A strong year, but hazards ahead

Chief Market Strategist Evan Lucas looks forward while wrapping up the year that was.

Financial year 2018 is almost over, giving us a perfect point to reflect on where we have been and what is likely to be seen in financial year 2019.

Both economically and financially, FY18 has been impressive from a domestic and international perspective. Here are the driving forces behind FY18.

The economics of FY18

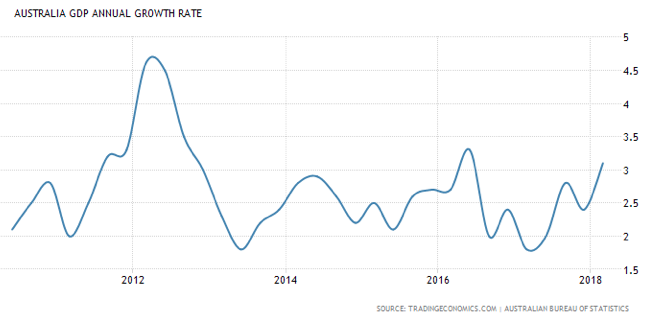

- GDP will most likely log its 27th consecutive year of growth. We need to see Q2 results in early August to lock this in but forecasts are for another quarter of expansion. GDP in FY18 expanded solidly, peaking at 3.1 per cent, the third-highest read in the post-GFC era.

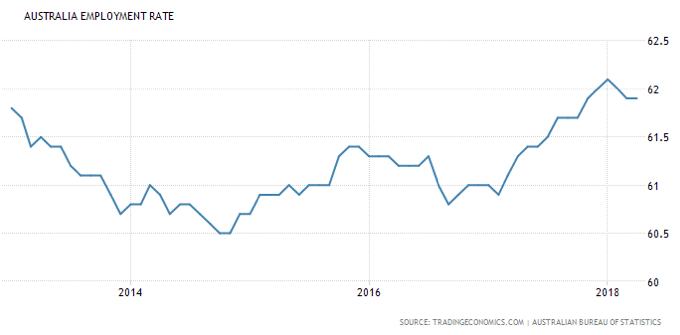

- Employment has remained strong across FY18. Australia created 276,000 jobs in the financial year, and the unemployment rate fell to 5.4 per cent – the equal lowest level seen in the post-GFC era. This rate is also the Reserve Bank of Australia's (RBA) most preferred measure for employment. Workforce participation hit its highest level in five years and we saw record highs for female participation.

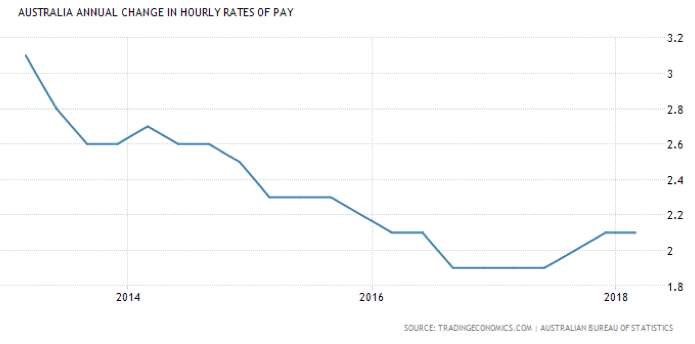

- Wage growth, however, remained a constant thorn in Australia's overall employment basket, starting the year at a record low before bouncing back in Q2 FY18. However, at 2.1 per cent, it's still low by historical standards, and with underutilisation still at 14 per cent, slack still has a way to go to help push wages up.

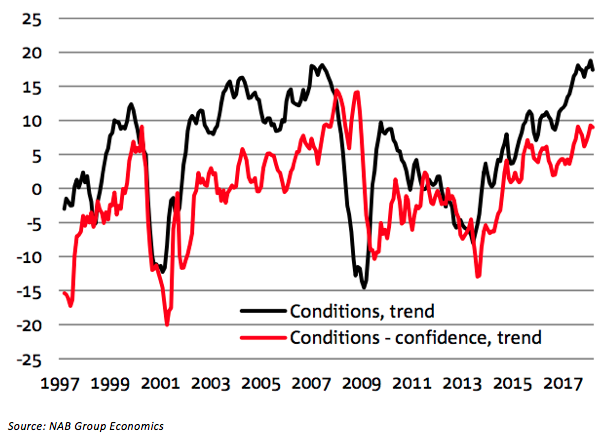

- Business conditions hit a record high in FY18 and has maintained that momentum throughout the financial year. Confidence also peaked throughout the year which has led to a pick-up in business spending in GDP. The private investment component of GDP finally turned a corner in FY18 and added points to the GDP equation; non-mining investment was the standout, up 14 per cent through the year.

