Retail stocks rise again

Summary: Retailers, and more broadly the consumer discretionary sector, are already seeing the favourable conditions of lower oil prices and declining interest rates translate into greater earnings. In fact, trading updates from the sector have been universally positive for January and February. |

Key take-out: While it is nice to identify a favourable thematic, it is really only of any use if it hasn't been factored into the share price yet. In our view, however, investors will benefit from exposure to it. Stocks that appear to screen favourably include Dick Smith, SkyCity Entertainment, Crown and, on any pull-back, Beacon Lighting. |

Key beneficiaries: General investors. Category: Economics and investment strategy |

The interim reporting season is in full swing, with the market focused on the key themes of lower oil prices, a cut in the official cash rate and a weaker Australian dollar (see Currency, earnings and the reporting season).

But what investors may not recognise is that one sector in particular is already reaping the rewards from some of these conditions: Retailers.

While results for the six months to December 31 showed signs of improvement for the industry, one clear observation from reporting season is that trading updates for January and February have been universally positive.

This is interesting as consumer and retail stocks are offering undemanding valuations, decent dividend yields and the prospect of above average earnings-per-share growth in the coming years. It certainly seems like a good time to take a closer look at these stocks.

Since the start of 2015 conditions have certainly improved for the average consumer. Mortgage rates have come down (and seem likely to fall further) and petrol prices have declined – handing incremental disposable cash to the average household. Further, asset prices have materially increased.

While it a logical step to conclude that consumer related businesses will benefit from this backdrop, let's first take a brief high level look at what lower rates and lower petrol prices actually mean.

Petrol price decline: a true free kick

We have all seen the decline in petrol prices at the pump but what does it simplistically mean?

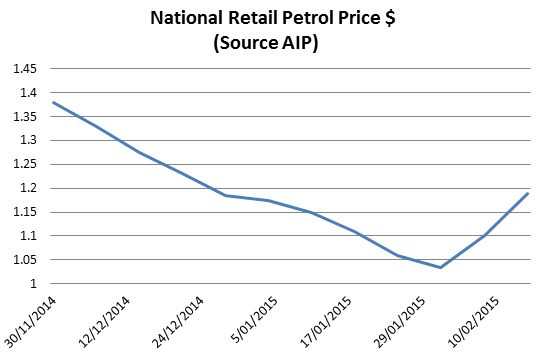

In 2012, passenger vehicles in Australia consumed 18.51 billion litres of fuel, according to ABS data. As shown below, the decline in retail petrol pricing has been meaningful so far in 2015.

In 2014, the retail petrol price averaged $1.488 per litre, while in 2015 so far it has averaged $1.11, according to figures from the Australian Institute of Petroleum (AIP).

If petrol averages $1.11 for the rest of the year it will reduce the passenger vehicle fuel cost by around $7 billion in 2015.

To put this number into context, it compares to 2014 total retail sales in Australia of around $280 billion and equates to an average $850 saving per household in Australia.

All in all this is a meaningful tailwind for consumers in Australia in 2015.

Declining interest rates: the double-edged sword

Interest rates have been a hot topic of late with the RBA cutting the cash rate to 2.25 per cent in February. However, a reduction in interest rates can be a bit of a double-edged sword for the consumer.

On the one hand the rate cut will provide a benefit for the one-third of households who own their home via a mortgage (roughly a third own outright and a third rent), but on the other hand interest rates are usually reduced for a reason. Rates are usually reduced because the economy is facing genuine challenges. This time appears no different.

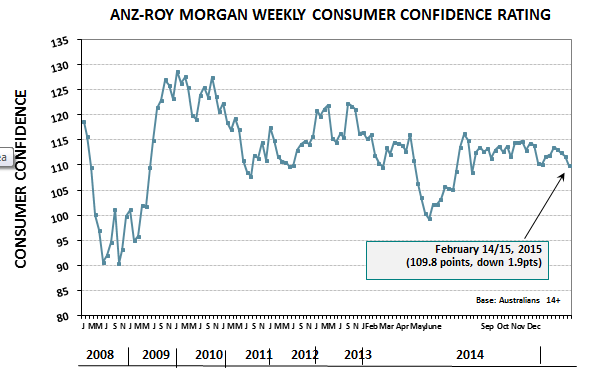

To this latter point we highlight that the ANZ-Roy Morgan Consumer Confidence Survey fell 1.7 per cent in the week ending February 15 to the lowest level since August 2014.

