Readings & Viewings: June 29, 2018

Welcome to this week's Readings & Viewings, a slightly different column from the norm because, you guessed it, it's the end of the financial year (almost).

What better way to start things off than a snapshot of where we are now, and where we started at the beginning of July 2017.

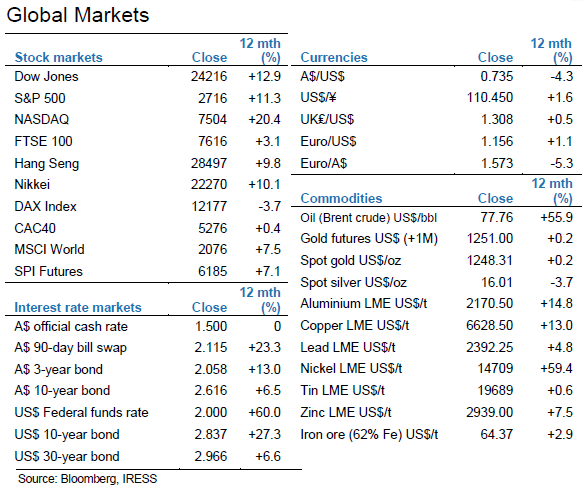

The US stock market market, on an annualised basis, is streets ahead of the rest of the world since July last year. On the other hand, things haven't been great since earlier this year, with the Dow actually lower. On interest rate markets, the $A and $US bill and bond rates are higher. Of course, while our official cash rate is still locked at 1.5 per cent, US rates up 60 basis points.

Then, it's been a relatively solid year for most commodities, including oil (even though it has come off the boil).

The good news is that the Australian stock market has finished the financial year with an impressive total return (including dividends) above 13 per cent.

That means our market has now closed ahead in nine out of the last 10 years, although investors have been subjected to heightened volatility over the last five months thanks to global geopolitical events. More specifically, the eruption of the US-China-Europe trade war threatens to challenge investors over the course of 2018 and beyond.

More on that further below. So where do investors sit at the mid-point of 2018 exactly? Firstly, read this EOFY wrap-up from InvestSMART's Chief Market Strategist, Evan Lucas. He quite rightly points to looming challenges ahead. It's something to take on board.

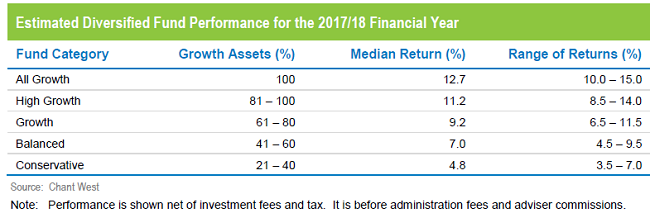

Even still, this financial year has been good for superannuation funds. Research house Chant West has calculated the median return from managed super funds with a 61-80 per cent allocation to growth assets will be about 9.2 per cent for 2017-18. Not bad, and funds that took a more aggressive growth allocation should be expecting a return of 11 per cent or more.

These returns should be the 2017-18 benchmark for self-managed super fund trustees. How did your fund perform, and is your portfolio properly positioned in terms of your overall risk profile and investment time frame? If you didn't catch Laura Daquino's article during the week, Four steps to rebalance your portfolio, it's definitely worth a read.

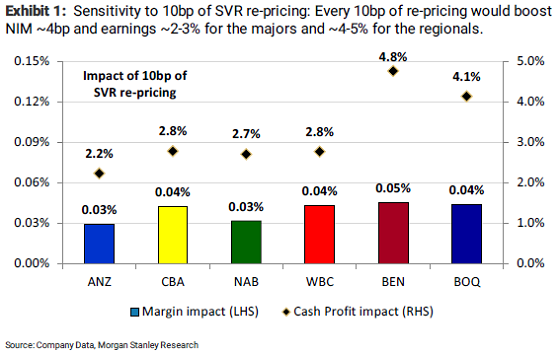

Now, much has been written about the outlook for Australia's major banks, which make up a sizeable portion of many people's share portfolios. Under pressure from the Royal Commission and tougher lending conditions, the banks are definitely in the investment spotlight. But the following chart from Morgan Stanley shows the impact on the banks' net interesting margins and earnings for every 10 basis point rise in their mortgage rates. Very interesting, with rates on the move up.

