What's in store for The Reject Shop?

| Summary: Shares in discount retailer The Reject Shop fell sharply last week as the company announced a downgrade to its full-year profit guidance. The company faces further short-term challenges associated with its store roll-out program, increased retail competition, and the effects of the falling dollar on product margins. |

| Key take-out: The Reject Shop has blemished a good track record of profitability (or return on equity) by achieving a lower level of profit on a substantially increased capital base. Poor recent trading opens up the potential of a bid for the company. |

| Key beneficiaries: General investors. Category: Shares. |

| Recommendation: Neutral. |

In my recent Clime Growth Portfolio review (published on the January 22, 2014), I mentioned that the share price of The Reject Shop Limited (ASX:TRS) had moved to a level that required me to review the holding.

At that point I suggested that a share price of $18 would (in the absence of significant new information) cause me to exit TRS.

Then, just last week, TRS informed the market that it had materially downgraded its profit guidance for 2014 on the back of weak actual trading in the six months to December 31, 2013. Indeed, the crucial parts of the announcement were that both the interim profit and the 2013-14 full-year profit would be below the previous year reported results.

To be frank, this is a poor outcome for TRS. This is because there are two crucial factors that should have lifted profit from the previous reported periods.

First, there was the rapid store roll-out that included stores acquired from the closure of the discount retailer known as Retail Ventures. The Retail Venture stores certainly aided the store growth of TRS in the first-half, particularly in Tasmania where stores were previously trading as “Chickenfeed”.

Secondly, there was the $43 million capital raising completed by TRS in April, 2013. This capital should have pushed profit higher, even if it was used to simply retire debt. I will derive an intrinsic value based on forward estimates of earnings and profitability a little later, however it is important to understand that value growth is driven by returns on incremental equity.

Unfortunately TRS has blemished a good track record of profitability (or return on equity) by achieving a lower level of profit on a substantially increased capital base. Put simply, TRS had $56 million more capital employed in the December-half than it did a year earlier and it produced a lower actual profit. That is a poor outcome.

Where to from here?

TRS shareholders will have a difficult six or so months to navigate as the company continues with its store roll-out and management tries to drive an improvement in the trading of established stores. From the announcement it appeared that TRS lost momentum in some of its mature stores, which struggled to grow sales with increasing costs flowing through.

Weak consumer demand is another issue, but so too is a very competitive retail landscape in discount variety stores. Both Woolworths (Big W, ASX:WOW) and Coles (Kmart, ASX:WES) have commented on how difficult this market segment has become.

Another developing issue is the sharp devaluation in the Australian dollar. TRS is a significant importer of product and so it will have to readjust its business to adapt to a lift in product prices. In the discount market this will be difficult, and particularly so if consumer sentiment remains poor with a lift in unemployment.

TRS, like most retailers, would have significant forward cover on exchange rates. As time transpires these contracts will expire and import prices will rise rapidly. TRS will need to lift retail prices to maintain gross margins or it will suffer from continuing decline in margins. The next 12 months will not be a test of sales growth as inflation will stir this along – rather it is all about margin.

Corporate potential

The sharp fall in share price and therefore the market capitalisation of TRS will certainly lift the risk of corporate activity. TRS was originally floated as a small private equity sale nearly 10 years ago (June 1, 2014) and today some larger private equity firms may be doing their sums. This is because the market value of TRS is now about $320 million, and in the last six months the reported earnings before interest, tax, depreciation and amortisation (EBITDA, pre store opening costs) has lifted faster than reported profits.

TRS does expense store opening costs immediately, and therefore it produces a conservative reporting of profits. This is also reflected in the recent jump in depreciation charges as the burgeoning number of store fit-outs is amortised. So when a private equity fund looks at the accounts it sees a depressed profit result, but with a high EBITDA forecast of about $60 million in 2014-15. The EBITDA multiple is thus about 5.5 times and right in the sights of private equity.

