Preparing for a stock market correction

Summary: The Australian share market rose strongly in the first quarter of 2015, with all major sectors performing relatively well except for resources and consumer staples. But the outlook for the market is mixed. Investing in the stock market only makes sense to me if I have an exit strategy in the event of a crash. |

Key take-out: Trend investing and momentum investing assist early entry to a market boom and early exit in a market bust. |

Key beneficiaries: General investors. Category: Shares. |

After a flat 2014, the March quarter 2015 was a zinger with the All Ordinaries share index up almost 9 per cent, the best March quarter in almost quarter of a century!

But there is speculation that the market is susceptible to a sudden reversal. This idea was reinforced this week by Reserve Bank of Australia Governor Glenn Stevens at a speech in New York, when he mentioned the risk of an abrupt sell-off.

On March 25 the index was only 63 points off 6000, not bad when on December 16 it was just 131 points above 5000. Since that time the share market has drifted, currently trading at around 5870. The market timing strategies I follow rode that upturn all the way.

The strong result for local shares was surprising given serious headwinds such as:

1. A resources price collapse led by iron ore, coal and energy.

2. A slowing China on the back of a property bust and corruption crackdown.

3. An Australian dollar falling too slowly to restore industry competitiveness.

4. The RBA postponing lower rates for fear of the Sydney property boom.

5. Dysfunctional or untested governments in all jurisdictions bar NSW, SA and WA.

But analysts think the 'hunt for yield' explains it all. To quote one analyst:

“Any investor under the illusion that earnings are more important than interest rates to the performance of shares got a quick reality check this quarter. It's interest rates hands down. And not just in Australia.

“The performance of global share markets reveals that six years after the worst of the global financial crisis, it is still the promise of cheap money from central banks, and nothing much else, that is driving shares higher.”

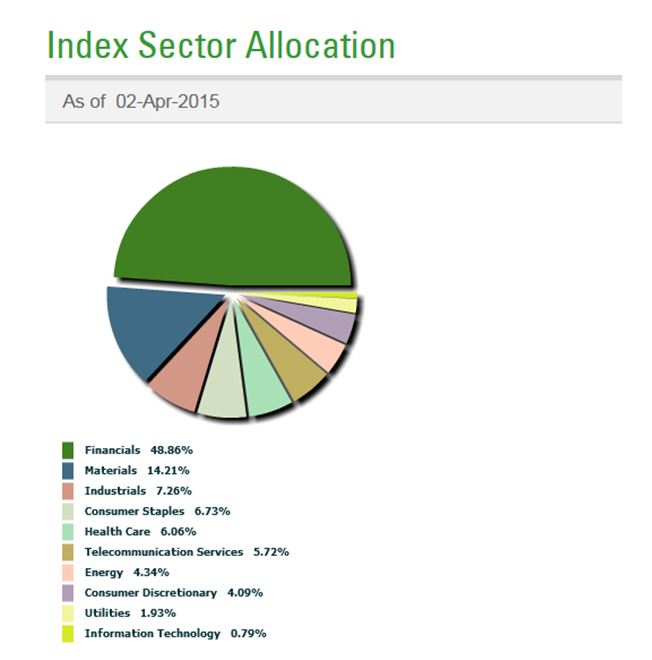

The S&P/ASX 200 share index is dominated by Finance (including property) and Resources (covering basic materials and energy) stocks. Add Industrials, Consumer Staples, Health and Telecommunications stocks and that's over 93 per cent of the index's market capitalisation.

Source: State Street Global Advisors

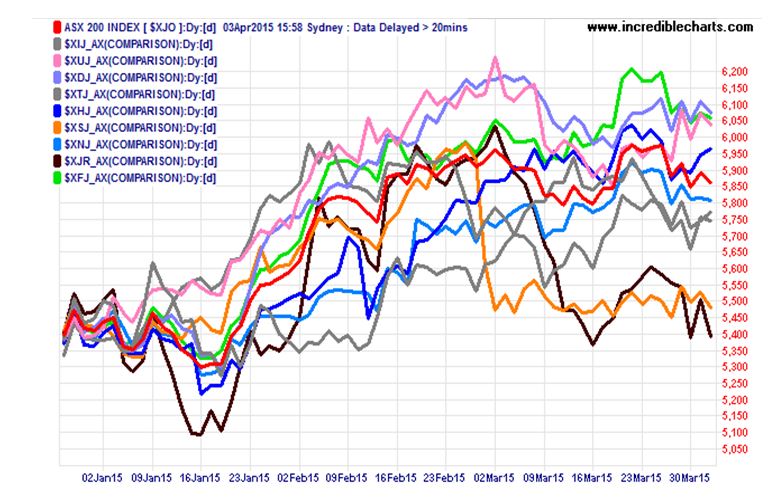

As can be seen in the next chart all major sectors did relatively well in the March quarter except for brown XJR (Resources including Basic Materials and Energy) and orange XSJ (Consumer Staples). Indeed, the Australian market is doing well except for resources and consumer staples.