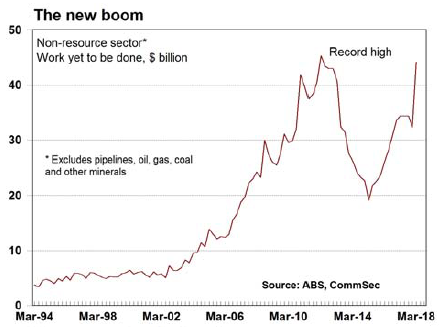

So, the banks may not be bashed as much as some thought? That's good for the economy generally, and so is Australia's infrastructure boom. Over the last year and a bit, a record $35.8 billion of engineering project work was done for the public sector alone. On top of that, there's still $44.2 billion of engineering work yet to be done, excluding resources.

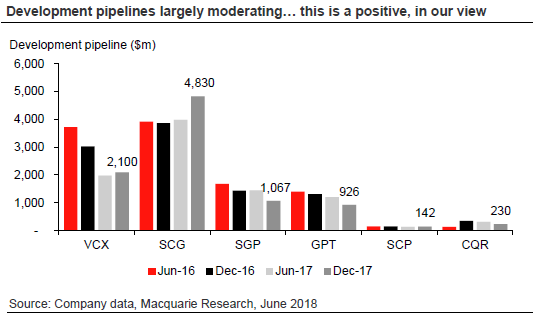

Yet, while infrastructure activity including major road and rail projects is certainly booming, the same can't be said for commercial building activity. The following chart from Macquarie Wealth Management shows the development pipeline is moderating. It sees this as positive, with landlords and tenants increasingly focusing on improving sales productivity from existing sites.

Now, let's move on to more global matters.

It's “game over” for oil, says Seeking Alpha. Even with OPEC lifting production, it says oil prices will head higher because the oil deficit will decrease.

Of course, if you own a Harley Davidson, what happens to oil prices is important. But that's not going to be as important as where your Harley is built, and Donald Trump is taking a tough two-wheel line.

He's not happy about the MC firm, which is in stark contrast to his comments made in this video a year ago.

It all comes back to the US trade war against China. So, is Trump sowing the seeds of a 10 per cent stock market correction?

Speaking of corrections, Wells Fargo is back in the news yet again. The US bank is paying the steep price for improperly pushing retail customers into complex products. Sounds like a Royal Commission story, doesn't it?

So does this one. In Australia, it was about charging dead people fees for financial services never delivered. In the US, financial services company MetLife has just been charged with fraud for failing to pay the pensions of ‘dead' retirees.

There begins the exodus. Christine Lagarde, chief of the International Monetary Fund, has warned London must prepare for a mass financial exodus.

Where to next? Not bitcoin, according to the Reserve Bank of Australia, which believes digital currencies are unlikely to succeed locally despite having success overseas. Maybe the RBA read this recent paper that's getting quite a bit of traction, The Economic Limits of Bitcoin and the Blockchain.

Meanwhile, Netflix is grappling with diversity issues which seem to be tanking its share price – which is up 100 per cent over the year, mind you.

Amazon, which in percentage terms has gained about two-thirds of that, is said to be in serious talks with the Pentagon.

Did you know? Amazon has close to 100 in-house brands, and private label is another area it's very committed to growing.

With that said, all the hype around startup culture seems to be fading, and it's no coincidence that big business is getting bigger and bigger. The number of US startups is rapidly tapering off.

It's fitting to ask the question then, how old are successful tech entrepreneurs, really?

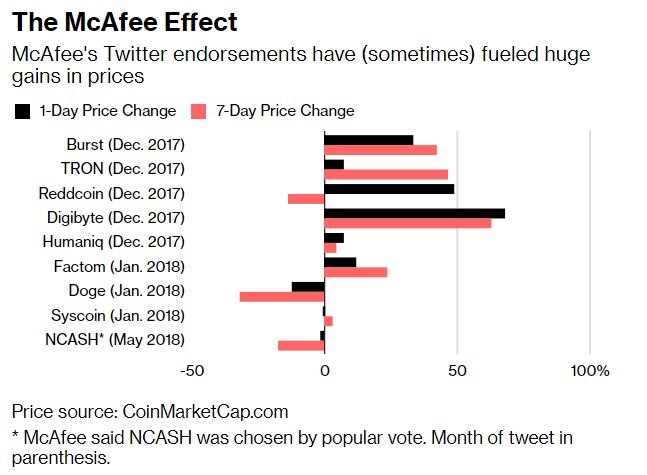

Twitter influencers, we hear about them less than the rest, but perhaps they're the most ‘influential' of them all?

A glimpse into the new aspirational class – note, it's very different to the former, who were much bigger on conspicuous consumption.

As always, save those pennies for something more worthwhile, and enjoy your weekend.