The survey noted: “It appears that concerns about job security, weak wages growth, and the economic outlook are outweighing the recent interest rate cut, lower petrol prices and rising asset values.”

Trying to infer the macroeconomic climate to the outlook for businesses is an inexact science at the best of times. What we do know is that declining interest rates and lower petrol prices add cash to household budgets. What we don't know is to what extent subdued consumer confidence prevents this cash from being spent on consumption. Indeed, if consumer confidence does improve, consumer related businesses are going to be very well placed.

Retailers are being rewarded

As bottom-up stock pickers we prefer to analyse businesses and speak to companies and others in the industry to generate insights into what is actually happening in the real world. This has enabled us to identify the improving trend within the consumer discretionary sector.

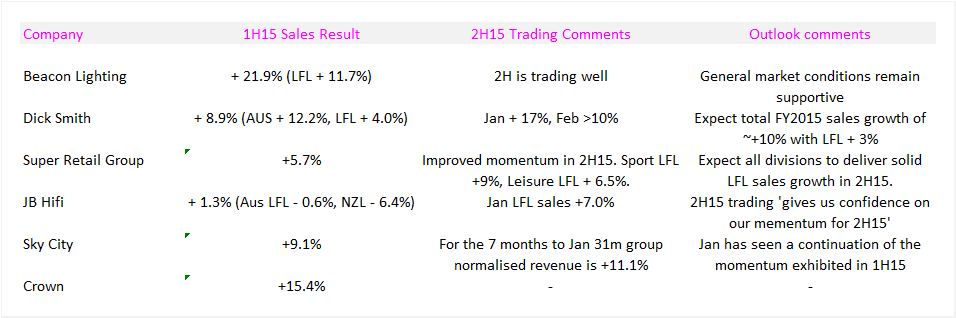

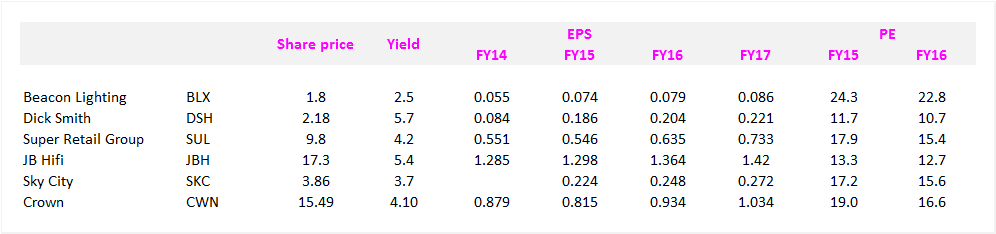

In the table below we show the performance of six selected stocks: Beacon Lighting (BLX), Dick Smith (DSH), Super Retail Group (SUL), JB Hi-Fi (JBH), SkyCity Entertainment Group (SKC) and Crown (CWN).

A number of factors help form a positive outlook for these consumer-related stocks:

- They are supported by a number of potentially favourable tailwinds and appear likely to deliver above market EPS growth;

- recent trading appears to have been very positive;

- valuations, in many cases, remain undemanding and;

- many of these stocks continue to offer above average dividend yields.

Profiting from a favourable thematic

While it is nice to identify a favourable thematic, it is really only of any use if it hasn't been factored into the share price yet.

For example, high-yielding stocks are going to be supported in a low rate environment but, as we discussed last week, valuations in some cases are at extreme levels. Or, as another example, the housing construction cycle is clearly booming, but to gain exposure you need to pay in some cases more than 20 times earnings (and peak cycle earnings at that!) to gain exposure.

If the reporting season is any guide, the outlook for consumer related businesses is improving in 2015. In our view investors will benefit from having exposure to this thematic. Stocks exposed to this theme that appear to screen favourably to us include Dick Smith, SkyCity Entertainment, Crown and, on any pull-back, Beacon Lighting.

Next week we will highlight more key themes that we see developing as we work through many of these earnings releases, attend analyst briefings and speak with company management teams.