Investing offshore in 2015

Summary: US stocks have outperformed over the past four years and it is probably time to diversify slightly. Europe and Asia are more modestly valued. Technology stocks will continue to do well next year, while most risks are geopolitical rather than macroeconomic. In terms of Eureka coverage, I will continue to cover technology disruptors and will look at opportunities in more varied parts of the globe. |

Key take out: 2015 should be another positive year for equities. Hopefully, clever stock pickers will be rewarded. |

Key beneficiaries: General Investors. Category: International investing. |

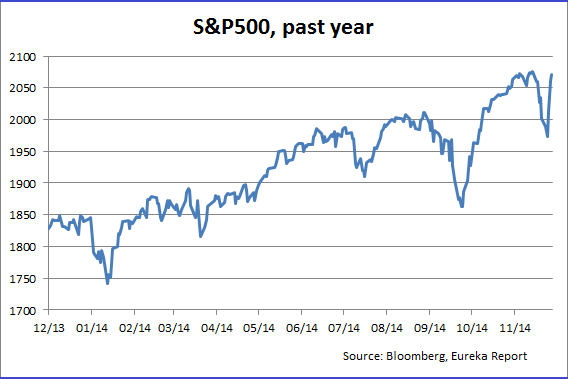

The first eleven months of 2014 have been profitable for global investors and even more so if you were investing in Australian dollars. In local currency terms the best performing large stock market to date is the US, with the S&P 500 gaining 12%. The tech-laden NASDAQ is doing even better, up 14%. If you were an Australian investor fortunate enough to own an S&P 500 ETF you have a 19% return, turbocharged by a declining Australian dollar.

The US wasn't the only market to do well in 2014. Double digit returns rewarded investors in the so-called emerging world, with India up 35% (43% in Australian dollars), Indonesia 21% (26% in AUD), and Thailand 23% (29% in AUD). Note the power of currency on returns overseas!

China, after a painful and frustrating five-year bear market, saw the CSI 300 rally 27% this year. Japan was in negative territory for most of 2014, has had a recent rally and has returned 9% so far (but only 2% in AUD due to the weak Yen).

Laggards included most Eurozone markets and the UK's FTSE 100. Brazil was essentially flat but in AUD terms is down 3%. Russia somehow managed a 5% return in RUB but for an AUD investor that market was off over 30%. Currency is a two way street. The Australian market also struggled and is down 1.3% so far this year.

In terms of industries, technology and biotechnology provided some market-beating returns. Significant laggards were energy, any commodity-based industry, gold, and construction/engineering.

The stocks that drove the S&P 500 to new highs were mostly the so called “mega caps” from the technology sector: Apple ( 43.6%), Microsoft ( 29.94%), Intel ( 43.22%), and Facebook ( 37.5%). Biotech names like Gilead ( 33.9%) and Amgen ( 45.7%) also contributed.

Exxon Mobil (-9%), Amazon (-17.6%), IBM (-14%), General Electric (-7%), and General Motors (-20%) negatively impacted the S&P the most during the year.

In 2014, global portfolio managers had to be significantly overweight the US market in order to outperform as other regions struggled. In fact, the US (particularly large cap stocks) has been the standout performer over the last four years (since the end of 2010) by a large margin. Is this a worry?

In local currency terms and not including dividends, the S&P 500 has gained 64% since December 31, 2010. The NASDAQ is up 80%. Other developed markets with the exception of Japan ( 75% off a very low base) pale in comparison.

The FTSE 100 is up but 13%. A broad index of European stocks has returned a paltry 16% or roughly 4% per annum. The German DAX is an exception with a 44% return. Decent, but miles behind the US.

Looking beyond the US

To be honest, I think it's probably time to move beyond an extremely heavy concentration in US equities after a huge four year out-performance and in the name of diversity. Not that I expect a big market correction or anything like that. I will always be able to find compelling investments in the US. Instead of having 90% to 100% in the US, investors might consider a 70% or 80% weight in 2015.

