Correction protection: The scorecard

Summary: Many new products designed to withstand market volatility outperformed base equity markets during the June downturn. Funds taking a modified stock picking approach fell less than their benchmarks, while one internally risk modified fund also outperformed. Multi asset products were the pick of the crop. |

Key take-out: Sensible financial engineering can improve outcomes compared to more traditional methods, especially in uncertain times. |

Key beneficiaries: General investors. Category: Strategy. |

Over the last few months we've been profiling the growing range of investment funds and products which are designed to withstand market volatility, and hope to produce steadier returns than traditional products and portfolios. You may have read some or all of these features: Smooth operators, December 10, 2014; Introducing the volatility managers, February 4; DAA, a new investment approach, May 20.

Put simply, the idea behind these pieces was to alert readers to the range of protected products now in the local market. Today in the wake of the market's de facto June correction (the ASX fell 9 per cent from peak to trough) we examine how well they have delivered on their promise to protect... and in general the results are good. Or to be more precise, many of these products outperformed base equity markets, with considerably lower volatility.

The problem recapped

The structural problem for traditional investments and portfolios is driven by low interest rates and artificial liquidity provided by quantitative easing programs in most major markets. As QE is wound back in the US, removing the stimulus for asset prices increases the prospect of market corrections. Traditional “strategic asset allocation” hopes for relatively uncorrelated prices across different asset classes, and doesn't cope well when rapid market shocks occur or when correlations are unusually high.

Tools for better performance

Fundamental analysis is the cornerstone of investing and looks at the prospects of share investments from the perspective of valuing the business that the shareholder owns part of. Metrics like cash flow, profit margins, ROE, “economic moats” and the like are used to determine the appeal, durability and price suitability of the investment. Sound investments with good fundamentals typically don't deteriorate in quality when markets correct – but even so, their prices suffer when markets fall.

Prices for good stocks improve as markets recover but retirees in “draw down” phase can and do lose capital if they are forced to sell down parts of their portfolio during periods of market distress. That's the problem that we now know as sequencing risk – and it's a live issue for most retirees.

Reflecting on and aiming to overcome these problems, the new wave of investments fall into three main camps:

1. “Long only” products which use modified stock picking approaches to reduce risk;

2. Internally risk modified products which overlay traditional investments with risk reduction technology;

3. Multi-asset products which change their investment mix to achieve a specific return objective, sometimes known as “real return” or “objective based” investments.

Modified stock picking

Traditional actively managed funds benchmark their performance against indices like the ASX 200. Because of this benchmark they are forced to hold large numbers of stocks (often as many as 80 – 100) and to adopt a high turnover approach (Australian share funds average 80 per cent pa turnover). Because these funds often fail to beat their benchmark, and may fall as far or further than their reference index in down markets, newer product providers are emerging with a focus on using concentrated, low turnover portfolios.

Some of these aim to reduce volatility and improve performance by picking and holding good quality stocks without any specific reference to an index benchmark. Others go further and explicitly select stocks which display low volatility, elevating this as a priority in the investment process.

Returns over the last couple of months shows that quality providers of concentrated portfolios have beaten the general market, although they have still fallen somewhat. The Montgomery Fund (managed by Roger Montgomery) has outperformed the ASX 300 index by 4.98 per cent pa since inception three years ago.

Model equity portfolios compiled by Malcolm Palmer (of Joseph Palmer and Sons) also showed outperformance, with their Australian Share Model Portfolio falling by -3.9 per cent during the quarter ended 30 June 2015, compared to a fall of -6.5 per cent for the ASX 200 (Total Return) index.

As an alternative, the Alliance Bernstein Managed Volatility Equities Fund explicitly aims to reduce volatility by picking stocks that have reasonable valuations, high quality cash flows and relatively stable share prices (reflected by lower than market level volatility). Since inception last year it has outperformed the general stock market. During the month of June the AB Managed Volatility Fund fell by -2.46 per cent, less than half the fall of the general market.

