One in four homes purchased with cash

One in four homes purchased with cash

Rising interest rates may be hurting home owners and first home buyers, but for one group of home buyers higher rates appear to be having little or no impact.

A new report by online conveyancing platform PEXA shows that last year one in four homes were purchased with cash[1].

The value of residential property sales across Australia’s eastern states totalled $478.6 billion in 2022, and 25.6% of this was funded with hard coin – a figure that rises to almost 27% in Queensland.

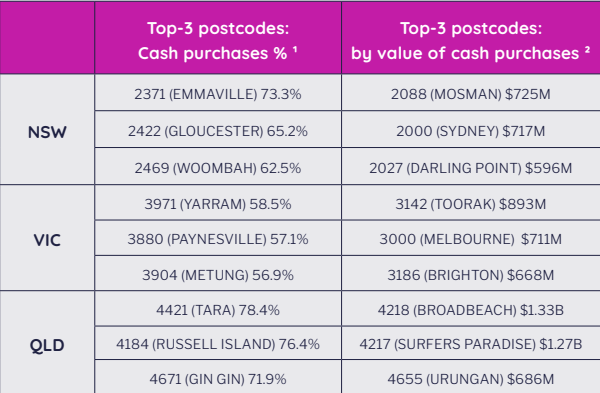

While PEXA says cash buyers tend to be older and have ‘international connections’, it adds that a high proportion of cash sales were in regional areas – 65% in QLD, and 56% in NSW. This suggests that cash purchasers were often older Australians moving to the country to retire.

That said, homes in some of the nation’s priciest suburbs have been paid for with the folding stuff, with Mosman in Sydney and Melbourne’s Toorak making up some of the leading postcodes for cash sales by value.

|

|

|

Source: PEXA |

Commonwealth Bank penalised $3.55 million for spamming beaches

If you’re anything like me, chances are your email inbox gets clogged with spam – email messages sent indiscriminately to a large number of internet users.

Spam isn’t just annoying for recipients, it can also be costly for those who send the emails, as the Commonwealth Bank of Australia (CBA) has just discovered.

The bank has been slapped with a $3.55 million penalty after it sent more than 65 million emails that didn’t comply with Australia’s spam laws.

An investigation by the Australian Communications and Media Authority (ACMA) found the CBA sent more than 61 million marketing emails to customers that unlawfully required them to log-in to unsubscribe.

A further 4 million marketing emails were sent out without a functioning unsubscribe facility. And 5,000 promotional emails were sent to customers who’d already asked to unsubscribe.

ACMA Chair Nerida O’Loughlin says companies must give people the option to unsubscribe from marketing messages – and make it easy to do so.

She adds, “The scale and duration of the breaches by the CBA is alarming, especially when the ACMA gave it early warnings it might have some issues and the steps it took were ineffective.

“The failure to fix the issues shows a complete disregard for the spam rules and the rights of its customers.”

This is the largest penalty imposed by the ACMA for breaches of the spam laws.

In addition, ACMA has accepted a 3-year court-enforceable undertaking from CBA committing it to an independent review of its e-marketing practices and to implement improvements.

Amnesty for small businesses to get on track with tax

For small business owners, managing tax affairs can rank pretty low on the list of ‘most enjoyable tasks’.

For a variety of reasons tax returns and business activity statements may get lodged late or not at all.

When this happens, it’s often a case of kicking the can down the road. When returns are finally lodged, businesses can face a tax debt beefed up by penalties and interest charges.

So, it’s a plus that the Australian Tax Office (ATO) has announced an amnesty for small businesses with overdue income tax returns, fringe benefits tax returns or business activity statements.

The amnesty applies to tax obligations originally due between 1 December 2019 and 28 February 2022, and it runs until the end of the year.

To be eligible, small businesses must have had total turnover below $10 million at the time the original lodgement was due.

ATO Assistant Commissioner Emma Tobias is urging small businesses that have fallen behind with tax obligations to take advantage of the amnesty to get back on track.

The ATO adds that if your small business lodges outstanding returns or activity statements through the amnesty period, a penalty may show up on your account. Don’t worry, the ATO says it will remit it.

[1] https://www.pexa.com.au/staticly-media/2023/06/PEXA-Cash-Purchases-Report_Final-sm-1686105392.pdf

Frequently Asked Questions about this Article…

According to a report by PEXA, one in four homes in Australia are being purchased with cash due to rising interest rates, which seem to have little impact on cash buyers. These buyers are often older Australians, possibly with international connections, and are purchasing homes in regional areas or high-value suburbs.

The highest percentage of cash home purchases are seen in Queensland, where 65% of sales in regional areas are made with cash, followed by New South Wales with 56% in regional areas. Additionally, affluent suburbs like Mosman in Sydney and Toorak in Melbourne also see significant cash transactions.

Typical cash buyers in the Australian property market tend to be older Australians, often with international connections. Many are purchasing homes in regional areas, possibly as part of a retirement plan.

The Commonwealth Bank breached Australia's spam laws by sending over 65 million emails that did not comply with regulations. This included emails that required customers to log in to unsubscribe and emails sent without a functioning unsubscribe option.

The Commonwealth Bank was penalized $3.55 million by the Australian Communications and Media Authority (ACMA) for its spam law violations, marking the largest penalty imposed for such breaches.

The Australian Tax Office (ATO) has announced an amnesty for small businesses with overdue tax obligations, such as income tax returns and business activity statements, originally due between December 1, 2019, and February 28, 2022. This amnesty allows businesses to lodge overdue returns without facing penalties.

To be eligible for the ATO's tax amnesty, small businesses must have had a total turnover below $10 million at the time the original tax lodgement was due. The amnesty runs until the end of the year.

Small businesses should lodge their outstanding tax returns or activity statements during the amnesty period. While a penalty may initially appear on their account, the ATO assures that it will be remitted, helping businesses get back on track without additional financial burden.