The US market is “fairly” valued at 16 times 2015 earnings per share but not grossly overvalued. The US economy is doing well and corporate earnings are solid. I expect, all things being equal, more of a normal historical return of 6% to 7% or so. The Australian dollar has more downside in my opinion, so that return could be conservative.

Europe and Asia are much more modestly valued especially relative to history. Asia (ex Japan) is trading well below historical averages on price-earnings ratios and price to book. Europe is at a 20% discount to the US in price to earnings terms. These markets, having marked time for the past few years have the potential to finally play “catch up” and are certainly worth a look.

Technology will continue to do well in 2015, both in the US and abroad. While some of your “big tech” names like Microsoft, Cisco, Intel and Oracle have had a pretty good year that comes after a long period of flat to indifferent relative performance. There may be more upside left. Small and mid-cap technology (where my focus is) will still be a good place for growth investors in 2015.

Some of your other mega cap names like Google and Amazon (is it a tech stock or a retailer?) have struggled on profitability concerns. Google might be worth a look here as it diversifies into other fascinating but related businesses (see Searching for value in Google, December 22).

I expect a rebound in oil prices in 2015 so the energy sector (a dog in 2014 due to falling crude prices) could be interesting. I would be accumulating Schlumberger at these levels. With Brent below $US$70, shale producers may well curtail production while undergoing a cash flow squeeze from lower prices. A growing US economy and low gas prices could well increase demand for petroleum products as motorists take advantage of cheap fuel. Less supply and more demand equal higher prices.

Risks and headwinds

I think most risks are in the geopolitical arena, not macroeconomic. While the Middle East remains worrisome with ISIS still active and Palestinian/Israeli tensions escalating, it's Russia and Ukraine that could be more problematic, particularly if Putin starts to eye other countries that have Russian minorities. A train wreck of an economy may embolden him even more. Do the Russians not remember the 1930s? One to watch – carefully.

Interest rates will probably rise at some point in 2015 in the US and the UK in order to reverse the extraordinary easing that has taken place and to address an ever improving economic picture at home and abroad. I expect central banks to manage expectations accordingly and markets to take it in their stride.

So net/net, 2015 should be another positive year for equities and hopefully continue to reward clever stock pickers.

The year ahead in Eureka picks

What can subscribers expect from the international section of Eureka Report in 2015? First and foremost, I plan to continue to present investible ideas around the McKinsey Global Institute's “12 disruptive technologies” and hope to cover all twelve categories (see Investing in technology disruptors, July 23). For a growth investor I can't think of a better place to look.

We are also going to spend some time on those “neophyte disrupter” companies like Uber, Airbnb, Lending Club, and Palantir that are primed to go public in 2015 and work out where and why we'd buy them.

As I said, we need to travel farther afield next year and have a good look at investment opportunities in some of the “neglected” (neglected by me anyway) parts of the globe like Europe and Latin America, a region I know well.

We are also going to spend some time looking specifically at some of the high-growth economies in Asia such as Indonesia, the Philippines, and Thailand, particularly where retail investors can invest directly. Smaller companies with a consumer focus are interesting here.

China will also be a priority and we'll be analysing both the dually listed “H” shares that trade in Hong Kong and the China “A” shares that investors can buy through the new reciprocal exchange arrangements put in place recently. China looks like it's breaking out of its “bear” mode as economic growth shifts to more of a consumption driven model. We'll also be spending some time on Chinese corporate governance when investing in Chinese companies and what to look for. I also plan to do some work on Alibaba.

Another priority I have is to hopefully educate investors in the intricacies of portfolio management, risk controls, and performance attribution in order to “demystify” the whole investment process. I also intend to introduce investors to the science of quantitative investing – using the power of the computer to generate ideas.

So all in all, an ambitious program but worth it in my view. Australian investors need to become global investors.