Putin's dairy war is hurting our farmers

Australian Prime Minister Tony Abbott may be planning to ‘shirtfront' Russian President Vladimir Putin but Putin has already ‘shirtfronted' large parts of the global dairy industry.

The prices of key dairy products have fallen around 40 per cent on global markets in the past six months, partly because of Putin's actions. Australia's export dairy industry, like iron ore and coal, has moved from boom to tough times.

Most Australian dairy farmers have so far been insulated from the worst of the impact because of their unique pricing arrangement, but times will get tougher.

New Zealand's Fonterra has received the full Putin price impact and Canadian dairy giant Saputo and its Australian farmer suppliers have received a glancing blow because the global price fall means Saputo paid too much for Warrnambool Cheese and Butter last year. Rival bidder Murray Goulburn may have dodged a bullet.

Although it is unlikely to happen, our dairy industry will be hoping that Prime Minister Tony Abbott stops sabre-rattling and at least gives the Russian President a smile at the G20.

Most of the change in dairy fortunes was caused by the response of Putin to the global embargoes placed on Russia after Malaysia Airlines Flight 17 was shot down.

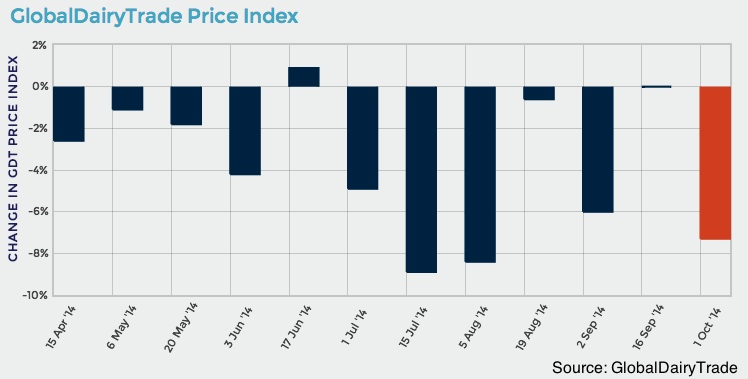

Putin knew how to hit Europe where it really hurts. He stopped dairy imports into Russia from the three aggressor markets: Europe, US and Australia. The timing could not have been worse, as you can see from the graph below.

There would have been a fall from the peak dairy prices of early 2014 even without Putin's embargo, because Chinese demand has not risen as much as expected and there has been a big rise in world production helped by an excellent season, particularly in Europe.

The Putin impact was doubled because, in response to losing the Russian dairy market, Europe is now subsidising farmers to stockpile dairy products. These new stockpiles are nothing like the dairy mountains that existed a decade ago, but they are sending shivers through the market at a time of oversupply and low demand.

The price of two export products, whole milk powder and skim milk powder, have fallen by the full 40 per cent. There have been declines across the board, although cheese has held up better than most products.

In Australia, the lower prices come after takeover binges, where the amounts paid for key assets now look too high. After a bidding war with Bega and Murray Goulburn, Saputo paid a massive $500million for Warrnambool Cheese and Butter. Partially in recognition of the new situation, Saputo has cut the price it is paying farmers for milk to $5.85 per kilogram milk solids, below the $6 benchmark currently being paid to neighbouring farmers by Murray Goulburn. Saputo risks Warrnambool farmers switching to Murray Goulburn and benefiting from the higher MG price. It's a high-risk strategy.

The NZ dairy leader Fonterra has about $1billion in Australian assets, which returned only around $31mn in profits last year, down 78 per cent on the previous year. Fonterra in Australia will be under more pressure this year. In NZ, most of Fonterra's exports are in the categories that have been savaged in price. It faces a grim time.

In Australia our biggest dairy group is the cooperative Murray Goulburn, which last year exported about $100mn in dairy products to Russia but it is a relatively small part of its total $3bn turnover.

About half of Murray Goulburn's production is sold on the local market and the company has expanded its exports in less volatile areas, like cheese.

As a farmer-owned cooperative, Murray Goulburn makes about the same trading profit each year. Its objective (and its real priority) is to maximise the milk price it pays to its farmers.

The Murray Goulburn milk price has been reduced from a peak if $6.81 per kilogram milk solids to $6 but that is still well above the prices paid in recent years.

Local milk sales, including the supply contract with Coles, are related to this $6 price. Forward selling of exports and the complex local pricing formula have insulated the farmers by maintaining the benchmark Murray Goulburn price at historically high levels.

Did Murray Goulburn dodge a bullet in not winning control of Warrnambool for $500mn-plus?

I think they did, because they would now have an extra $500mn in debt on their balance sheet. On the other hand Warrnambool, would have given Murray Goulburn $40mn in synergies, which would have lowered its costs. Saputo had no such synergies. But Saputo got a foothold into Australia, albeit an expensive one.

Unless Putin changes his mind about the dairy embargo, there will be some nasty losses and one or two players may look to leave the Australian industry.

Meanwhile the Russian people have come to like imported dairy products which are now rarely on the shelves, although NZ has not been banned.