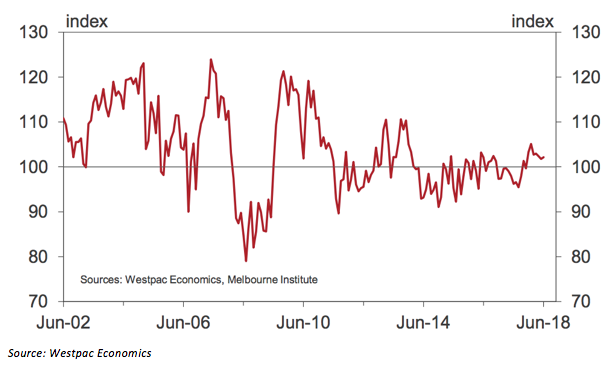

- Consumer confidence was slow to react to the overall economic conditions at the start of the financial year. However, as the year progressed, it had its best run in sentiment reads since 2014 from November through to March. It has moderated since then though, and those robust readings have petered out as family finances remain a drag. But, consumer confidence remains above the 100-point mark, meaning, Australian consumers are still finishing the financial year optimistically.

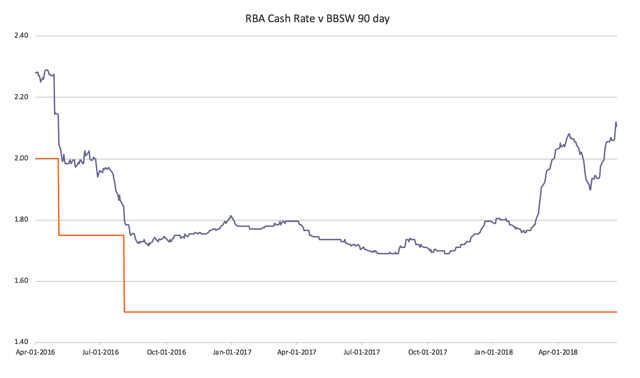

- The RBA remained a non-event in FY18, leaving the official cash rate at 1.5 per cent, and will probably keep it there in FY19 and even well into FY20. However, what was eye-catching over the last financial year was the movement in the 90-day Bank Bill Swap (BBSW) rate, which hit a 2-year high. Even more interesting was the movement in the BBSW Overnight Indexed Swap (OIS), which hit 59 basis points, the highest level since 2011 – in short, funding is getting expensive and will be an issue for FY19 and beyond.

The markets of FY18

- On a net total return basis, the ASX 200 index is up 13 per cent. That means nine of the last 10 financial years have been positive on a total return basis.

- On a capital basis, the ASX has added 8.4 per cent. That means four of the last five financial years have been positive for the index on a capital basis.

- On a sectoral basis, energy, information technology, materials and healthcare were the standouts, each adding strong double-digit returns. While on the other side of the equation, telecommunications, utilities and financials floundered.

.png)

- Going even more granular, the best sub-sector performers were auto and components plays ( 44 per cent) and biotech and pharmaceuticals ( 43 per cent). The worst performers at a granular level were telecommunications (-35 per cent) and banking (-10 per cent).

- Over to currencies, the $A/$US lost 3 per cent as interest rate differentials and geopolitics in 2018 finally overran the commodity and China proxy trade that was propping it up. The Reserve Bank would like the Australian dollar even lower still, and Australian-US bond differentials may deliver this in FY19.

What to expect in FY19

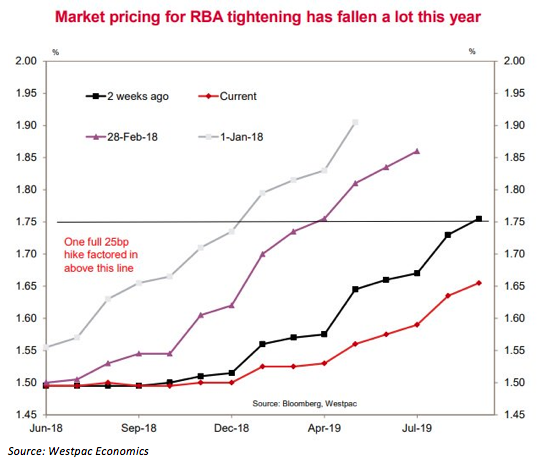

- Australia's low rate and low inflation macro environment will continue in FY19. Reserve Bank cash rate expectations are incredibly flat, with the next forecasted rate rise now not expected until some time in calendar year 2020, as highlighted in this chart from Westpac.

- The current economic backdrop would suggest, domestically, lower nominal returns are likely the next financial year.

- Secondly, FY19 and FY20 will face escalating geopolitical tensions (White House policy, European politics, Brexit, trade wars), higher global credit rates as the US Federal Reserve hikes rates a possible six times over the next 18 months, and fluctuating energy prices as oil sees supply impacts from both increases and cuts at OPEC. These macro environmental issues will hit the global growth story, and by default, equity markets.

- In my view, this is the largest risk to Australia, our broader region and the globe, therefore diversifying across sectors and asset classes would seem prudent to assist in smoothing out probable market volatility.