Yet the outlook for the market is mixed.

The bears say that the resources crunch could last until the next decade and is likely to be accompanied by a residential property crash because Australian households are over-geared. That would hurt our banks given their large mortgage exposures.

Also according to the Reserve Bank “commercial property conditions have softened significantly and there are now clear signs of an emerging oversupply in some markets.” In the office market in particular, vacancy rates are already high and rents are falling. Office conditions in Perth and Brisbane are “particularly weak”. Little wonder that non-residential building approvals (which account for 40 per cent of non-mining investment) are falling.

The bulls say that historic low interest rates, depressed oil prices, a falling Australian dollar, subdued price inflation and record high immigration are perfect conditions for a primary bull market.

Moreover, Australia still has a severe dwelling shortfall which is why dwelling prices are booming in the areas of most acute shortage. These price rises will spur more residential construction to catch up to unmet demand. Only in Melbourne's inner city apartment market is a supply glut evident.

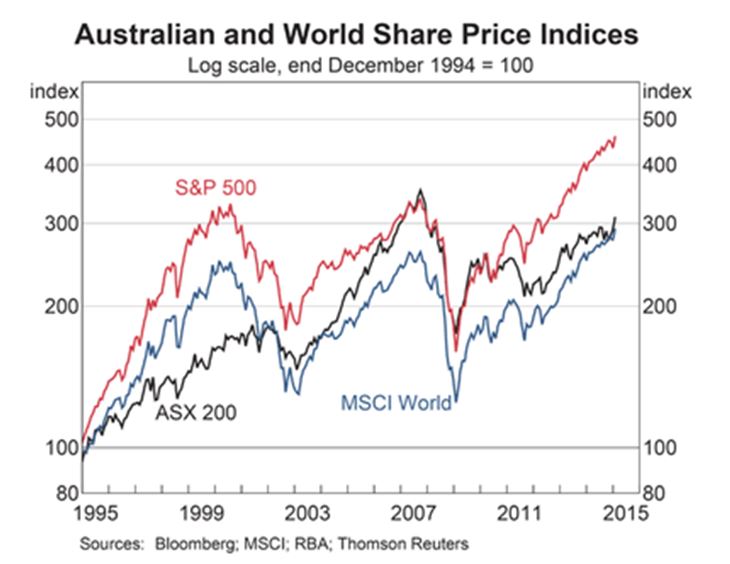

Beyond all that, Australia's stock market is still lagging America's and the rest of the world has only just caught up with us according to the following 20 year chart compiled by the Reserve Bank. Where local and foreign share markets go from here is anyone's guess.

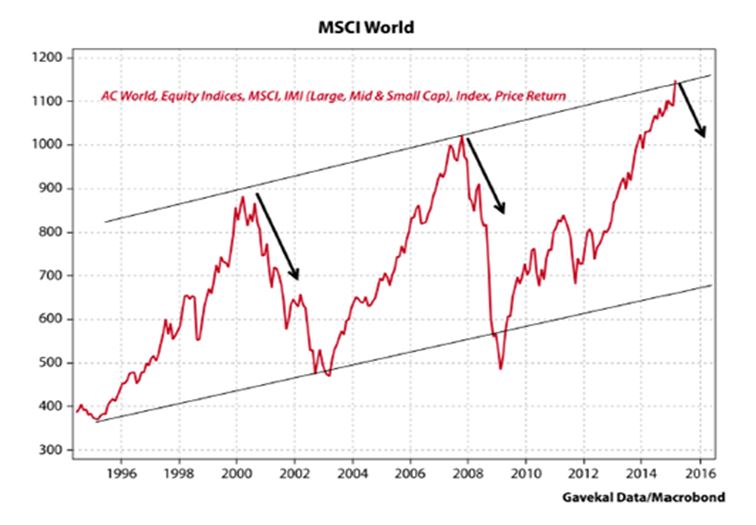

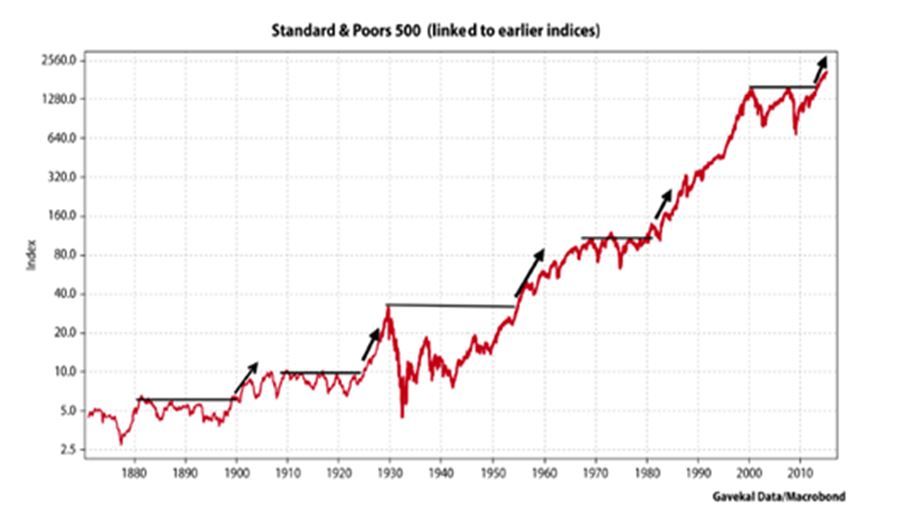

Alan Kohler says this about where the global equities cycle is at present:

“… no matter what happens with the Australian economy, the world trend cannot be escaped.

