements and instil corporate reform.

That being said, corporate Japan is decades behind US companies in terms of transparency, corporate governance, earnings quality and investor access so I'm not surprised activist investors are starting to target this market.

The Economist, in an article published in May last year, points out that Japan even lags the developing world in this area, with some 600 of the largest Japanese companies having no outside directors where this is a requirement in South Korea, China and India.

So how will Dan Loeb succeed where others have failed? He has successfully agitated for change in US companies like Sotheby's, Yahoo and Dow Chemical and he is a high profile investor like Carl Icahn, Bill Ackman and Nelson Peltz.

One thing in his favour is that foreign ownership of corporate Japan has increased to around 26% from 8% over the last 20 years and the economic reforms of Prime Minister Abe are attracting even more foreign capital.

Another is that he has already taken a run at Sony – one of Japan's largest and most mismanaged companies – suggesting that the company split the electronics and entertainment businesses (Sony rejected his suggestions).

If nothing else, it will focus investors (both Japanese and foreign) attention on Fanuc and may persuade the company to act in terms of improving corporate governance and returning cash to shareholders.

Recommendation

Fanuc is a buy for long-term oriented investors in my opinion.

Its businesses are firmly underpinned by robust end markets in Asia Pacific and the US.

The company will also receive a significant boost to its long-term growth as it benefits from the “next wave” of robotics, where analysts are predicting a much higher growth rate over the next decade to 2025 relative to the past 10 years.

This will be driven by cheaper robotics prices, the need for more intelligent machines, a change in low global adoption rates (according to the Robotics Industries Association (RIA) only 10% of US companies that would benefit from factory automation/robotics have installed equipment) and an increase in the pathetically low robot density in China.

Indeed, China has only 23 robots per 10,000 employees, while Japan has 332 per 10,000.

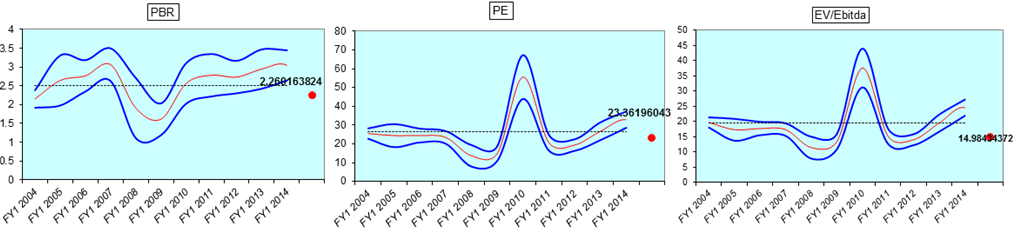

In spite of delivering solid results over the past few years, Fanuc is trading at the lower end of its historical ratios (price to book, price to earnings and EV/EBITDA), as shown in the chart below.

I believe that Fanuc can easily trade at its 10-year median PE of 23.

In calculating my target price, 23 times the FY16 earnings per share of 1,080 yen is 24,800 yen. That's 10% upside from current levels. The stock has already gained 15% this month to date on positive news flow (and 9% since I started writing this).

My suggestion would be to buy a bit at current prices and then add on market weakness. Any temporary rise in the yen would also provide an opportunity to pick up shares below current levels. Given the inherent volatility of currencies and markets you usually always get an opportunity.

Risks

- A further contraction in Chinese economic activity.

- Tepid global economic growth decreases demand for machine tools.

- A downturn in global automotive capital expenditure.

- A significant increase in the value of the yen (versus the USD or euro).

- The emergence of a Chinese competitor in CNC/servo motors.