Telstra at fair value

| Summary: The market value of Telstra has almost doubled over the past four years, but the telco’s strong share price growth has not been the result of significant earnings growth. Rather, the rally partly reflected a recognition of the intrinsic value of Telstra and the high investor demand for its dividend yield. The company’s current share price reflects intrinsic value plus the value of future NBN cash flows. |

| Key take-out: While the NBN is becoming a huge cost burden on the community and the federal debt load, it remains a substantial benefit for Telstra shareholders. |

| Key beneficiaries: General investors. Category: Shares. |

| Recommendation: Neutral. |

It is interesting to reflect that today Telstra (ASX: TLS) has a market value on the Australian Securities Exchange of about $63 billion, while in 2009 it was valued at about $33 billion.

Over the four-year period, the market capitalisation of TLS has lifted by approximately 90% ($30 billion), and the company has paid about $14 billion in fully franked dividends.

The total shareholder return over this period has been about 130%, without adding in the benefit of franking credits, and therefore the compound annual rate of return has been over 20% per annum.

With such a high return, one would expect to see a significant lift in profits over the period. However, that is not the case. Indeed, TLS reported an after-tax profit of about $4 billion in 2008-09 (pre adjustments) and will do so again in 2013-14 when adjustments are made for discontinued or sold businesses. Reported earnings dipped in 2011 and 2012 as TLS undertook various financial adjustments to its reported results. In most years, reported earnings were below those paid in dividends.

This leads to a significant point for readers to understand. In 2009, TLS was very cheap and was a bargain when it was yielding 10% fully franked and trading on a price earnings ratio (P/E) of eight times. Further, it was still good value as it traded up and over $4 per share for the next three years.

Today, it is not particularly cheap in trading on a projected P/E ratio of 15 times and a yield of 5.7% fully franked.

On reflection, 2009-10 was clearly a unique opportunity for Telstra investors. The whole equity market was recovering from the global financial crisis and Telstra’s major shareholder, the government-owned Future Fund, actively squashed the price by indicating its intention to sell 1 billion shares over the ensuring 18 months.

Therefore, over the last four years, the TLS price has lifted without growth in earnings and so the P/E ratio has expanded. In my view the rally from $2.60 to the mid-$4 range was the proper reflection of intrinsic value. The subsequent lift in price to above $5 reflects the demand for high-quality yield investments caused by the historically low interest rate environment. However, it also appears justified given the value of the NBN (National Broadband Network) cash flows to Telstra’s operational outlook.

The Telstra result

I do not propose to cover in detail the latest TLS result as readers can read a significant amount about it from the very informative presentation given by the company. In my view, the broad thrust of the result is that TLS grew revenue (plus 4%) faster than expenses (plus 2%), and this produced a stronger profit line (plus 7%).

TLS continued to generate solid revenue growth from mobile customers (plus 6.4%) that offset the continued decline in fixed line revenue (minus 7.3%). The TLS market reach in its 4G mobile network has now breached 85%, and this has created a significant advantage for it over its competitors. Data based revenue also lifted nicely by 6%.

As for the NBN rollout and the TLS compensation, the public and investors are left to wonder. The NBN remains a remarkably secretive national infrastructure development, with no agreed path to completion. It surely ranks as one of the most inept attempts at infrastructure development in the world today, and its poor execution adds to the productivity challenge that confronts the whole Australian economy.

Today I can merely point to a net present value claim by TLS of about $11 billion as compensation and for its role in the NBN rollout. While this figure does not appear in the TLS balance sheet as an asset, TLS seems assured that it will be paid this from its public statements. TLS and the federal government will sit down in coming months to discuss the new proposal for a multi-technology rollout. This may well include a payment to Telstra from the NBN to take over the copper wire network. As this copper was previously to be junked, then this could become another windfall for TLS.

In any case, the NBN payments are important for TLS as its net debt remains stubbornly high at $13 billion – even after $2.9 billion of recent asset sales. Clearly the increased TLS dividend of 1 cent per annum (i.e. $125 million) is based on the assumption that the NBN cash will flow, because the operating result in itself hardly justifies it.

Valuation of Telstra

The good news for TLS owners is that, from an intrinsic valuation perspective, the company is now growing earnings net of adjustments. Indeed, despite the increase in dividend to 29 cents per share, the earnings of circa 32 cents per share in 2014 will clearly cover it.