Today, TRS is relatively under geared and its poor recent trading opens up the potential of a bid for the company. In particular, a privatisation owner could cut costs, slow store roll-out and introduce debt to drive up returns on equity. Thus, at current depressed prices, long-term shareholders should be patient and look to add to their holdings if an opportunity arises.

At what price?

To begin with, let’s consider the derivers of intrinsic value.

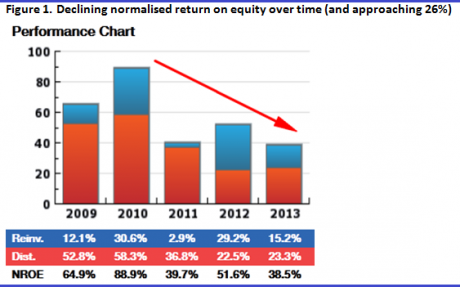

First is the normalised return on equity (NROE). TRS is certainly experiencing a decline in this metric. Market forecasts suggest that NROE will settle over the next few years at about 26%, a far cry from three years ago.

Source: StocksInValue.com.au

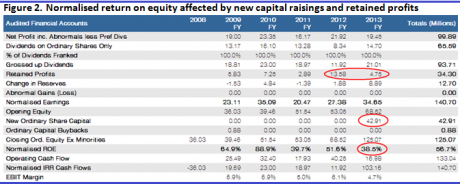

The decline in NROE is caused by a poor return on raised and retained profits. In the last two years TRS has retained profits of $18 million and it raised $43 million in new capital (as circled in Figure 2). At this point the increased capital has not achieved a return.

However, I expect there to be a recovery in profits over the next two years.

Source: StocksInValue.com.au

I have adopted the NROE of 26%, which aligns with current market profit forecasts from broking analysts for 2015. On that basis, the current share price reflects the expected earnings of TRS but it does not acknowledge the risk of a sharp recovery in 2015 or corporate activity.

Source: StocksInValue.com.au

Therefore I will hold TRS at current prices, but I am not enthused about the short-term prospects and will have this stock on constant watch.

John Abernethy is the Chief Investment Officer at Clime Asset Management, one of Australia’s top performing equity fund managers. To find out more about Clime Asset Management, visit their website at www.clime.com.au.

Clime Growth Portfolio Statistics

Return since June 30, 2013: 6.33%

Returns since Inception (April 19, 2012): 25.05%

Average Yield: 6.50%

Start Value: $141,128.64

Current Value: $150,060.61

Dividends accrued since June 30, 2013: $3,622.96

Clime Growth Portfolio - Prices as at close on 4th February 2014 | ||||||

| Company | Code | Purchase Price | Market Price | FY14 (f) GU Yield | FY14 Value | Safety Margin |

| BHP Billiton Limited | BHP | $31.37 | $35.50 | 4.91% | $41.34 | 16.45% |

| Australia and New Zealand Banking Group | ANZ | $31.00 | $29.30 | 8.39% | $34.31 | 17.10% |

| Westpac Banking Corporation | WBC | $28.88 | $30.40 | 8.55% | $31.51 | 3.65% |

| Woolworths Limited | WOW | $32.81 | $33.69 | 5.89% | $35.88 | 6.50% |

| The Reject Shop Limited | TRS | $17.19 | $10.75 | 4.92% | $11.33 | 5.40% |

| Brickworks Limited | BKW | $12.70 | $14.12 | 4.15% | $12.75 | -9.70% |

| McMillan Shakespeare Limited | MMS | $16.18 | $11.51 | 5.59% | $12.09 | 5.04% |

| Mineral Resources Limited | MIN | $8.25 | $10.98 | 8.98% | $12.24 | 11.48% |

| SMS Management & Technology Limited | SMX | $4.55 | $4.00 | 7.14% | $5.29 | 32.25% |

| Security | Code | Value | ||||

| Cash | CASH | $50,912.20 | ||||