Internally risk modified products

Managing risk through derivative based hedging strategies is often found to be overly expensive, mainly because the costs of doing so reduce returns during periods when expected risks don't materialise. Put options provide explicit insurance against market falls but can add costs of 5 per cent pa (or more) to share investments. Using futures is less expensive but when markets rise, selling futures works against you and adds costs to the portfolio.

Next generation risk management techniques use dynamic hedging to increase protection when markets begin to trend down, and to reduce protection as they recover. Predicting the future is hard, so the indicators used need to be carefully designed to work in the real world. Risk management firms like Milliman provide this technology to global insurance and asset management groups, including in Australia to product issuers like BetaShares and Plato.

The BetaShares “Dividend Harvester” fund (ASX code: HVST) invests into high yielding stocks, and uses the Milliman “Managed Risk Strategy” (MMRS) to limit downside risk.

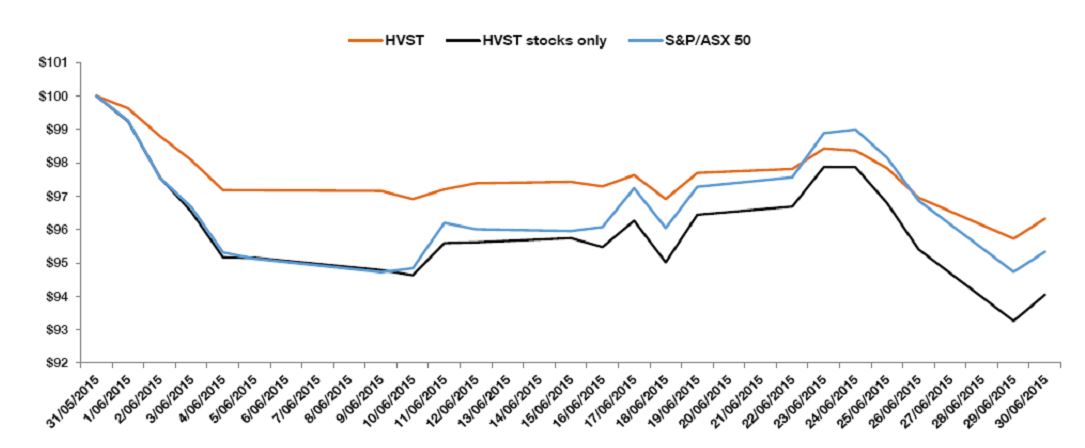

The HVST portfolio returned -3.67 per cent for the month of June, which compares to the S&P/ASX 50 return of -4.66 per cent and the underlying stock basket of -5.95 per cent. The MMRS hedge level ranged between 35 per cent and 42 per cent during the month, which helped reduced volatility (9.1 per cent for HVST vs. 16.4 per cent for the underlying stock basket). This performance is shown in the chart below.

Source: BetaShares

Multi asset products

Unlike traditional “balanced” investment funds which are compiled using “strategic asset allocation” techniques, newer style multi asset funds select underlying investments solely on their capacity to meet a defined “objective” return. Schroders “Real Return” fund is offered in two versions, one which targets a return of CPI 5 per cent pa, and the other which targets a return of CPI 3.5 per cent pa. AMP Capital offers the Dynamic Markets Fund which targets a return of CPI 4.5 per cent pa. Unlike the Schroders Fund which is built entirely using specific asset class funds also created by Schroders, the AMP fund only invests into low cost ETFs and index funds.

