What more rate cuts will mean for investors

Summary: With inflation likely to remain below its annual target, investors should ready themselves for more interest rates cuts. |

Key take-out: A cash rate of 1 to 1.25 per cent will provide support for most Australian stocks, but may not have the same effect on the housing market. |

Key beneficiaries: General investors, property investors. Category: Economics. |

Australia's low-inflation, low-interest rate economy is here to stay, according to the Reserve Bank of Australia (RBA). In its quarterly Statement on Monetary Policy, released on Friday, the central bank indicated that inflation was likely to remain below its annual target of 2-3 per cent until the end of 2018. Investors should, in other words, ready themselves for more interest rates cuts.

Australia's economic outlook

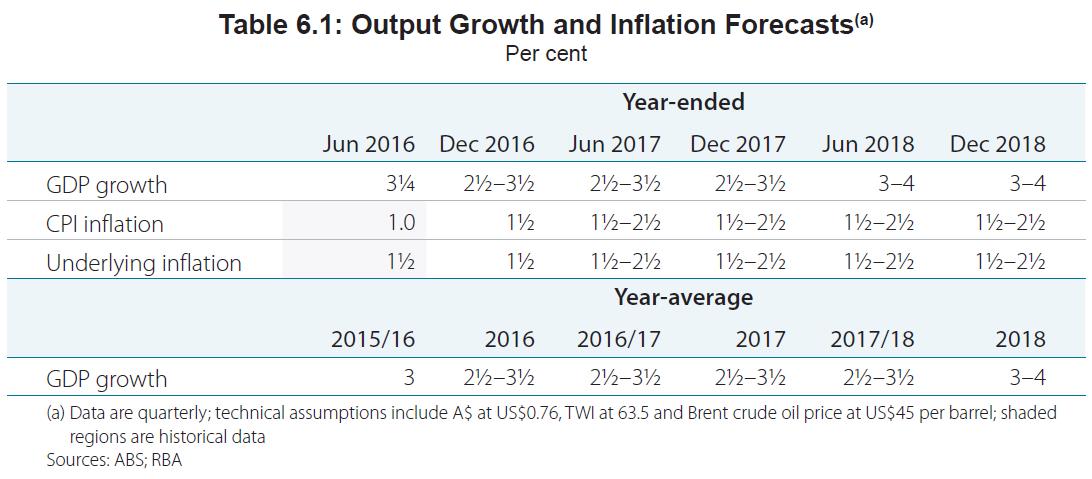

The economic outlook is little changed from three months ago, when the last Statement on Monetary Policy was released, with the economy forecast to grow at between 2.5-3.5 per cent in both 2016 and 2017 before jumping to 3-4 per cent in 2018.

The outlook for inflation is also little changed from three months ago. Taken at face-value these forecasts suggest that the RBA will cut interest rates again to support domestic activity and lift inflation.

The RBA's official forecasts are contained in the table below:

These forecasts help to shape financial markets, including the ASX200 and pricing for government bonds. But it is important for investors to realise that there is considerable uncertainty surrounding this outlook.

It would be an understatement to claim that the RBA doesn't have a great forecasting record. Reserve Bank research, published in 2012, indicates that there is no evidence that the bank can predict economic growth, even in the near term.

