The cryptos hangover still lingers for investors

Summary: The values of major cryptocurrencies have fallen significantly in the last six to seven months.

Key take-out: There is no single reason for the dip, other than the fact investors have simply stopped buying.

Remember when cryptocurrencies were soaring, turning some punters into crypto millionaires?

With the value of cryptocurrencies (most notably bitcoin) rising exponentially in such a short period of time late last year, and with plenty of mainstream media attention, many decided they wanted a piece of the action. It seemed like a great idea in theory, with many people pouring money into them – often without worrying about how they work or what they actually are – in the belief they simply couldn't lose.

But ever heard the old saying about something that sounds too good to be true? Anyone who bought the major cryptocurrencies at their zenith late last year certainly has.

The crash

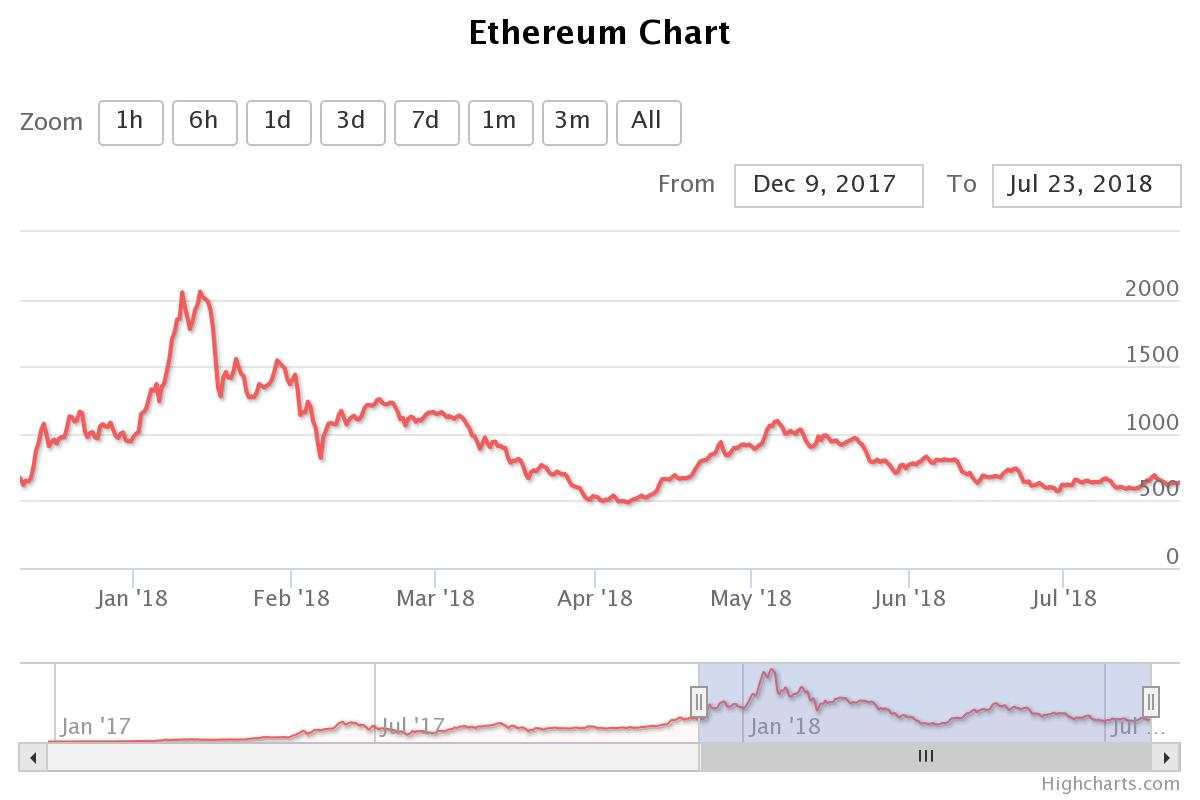

As a general rule, the values of most prominent cryptocurrencies peaked late last year or early this year, and barely half a year later, many have lost significant value. As of Monday bitcoin, for example, had lost over 60 per cent of its value since mid-December. Similarly, the value of ethereum has fallen by nearly 70 per cent in just over six months. Ripple, which is slightly different in that it is a blockchain platform with its own coin, has fallen in value from around $3.55 as the calendar flipped to 2018, to just under 62 cents on Monday, a decrease of more than 80 per cent.

.jpeg)

Source: www.coinspot.com.au

Mind-boggling numbers indeed.

Something terrible must have happened to cause this, right? Not really, according to co-CEO of Bitcoin.com.au, Rupert Hackett.

