Paul Clitheroe's Making Money

5.6 million Australians to receive cash back from their insurer

There’s plenty going on in the insurance industry right now.

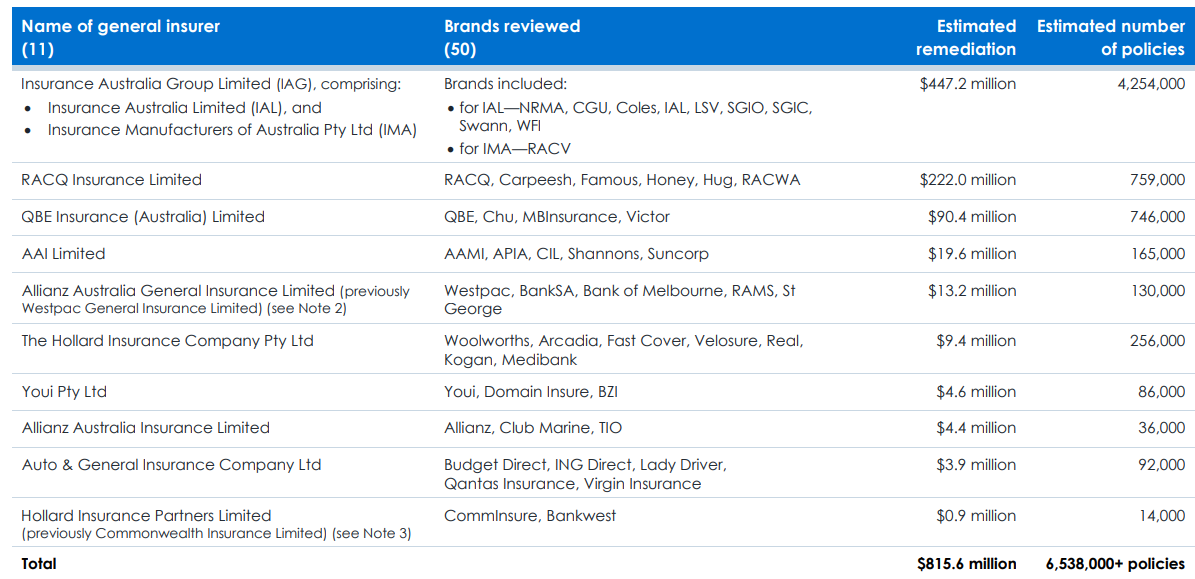

Money watchdog ASIC has announced that over 5.6 million Australians are due a refund on insurance after it unearthed pricing failures stretching back many years.

The sums involved are mammoth, with a total of $815 million expected to be made in remediation payments.

Hardest hit is industry goliath IAG, whose brands include NRMA, RACV and Coles Insurance. It owes a total of $447.2 million, to be shared across 4.2 million policies.

|

Insurance companies involved in pricing failures since 1 January 2018 |

|

|

|

Source: ASIC[1] |

According to ASIC, the insurance industry has been aware of the risks of pricing misconduct for years, with general insurers put on notice as far back as 2013.

ASIC Deputy Chair Karen Chester says, “Earlier action by insurers would have avoided much of the consumer harm we now see, with $815 million in remediation.”

General insurers are not the only ones being called out by ASIC.

Just days after the remediation announcement, a swag of insurers were blocked from selling pet insurance through brands such as Woolworths, RSPCA, Petbarn, Guide Dogs, Medibank, Bupa and HCF.

One of the key problems ASIC identified is that the insurers may not have properly considered the ‘financial situation’ of their customers – a reference to the way some pet policies require owners to pay a vet’s bill upfront before being reimbursed by their insurer.

Don’t rush for a refund says ATO

Plenty of us will be hankering to get our hands on this year’s tax refund. But the Australian Taxation Office (ATO) is discouraging taxpayers from being overly enthusiastic.

ATO Assistant Commissioner Tim Loh says tax returns lodged in early July are more likely to be changed by the ATO compared to those lodged later.

He notes that while you can lodge from 1 July, there is a much higher chance your tax return will be missing important information compared to lodging in late July. That’s when most information from employers, banks, government agencies and health funds will be automatically loaded into your tax return, regardless of whether you use a registered tax agent or lodge yourself.

“Once the information we collect is available, all you need to do is check it and add anything that’s missing,” says Loh.

Sadly, this year’s tax refund may not be as lucrative as in the past.

The ATO says it expects fewer people to receive a refund, and says refunds are likely to be smaller than many of us may be hoping for. One reason for this is the phasing out of the low and middle income tax offset (LMITO). The popular offset, which was worth up to $1,500, ended on 30 June 2022.

Qantas pushes Australians to reunite with $400 million COVID flight credits

While many Australians battle daily living costs, we often let money slip through our fingers. The nation’s $16 billion pool of unclaimed super is testimony to this.

Now it seems plenty of us have forgotten about COVID flight credits, which were handed out during the pandemic when borders were closed and airlines grounded.

Qantas alone is sitting on a $400 million stockpile of unused COVID flight credits, and it’s keen to get Australians to redeem them before the credits are scrapped at the end of this year.

To help us reunite with flight credits, Qantas has launched a new ‘Find My Credit’ online tool. It can help locate Qantas and Jetstar bookings that are up to three years old.

Find My Credit can be found on the Qantas website. You’ll need booking details plus your name or email to locate any outstanding credits.

If you’d rather get your money back, the majority of COVID credits can be converted into refunds. Qantas says it can’t arrange this automatically as credit cards used for purchases as far back as 2019 may have expired. To organise a refund, call Qantas on 13 13 13 or speak to the travel agent you booked flights through.

[1] https://download.asic.gov.au/media/lnxpj0uu/rep765-published-23-june-2023.pdf

Frequently Asked Questions about this Article…

Over 5.6 million Australians are set to receive refunds from their insurers due to pricing failures, with a total of $815 million expected in remediation payments.

IAG, which includes brands like NRMA, RACV, and Coles Insurance, is the hardest hit, owing $447.2 million across 4.2 million policies.

ASIC identified issues where insurers may not have properly considered the financial situation of customers, particularly with policies requiring upfront vet bill payments before reimbursement.

The ATO advises against rushing to file early in July, as tax returns lodged then are more likely to be missing important information compared to those lodged later in the month.

Tax refunds may be smaller due to the phasing out of the low and middle income tax offset (LMITO), which ended on 30 June 2022.

Qantas has launched a 'Find My Credit' online tool on their website to help locate unused COVID flight credits. You'll need your booking details and name or email to find any outstanding credits.

Yes, most COVID flight credits can be converted into refunds. However, you need to contact Qantas directly or speak to your travel agent to arrange this, as automatic refunds aren't possible due to potential expired credit cards.

It's important to check for any unclaimed superannuation, as Australians have a $16 billion pool of unclaimed super. You can use online tools or contact your super fund to locate any unclaimed super.