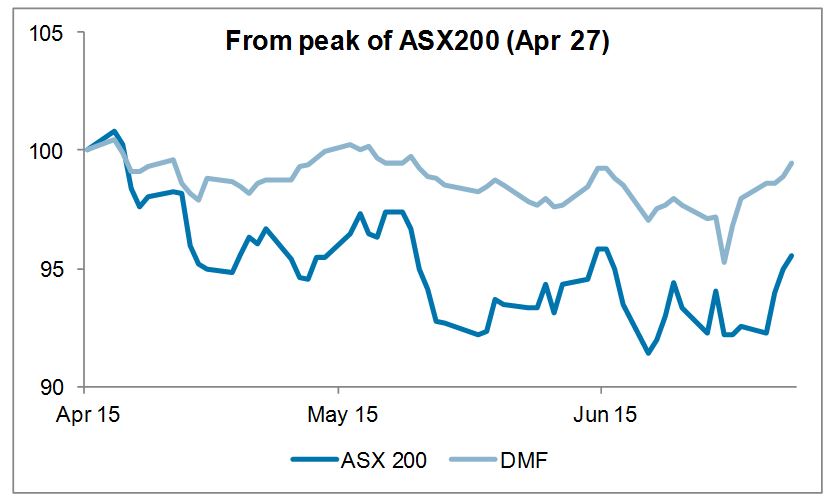

The AMP Dynamic Markets Fund gross return during the June 2015 quarter was -0.4 per cent. Following the March quarter gross return of 5.3 per cent, it has delivered a 12-month return of 16.7 per cent during the financial year to June 2015 with a volatility of 5 per cent per annum during the same period.

These returns show that the AMP Dynamic Market Fund has fared very well compared to the Australian stock market, illustrated by the chart below.

Source: AMP Capital

The Schroders Real Return fund also enjoyed strong resilience during this period with a three-month decline of -1.36 per cent (gross of fees) and -1.51 per cent (net of fees). Its one-year returns (to the end of June 2015) were 7.05 per cent pa (gross of fees) and 6.41 per cent pa (net of fees).

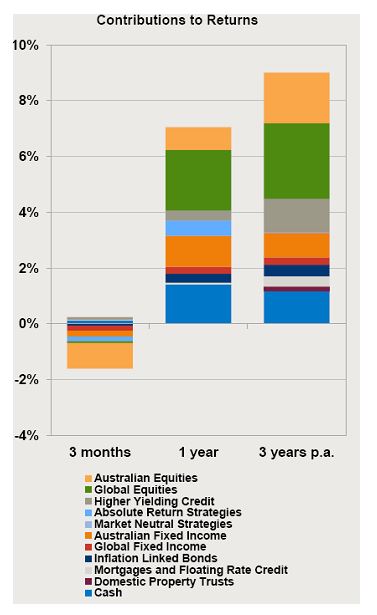

To illustrate the way that these multi asset funds work, consider the table below which shows the contribution to returns from the underlying investments within the Schroders Real Return Fund (CPI 5 per cent version):

Source: Schroder Investment Management Limited

Conclusion

Markets can behave differently during specific downturns, and building an investment to withstand them is notoriously difficult. The 1987 crash happened rapidly, during a two-day period. September 11 was even more compressed, while the GFC was like the “death of 1000 cuts” with a slow winding down of asset prices over a 12-18 month period. Illustrating the resilience of an investment by observing its behaviour during the recent Greek crisis can't predict how it will perform in different circumstances, but can still be a useful guide for those looking for lower risk/stable return products.

In that light, we can conclude that:

• Quality stock pickers have outperformed the general market, index funds and traditional managed funds;

• Stock picking using specific rules which target low volatility stocks has also outperformed the general market with returns better than those delivered by quality stock picker portfolios;

• Internally risk managed products have also fared better than stock picking products, and have fared slightly worse than low volatility products;

• Multi asset, “objective” based investments have been the pick of the crop, showing good resilience and returns during the period.

Investors may wish to consider using some or all of these approaches in their portfolios. Sensible financial engineering can add value and improve outcomes compared to more traditional methods, especially in uncertain times.

Dr Tony Rumble provides asset consulting services to financial product providers and educational services to BetaShares Capital Limited, an ETF provider. The author does not receive any pecuniary benefit from the products reviewed. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.