Medibank IPO first impressions: Low yielding and not cheap

Summary: The yield for Medibank Private is likely to reduce after the first dividend payout, but this has not been widely understood. The yield is also way below the banks and Telstra. The insurer's significant investments mean investors are in some part buying an investment company. Meanwhile, fee regulation means the company may not be able to pass on costs, which would crimp margins. |

Key take out: At the minimum offer price, the Medibank Private float looks good. At the upper end, it is okay but not as exciting because much of the upside is priced in. |

Key beneficiaries: General Investors. Category: Shares. |

It looks as though we are headed for another leg of the yield boom and, perhaps not surprisingly, the Medibank Private float has become a part of that new phase.

But a warning. Be aware the government float of Medibank is being priced at the level associated with health companies, but it's not a health company ... it's an insurance company dealing in the healthcare sector.

What's more, the government and its advisers have played hard to the legion of investors looking for yield. Indeed the worst part of the Medibank Private prospectus is way they have played to those yield-hungry investors – almost to the point of being slightly misleading. More of that later.

First, thanks to research by Westpac chief economist Bill Evans I want to update you on developments in the yield boom. Over in the US they looked over the cliff of interest rate rises and what they saw was not pleasant. So everybody moved back and began to appreciate that the implications of too rapid an increase in US interest rates were much nastier than had previously been envisaged.

And so the market had been pricing in an expectation that there would be three 0.25% interest rate increases by the end of 2015 – a total of 0.75% – plus a 1% increase in 2016 in four equal instalments.

Indeed the market thought it was actually being conservative because the average of the opinions of the 16 US Federal Open Market Committee members had come to an expectation of a 1.5% in 2015 and 1.25% in 2016 – a total of 2.75%. The market is now being priced on a totally different basis – that there will only be a 0.25% rise in 2015 and 1.25% in 2016 and, surprise, surprise, that is about what the chair of the Federal Reserve Janet Yellen and former vice-chairman William Dudley were advocating.

That lowering in the outlook for interest rates when the market saw the consequences of what they had been forecasting helped cause American 10-year bonds to fall below 2% last week although part of that fall came because a gambling institution had punted the wrong way and was covering losses.

With American rate increases now being delayed there was a sudden expectation that maybe there was scope for Australia to actually reduce interest rates.

That is probably an outside chance but a number of banks are thinking about further lowering their deposit rates – a dangerous sign for interest-bearing security investors.

The Reserve Bank of Australia would have already lowered interest rates given the sluggishness in the Australian economy but for the likelihood that any lower rates would further inflame house prices and lock in a bubble.

Australian banks have been under a cloud because they are priced so much higher than overseas banks and they are going to be required to hold more capital which will curb earnings growth. In addition a number of high-tech players are targeting the banking industry to slice portions of their revenue base by using low-cost new technologies that can perform the same or better services at much lower prices. But this threat is not immediate so while it had played a part in reducing bank share prices, now interest rate rises look like they have been deferred in the US there is a reasonable chance of a deposit rate fall in Australia – so for the market it is back to bank shares and high-yielding stocks. And that trend could continue.

So when it came to floating Medibank the advisors to the federal government said, “You must play the yield game to maximise your return.” And they did it with a vengeance.

Calculating yield

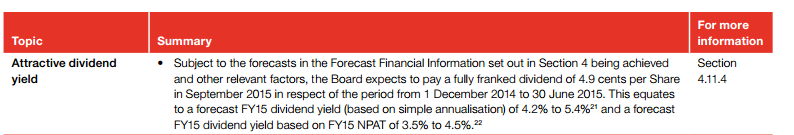

Medibank Private is expected to earn some 9.4 cents a share in the year ended June 30, 2015. The indications are that in a normal year it should pay a dividend of around 75% of its profit which would equal about 7 cents a share. On the basis of a $2 share price (the upper end of the indicative range) this equals a yield of only 3.5%, albeit fully franked. That's way below the banks and Telstra. Not good in a yield boom. So Medibank Private devised a cunning scheme and in the seven months of 2014-2015 after the float it will pay a dividend at an annual rate of 8.4 cents – i.e. 4.9 cents for seven months.

And as a result of that one-off inflated dividend payment the government is able to say that on a basis of a $2 share price the yield would be 4.2% fully franked. Of course the yields will be higher if the retail issue price is lower than $2 per share.

But in future years it is highly unlikely Medibank would repeat such a payout ratio and the prospectus it actually quotes the 3.5% yield on a normalised payout ratio. Indeed to maintain the 8.4 cents a share rate of dividend that Medibank has established, the company would need to earn in 2015-16 around 11.2 cents per share assuming its envisaged 75% payout ratio. That means profit in 2015-16 would have to rise by about 19%, no easy task.

As you can see what Medibank has done is a bit naughty but it worked as the Medibank “spin doctors” envisaged and almost every commentary on the first day used the 8.4 cents a share annual dividend rate to impute a yield of 4.2% on the basis of a $2 a share price. Later a few woke up.

I suppose it is alright to do those sorts of things, given the prospectus also mentions the lower yield, but Medibank is a good company and it shouldn't need misleading dividend policies to boost the float price.