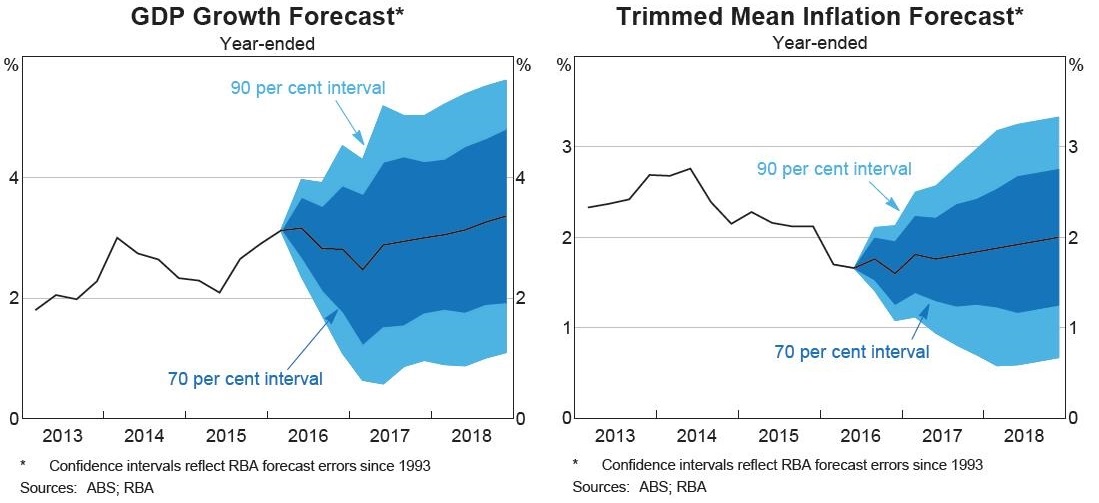

To the RBA's credit it acknowledges its shortcomings when publishing its official forecasts. The graphs below, contained in Friday's statement, show the confidence intervals surrounding the RBA's forecasts. The darker intervals indicate that the RBA is 70 per cent confident that inflation or growth will fall within those parameters.

If those confidence intervals strike you as being quite wide, that's because they are. When you remember that market pricing is based on that central scenario, you can get a good feel for the risks facing market participants. This is a useful habit for investors to get into – understand not only what the most likely scenario is, but also have an eye on the range of possible scenarios.

Investors should take comfort in the fact that the RBA is confident that Australia will not only avoid a recession over the next three years but also avoid a damaging bout of deflation. As I discussed a few weeks ago, persistent deflation can prove devastating for an economy (Cuts coming: How latest inflation affects rates, July 27).

Arguably the most important implication arising from these forecasts is that they may force the RBA to cut interest rates again. At 1.5 per cent the cash rate is already at its lowest level in history, but investors should prepare themselves for a cash rate of 1-1.25 per cent over the next 12 months. This will provide support for most Australian stocks, along with the property sector (though as I explain below, lower rates may not be sufficient to drive house prices higher).

With regards to specific sectors, the RBA remains fairly upbeat about the retail sector and it expects household spending to rise at a solid pace over the next three years. I don't necessarily agree with the RBA's view due to a combination of lacklustre wage growth and the possibility that house prices will fall.

The big driver of economic activity over the next few years is likely to come from liquefied natural gas (LNG) exports. This sector is a fascinating one for investors. We know that exports will boom, and a heap of LNG investment is about to shift into production, but we also know that commodity prices can be sensitive to a significant rise in production.

That's what we saw with both iron ore and coking coal in recent years. The export performance of both these commodities has been extraordinary, but that hasn't translated into higher earnings or profitability for the major miners. In fact these miners have actually underperformed other sectors despite driving economy growth. We hope that the LNG sector avoids the same fate, but it would be naive to discount the possibility that LNG prices will fall as new supply becomes available.

Australian housing market

The Reserve Bank dedicated a fair portion of its statement to Australia's property sector. Over the past few years the housing market has been a key source of domestic growth – particularly throughout NSW and Victoria – but also a key source of financial risk.

