There is no "big problem" with ETFs

Everyone should be open to a bit of intellectual debate. When it comes to investing, you have to be willing to listen to other people’s opinions. You don’t have to buy what they’re saying, and sometimes it’s good to “block out the noise”, but qualified views are always worth hearing.

Just recently one of our colleagues at Intelligent Investor put forward his views on index funds, where a copy of a share market benchmark is sold as units on the ASX. His case was levelled at exchange-traded funds over the S&P/ASX200, with the headline: The big problem with index funds.

He made some good points, his main focus being the local benchmark’s concentration towards “financials”, which make up 40% of the index, and the big banks, which account for 29% of the ASX200.

An investor who bought an ETF over the ASX200, he pointed out, was taking a big tilt at the banks. “Our market is so concentrated, so devoid of variety and diversification among its largest companies, that index hugging investors are still picking stocks whether they’re aware of it or not,” wrote John Addis.

He’s right. In Australia, even if you buy the five largest listed companies you will own a third of the ASX200 benchmark — and four of those five will be banks.

IT'S ALL ABOUT TACTICS

But Addis’s case against ETFs falls over when you look beyond market capitalisation weighted ETFs over the Australian share market.

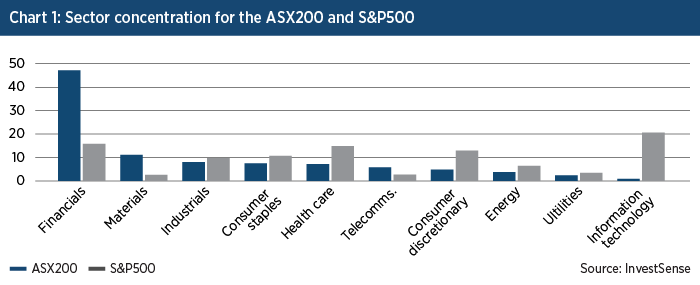

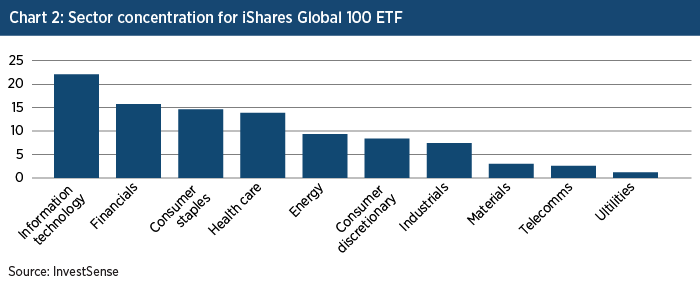

In most other developed markets, sector weightings are far more evenly spread than here. The first chart compares sector weightings of the major US benchmark, the S&P500, against those of the ASX200. Also, ETFs are offered which combine regional share markets, such as the iShares Global 100 fund. Its sector breakdown is shown in the second chart.

The key to using ETFs is to understand the benefits or drawbacks of owning the underlying indices, regions or strategies. As the big four Australian banks’ share prices rose steadily in the three years to March last year, the concentration of the ASX200 would have made it easy to take a share of those gains by owning a market-weighted index fund over the ASX. When valuations for the banks were peaking around the start of last year, an investor who understood the Big Four’s dominance of the ASX200 may have felt less confident about “owning the index”.

And that’s fine, because there are many more benchmarks available on the ETF menu. There is also more than one way to hold the ASX200 — or very large chunk of it — within an ETF.

A LEVEL APPROACH

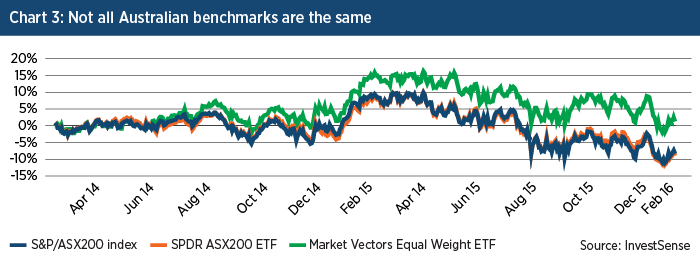

Seeing as the issue has been raised about sector concentration, it’s worth pointing out an ETF exists which only holds the largest companies at equal weights. The Market Vectors Australian Equal Weight ETF currently includes 73 stocks and will hold no fewer than 25, the provider says.

The trade-off of being underweight the banks is lower expected income, compared with a market-weighted ETF over the ASX200, but since the fund was launched in March 2014 it has stretched ahead of the benchmark, as chart three shows.

That relative outperformance might have a lot to do with the banks’ underperformance. Remember, the Big Four make up about 29% of the index.

Whether your portfolio is designed for growth, income or a bit of both, it can pay to tune in to what other’s are saying. Addis’s point about concentration in the local market isn’t a warning about using ETFs. There really isn’t a “big problem” with ETFs. Like any investment, the outcome is all down to selection and timing.

The InvestSMART portfolios are made up exclusively of ETFs, with portfolio construction and rebalancing managed by an investment committee. They’ve always known about the sector concentration in the local market, which is why the portfolios are diversified across global regions and asset classes.

Frequently Asked Questions about this Article…

The main concern with investing in ETFs over the ASX200 is the heavy concentration in financials, particularly the big banks, which make up a significant portion of the index. This concentration means that investors are indirectly taking a big tilt at the banks, which can affect diversification.

The ASX200 is heavily concentrated in financials, unlike other developed markets where sector weightings are more evenly spread. For example, the S&P500 in the US has a more balanced sector distribution compared to the ASX200.

Yes, there are ETFs that offer more diversification. For instance, the Market Vectors Australian Equal Weight ETF holds the largest companies at equal weights, reducing the concentration in banks and providing a more balanced exposure.

An equal weight ETF provides more balanced exposure by holding companies at equal weights, which can reduce the risk associated with sector concentration. Although it may offer lower expected income compared to a market-weighted ETF, it has shown relative outperformance due to the underperformance of the banks.

There isn't a 'big problem' with using ETFs for investment. The key is understanding the benefits and drawbacks of the underlying indices and making informed decisions based on selection and timing.

Investors can mitigate risks by diversifying their portfolios across different regions and asset classes. Using ETFs that track global benchmarks or equal weight indices can help reduce the impact of sector concentration.

Timing plays a crucial role in ETF investment success. Understanding market conditions and the performance of dominant sectors, like the big banks in the ASX200, can help investors make better decisions about when to buy or sell ETFs.

InvestSMART portfolios manage sector concentration risks by diversifying across global regions and asset classes. Their portfolios are made up exclusively of ETFs, with construction and rebalancing managed by an investment committee to ensure balanced exposure.