“I think in terms of the downtrend, there haven't really been any key outlying events that I would say were out of the norm that hadn't occurred in the last few years,” Hackett says.

In fact, he says, the explanation is much simpler.

“I think it was just completely overbought, at the end of the day. I think it was just a natural momentum up that reached its peak euphoria and there was no one really left … to buy.”

Curiosity undoubtedly played a role in the astronomical rise in cryptocurrency prices, but even Hackett admits to being surprised by just how high prices reached late last year.

“For anyone inside the market, it was very much insanity as to how something could get priced at such a high level without there really being a technical infrastructure change in that period,” he says.

Often with a fixed or semi-fixed supply and no central bank to regulate the process, changes in demand can have wild effects on the prices of cryptocurrencies. This can lead to a ‘snowball' effect, in which demand in a cryptocurrency market rises or falls, which places either upward or downward pressure on prices due to their fixed supply. This exacerbated when people see the price rising or falling, prompting them to buy or sell, creating more price increases or decreases, and the cycle starts again.

This phenomenon, dictated by the interest of investors, has clearly been the impetus behind the meteoric rise and spectacular fall in crypto markets, but it hasn't been the only factor.

Initial Coin Offerings (ICOs)

Investors weren't the only people jumping on the crypto bandwagon at the height of the madness, with a proliferation of people creating new coins as a method of raising capital to fund their own ventures – similar to an initial public offering. The sheer volume of coins established in the last six months is astounding, but plenty have failed. Nonetheless, people kept producing new coins and people kept buying them, although not always with the right intentions, according to Hackett.

“I think a lot of people have bought ICOs with a ‘get rich quick scheme' mentality and now they're having to face the music of realising that it's a lot more difficult and a lot more complex to actually build the idea into infrastructure,” he says.

A major issue with ICOs is that there are no restrictions on who can release their own coin, which can cause all sorts of legitimacy issues. Hackett admits this is a problem.

“One of the big concerns about ICOs is that there's been no barrier to entry so, as a result, more and more ICOs will be created until people are just not willing to invest in them anymore."

The Australian Competition & Consumer Commision recently found that cryptocurrency scams are the second most common type of investment scam in Australia. It has also been reported that Australians lost more than $2.1 million in cryptocurrency-related scams last year, about one third of which was lost in December, when crypto markets were really heating up. The combination of anonymity, ease of access and often ignorant investors makes the world of cryptocurrencies – particularly ICOs – an ideal hunting ground for criminals.

It would be naïve to think the news of scams, along with semi-regular hacking controversies on cryptocurrency exchanges, has not played a role in the crypto downturn, creating trust issues with investors and encouraging them to ‘get out' before they get caught, which would cause prices to ease.

Regulation

This is a constantly evolving area, which varies greatly across borders. Some countries, such as Japan and South Korea, are quite advanced in their regulation of crypto markets; but in other countries, cryptocurrencies are banned altogether. In Australia, cryptocurrencies are classified as capital gains tax (CGT) assets, meaning CGT may be payable when cryptocurrencies are traded for other cryptocurrencies, or sold at a profit.

The only certainty in this area is that regulation will continue to develop and change, and anticipation of a tighter regulatory environment has contributed to falling prices.

In its annual economic report released last month, the Bank for International Settlements (BIS) found that cryptocurrencies cannot replace our current monetary system without significant upgrades. One of the major problems, according to the report, is that cryptocurrencies are simply too volatile to act as a mainstream payments system.

“The essence of good money has always been trust in the stability of its value,” the report says.

The report also notes that, “the more people use a cryptocurrency, the more cumbersome payments become”. This is because the technology behind certain cryptocurrencies can only handle a predetermined number of transactions at any given time, meaning that when capacity is reached, new transactions must enter a queue, which can cause lengthy delays and high transaction costs.

Lastly, the BIS is concerned about, “the fragile foundation of the trust in cryptocurrencies”. This is due to the fact that there may be multiple versions of the ledger on which cryptocurrency transactions are recorded, and also that cryptocurrency miners may have the ability to manipulate the currency.

Speaking at the Australian Business Economists Briefing last month, the Reserve Bank of Australia's Head of Payments Policy Department Tony Richards expressed a view in line with that of the BIS, casting doubt on whether cryptocurrencies really have a real place in the monetary system.

If nothing else, the cryptocurrency craze and subsequent crash can act as a sage reminder that when it comes to investing, there is virtually no such thing as ‘making a quick buck.'

Speculating is a dangerous game, and investing in cryptocurrencies isn't a decision to be made lightly.