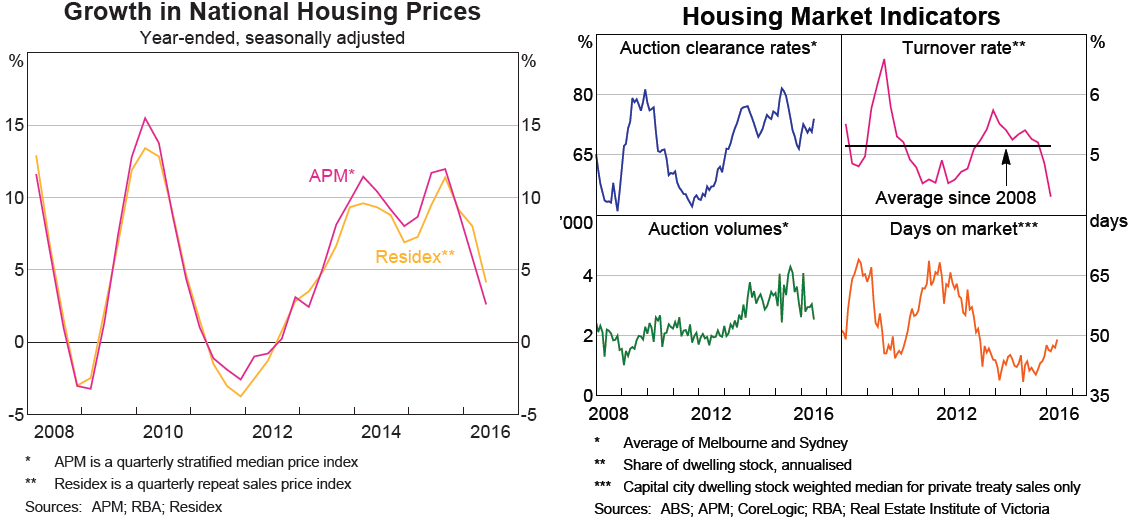

According to the RBA, "a range of indicators suggest that conditions in the established housing market have eased this year". House prices were unchanged during the June quarter, following relatively weak results in the December and March quarters, with annual growth easing to its lowest level in three years. According to one house price measure, Sydney prices have failed to keep up with inflation over the past 12 months.

Readers will be aware of this after my article last week discussing recent developments in house prices and rents (The pressure is rising on Aussie property, August 2). Nevertheless, the RBA's interpretation of the housing market will have important implications for monetary policy.

Throughout most of 2014, for example, rising house prices were considered one of the reasons why the RBA was reluctant to cut interest rates. Even today there are analysts who are concerned that the RBA's recent interest rate cuts will inflate the housing market further.

Auction clearance rates remain one of the few strong indicators of the housing sector. Historically clearance rates have tracked house price growth quite closely, although in recent months there appears to be some divergence. We have seen a fair drop-off in turnover and auction volumes, which usually reflects a lack of demand. Meanwhile, the average ‘days on market' has also increased to its highest level in around three years, which indicates that it is taking sellers a lot longer to find a buyer at a price point they deem acceptable.

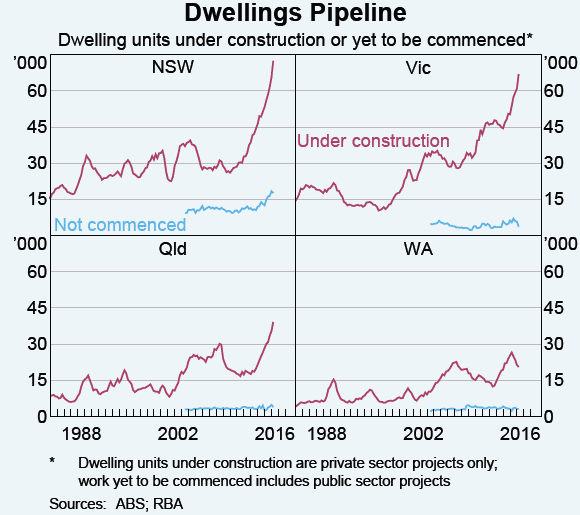

The RBA also touched upon housing construction, driving home how remarkable the current upswing in construction has been. The number of apartments being built in Sydney and Melbourne is simply unprecedented. An increase in supply of this nature will inevitably hit both rents and apartment prices in the inner city areas.

What's interesting is that these apartment buildings will be completed during a period of relatively weak house price growth. Furthermore, higher lending standards and requirements from the Australian Prudential Regulation Authority (APRA) for the banks to hold more capital against their real estate assets will limit the scope for future price growth.

This combination of events has given rise to increasing concerns about ‘settlement risk' or the risk that those who purchased ‘off-the-plan' in these large apartment developments will walk away from their agreements. My Eureka Report colleague, Robert Gottliebsen, discussed this phenomenon with relation to the Meriton property development group last week (Chinese buyers are starting to rescind on apartment contracts, August 4).

Putting the pieces together we can safely say that now is not a great time for short-term property investors looking to make a quick capital return. Property investment also isn't ideal right now for those seeking a stable and growing income stream. Those with longer term aspirations may still see some benefit from property investment but it wouldn't be wise for investors to overextend themselves if prices fall.

Higher lending standards, ample supply and a tighter regulatory environment suggests that house prices across the country will struggle to replicate the gains that we have become accustomed to over the past few years. In fact it wouldn't be unreasonable to suggest that house prices may struggle to grow at all in the next two to three years, even with the RBA cutting interest rates further. Investors should bear this in mind as they construct their investment portfolios.