Once again, I will derive the intrinsic value of the business from the reported earnings, franked dividends and stated equity. Then I will have to make an adjustment for the NBN proceeds to determine value.

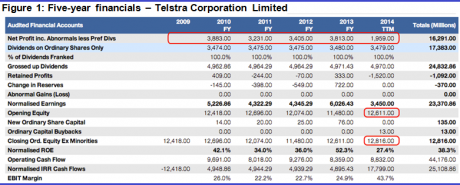

Source: StocksInValue

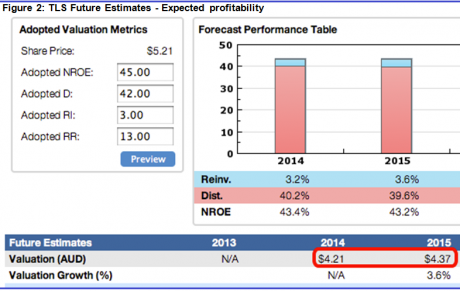

The above table (Figure 1) shows my point that earnings have barely lifted in the last five years. The half-year reported result suggests that TLS is on track for a $4 billion profit. Also we can see that equity in the TLS balance sheet has barely moved over five years. Therefore, as TLS begins to lift earnings into the future, it will do so on a fairly static equity base. This leads to the next chart (Figure 2) where you can see that I expect profitability (measured by profit divided by average equity) to begin to rise in future years.

Source: StocksInValue

This forecast of improving profitability seems to be gathering pace across market analysts. Clearly the receipt of NBN proceeds, in whatever form, will drive TLS profits higher and also its profitability. Therefore I have adopted normalised return on equity (NROE) of 45%.

As for my required return of 13%, some may suggest that this is too high. If I reduced this then the TLS valuation wold rise.

In any case, I noted earlier that the NBN proceeds have a net present value to TLS of about $11 billion.

This amounts to about $1 per TLS share, and so my forward valuation of TLS is about $4.21 intrinsic plus the NBN proceeds. That equates to the current market price of about $5.20.

Finally, there are two interesting points re Telstra and the NBN.

First, it looks to me that the TLS intrinsic value will continue to lift in a mild fashion in future years. Low bond yields certainly support this prognosis.

Second, I can’t help reflecting on the $11 billion of compensation from the NBN. It is a net present value calculation, and so the slower the rollout of the NBN the bigger the actual cash payments will be. Like all infrastructure developments, there is a requirement to get them built quickly and efficiently. The NBN is becoming a huge cost burden on the community and the federal debt load. However, it remains a substantial benefit for TLS shareholders.

John Abernethy is the Chief Investment Officer at Clime Asset Management, one of Australia’s top performing equity fund managers. To find out more about Clime Asset Management, visit their website at www.clime.com.au.

Clime Income Portfolio Statistics

Return since June 30, 2013: 13.08%

Returns since Inception (April 24, 2012): 42.07%

Average Yield: 7.16%

Start Value: $150,754.88

Current Value: $170,480.77

Dividends accrued since June 30, 2013: $5,139.27

| Clime Income Portfolio - Prices as at close on 18th February 2014 | ||||

| Hybrids/Pseudo Debt Securities | ||||

| Company | Current Price | Margin over BBSW | Running Yield | Franking |

| MXUPA | $84.00 | 3.90% | 7.76% | 0.00% |

| AAZPB | $97.99 | 4.80% | 7.57% | 0.00% |

| MBLHB | $82.94 | 1.70% | 5.21% | 0.00% |

| NABHA | $74.70 | 1.25% | 5.18% | 0.00% |

| SVWPA | $88.90 | 4.75% | 8.34% | 100.00% |

| RHCPA | $106.31 | 4.85% | 7.06% | 100.00% |

| High Yielding Equities | ||||

| Company | Current Price | Dividend | GUDY | Franking |

| TLS | $5.23 | $0.29 | 7.92% | 100.00% |

| WBC | $32.86 | $1.82 | 7.91% | 100.00% |

| NAB | $35.04 | $2.03 | 8.28% | 100.00% |

| SKI | $1.74 | $0.11 | 6.34% | 0.00% |

| Code | Value | |||

| Cash | $33,625.74 | |||