I have no doubt that the float has been engineered so that the level of shares taken up by private people will force institutions to buy big chunks on the market so as to have their portfolios weighted to the index. That's what usually gives big new floats an initial premium.

Figure 1: Medibank prospectus – dividend information

Looking at investments

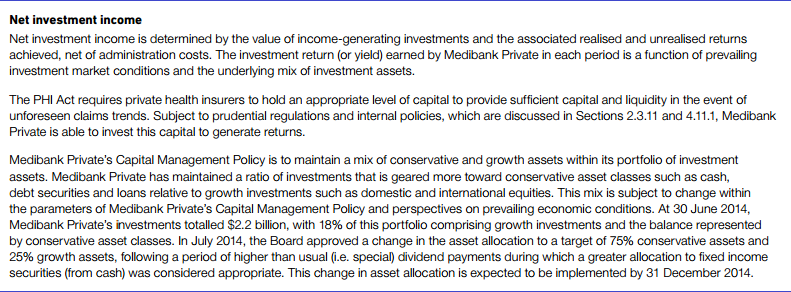

Another part of Medibank that is worth noting is that 22% of its 2013-14 earnings come from investments. Given the nature of its business of course it will need liquidity but 18% of Medibank's investments at June 30 2014 are equity investments and their good performance pushed up Medibank's 2013-14 profits. The company plans to amend its investment policy to lift its equity exposure.

Medibank Private's investments totalled $2.2 billion at June 30 2014, with 18% of this portfolio comprising growth investments and the balance represented by cash and interest-bearing securities. The $2.2 billion investment level will be reduced by the big dividend paid to the Commonwealth before the float. Medibank has changed its asset allocation to a target of 75% conservative assets and 25% growth assets. This change in asset allocation is expected to be implemented by 31 December 2014.

Reflecting lower interest rates and the reduction in the amount available to invest, investment income in the current year is expected to fall from $113.9 million to $89.7 million. That fall in investment income is the main reason why the expected 2014-15 profit of 9.4 cents a share is virtually steady even though the business has increased its turnover and operating profit.

Figure 2: Medibank prospectus – investment income information

It means that in a small but significant part you are buying an investment company.

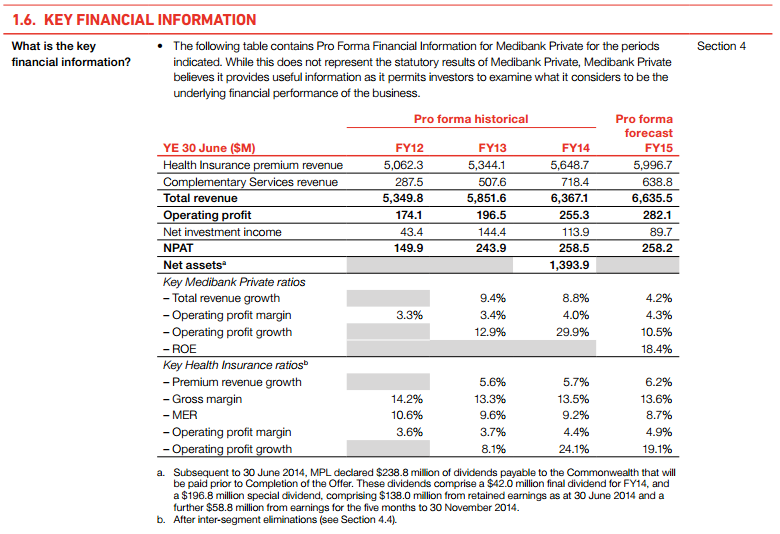

At a $2 price it has a price/earnings ratio of 21.3 times and a real yield of 3.5% (75% of profits), so you are looking at a stock that is not cheap. Medibank will need to perform and that means costs have to be reduced and market share and margins held or increased. There is every reason to believe that Medibank can do this but it is certainly being priced in a way that assumes that this is what will happen.

I have no doubt that there are worthwhile cost reductions that can be achieved in Medibank, but it will take time. There is a limit to what can be achieved by hard balling hospitals – you will just send them broke. What is needed is a total new look at the way hospitals are managed which is hard work because to do that requires changes in the CEOs.

Figure 2: Medibank prospectus – key financial information

The effect of regulated fees

My greatest fears in the Medibank Private float are that because the fees it charges are regulated, margins will be crimped because it will not be able to pass on costs. Previously the government was taking money out of its own pocket when it hit fee levels because it owned the largest player.

Even more dangerous is that health funds like Medibank have become accustomed to lifting fees by 5-6% or more. Salaries are no longer rising in big areas of the Medibank customer base so people have less discretionary spending. Unless Medibank can find a way to cut its fee increases it will lose customers, as people stop insuring. That becomes very dangerous if at the same time the Medibank customer base significantly ages and is multiplied again if a future ALP government wins office on health spending. Fee rises of 5-6% are not sustainable longer term in today's environment.

I think there will be a profit in Medibank Private and I think longer term you are buying a good business. The trouble is that you don't know what the price is. At the minimum level of $1.55 it looks good. At $2 it is okay but not as exciting because much of the upside is priced in which magnifies the long-term risks.