“We are either at the end of a global cyclical bounce…

“… or the start of an American structural break-out…

“… or both. Most likely both. As we learnt in October 1987, a cyclical reversal, even a horrible one, can still take place within a structural bull market. What's more, they are very hard to predict or anticipate. That's because the main precondition for such a correction is that no one predicts or anticipates it.”

That's why investing in the stock market only makes sense to me if I have an exit strategy in the event of a crash. Anything else is foolhardy.

There are two known and proven ways to manage downside risk in the share market; either trend-track or momentum-monitor the share index. I'm not talking about fast aggressive trading for speculation, but very slow defensive trading for insurance.

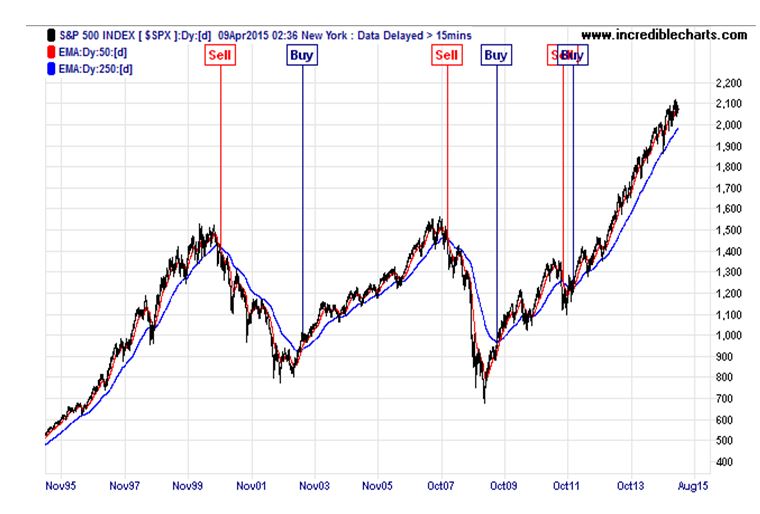

Take for instance the US market. A simple share index trend-tracking system (which I have previously applied to the Australian All Ords share index in If it's a “melt up” timing will be key, February 25 ) uses a (red) 50 day and (blue) 250 day trend line crossover strategy to signal when to buy and sell an exchange traded fund (ETF) based on such an index.

Below you can see how well that worked in the USA over the last 20 years. Anyone who used such a market timing system to buy and sell an ETF representing the S&P 500 share index would have enjoyed each share rally and avoided each bust with only a small hiccup (due to a market whipsaw) in October 2011.

Trend investing involves staying on the right side of the market's trend.

An alternative to trend-tracking is an ETF rotation system based on relative price momentum. This involves starting with a small menu of ETFs and always backing the fund whose unit price is rising the fastest over a set time period (which can be anything between 6 and 12 months).

Across the wider market there are also a range of products with defensive mechanisms that try to insure against sudden market reversals. Elizabeth Redman's recent feature on a 'defender' fund which uses options to provide a constant defence of an accumulating portfolio is a good example (see Perennial's LIC with a twist, April 15). There are also capital protected and other related products common across the market. Several features in recent times by Tony Rumble highlight other funds that have built in protections (see the archive here).

For my money, applying either a trend-tracking or a momentum-monitoring system to ETFs has two chief attractions:

1. It assists early entry to a market boom and early exit in a market bust; and

2. Over time it has beaten share price indices yet done so with lower volatility.

Its biggest drawbacks are:

1. Occasional whipsaws whose small losses are annoying, but not devastating; and

2. It's boring since trading is for loss “insurance” not for gambling.

If you are looking for speculative thrills then slow market timing won't appeal to you. But if you want to smooth your equity market returns, beat the index over time and do so with reduced risk then no other known approach matches trend or momentum investing.

Low interest on cash, term deposits and bonds is causing investors to switch to higher yielding shares. Market timing equity ETFs using either a trend or momentum system offers a safer path than just buying and holding a share portfolio indefinitely.

If you are under 30 you are young enough to make up any losses from a market crash, but if you are over 50 not having a system that tells you when it's safe to be in shares and when it's not is a high wire act. Staying out of crashes should be the first priority of anyone nearing or already in retirement. As Warren Buffett explains in his two rules for investing: Rule 1, never lose money. Rule 2, don't forget Rule 1.

Percy Allan is a director of MarketTiming.com.au. For a free three week trial of its newsletter and trend-trading strategies for listed ETF funds, see www.markettiming.com.au.