Mastering your investing emotions

Warren Buffett once said, “The most important quality for an investor is temperament, not intellect”. This means that our ability to control our emotions will often determine our success as an investor.

In our everyday lives, it’s actually healthy to experience a wide range of emotions. However, in investing, it pays to keep our emotions in check, as emotions can often lead to bad decision making, such as buying at the top of the market or selling at the bottom.

So, what is the cycle of market emotions, and where are we now?

Market emotions

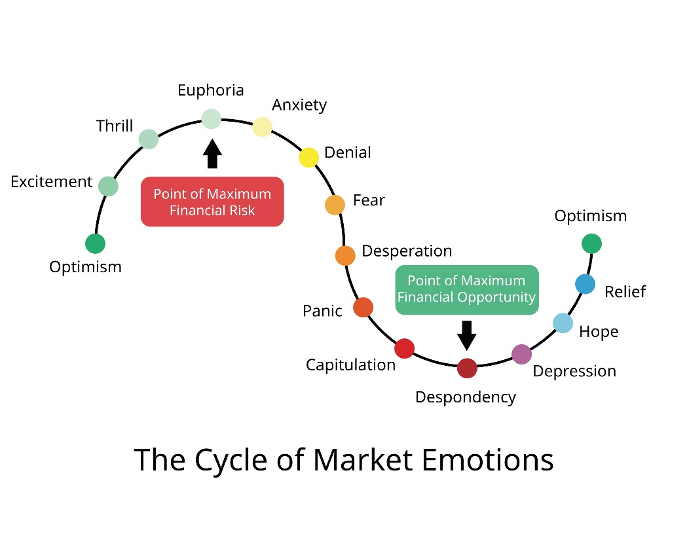

Several decades ago, a chart was developed, that highlighted the 14 emotions an investor will experience during a full market cycle.

An example highlighting the ‘Cycle of Market Emotions’ is the Global Financial Crisis (GFC).

The period 2005 to mid-2007 was a period of Optimism, Excitement, Thrill, and Euphoria as stocks and house prices reached new highs.

Then from mid-2007 to mid-2008, we saw Anxiety, Denial and Fear as asset prices fell and financial institutions collapsed. From mid-2008 until early 2009, Desperation, Panic, Capitulation, Despondency and Depression set in as stock and house prices plummeted.

However, from early 2009, markets gradually recovered, and Hope, Relief and Optimism returned, delivering huge gains for those who had stayed in the market or bought in.

The GFC was a stark example of the cycle of market emotions, but there have been many other such cycles, including the 1984 – 1989 market cycle that included the 1987 share market crash. Another example was the 1997 - 2004 market cycle that included the tech market crash of 2000.

It should be noted that no two cycles are the same, and as Mark Twain said, “History doesn’t repeat itself, but it often rhymes”.

The above chart highlights the 14 key emotional states that we can experience during a market cycle. The 14 emotions are:

Optimism: The cycle begins with optimism, and at this stage the market is moving upwards, and investors are optimistic that the future is bright.

Excitement: Stock prices have risen, some double-digit, and all things in investment markets appear positive.

Thrill: Investments keep rising, and on paper significant profits have been made.

Euphoria: Stock prices have now risen extraordinarily, with some stocks up 5-10 times. Investors become confident (i.e. overconfident) that they really have what it takes for investing, and invest more money. This is the point of maximum financial risk.

Anxiety: Investments now start dropping in price. Investors feel they need to ‘hold’ to get over this ‘temporary’ bump in the road.

Denial: Stock losses widen, and earlier gains have been eroded. Companies start issuing the dreaded ‘market updates’, and many companies start raising cash at steep discounts simply to survive. The pain becomes hard to bear.

Fear: Investors begin to realise that mistakes have been made, and start selling down their shares. They realise they’ve lost cash, but fear they will lose more.

Desperation: Investors sell even more shares at a loss, to move what they have into the safety of cash.

Panic: Shares keep going down, and investors keep selling at a frenetic pace.

Capitulation: Many investors decide the share market is not the place for them, so they sell everything.

Despondency: Investors think of what ‘could have been’ if only they had sold out earlier. They think of the hard yards ahead, simply to get back what they’ve lost. This, however, is often the best time to buy into the market, and provides the maximum financial opportunity.

Depression: The realisation of the extent of the losses has sunk in. This time, however, can be a good time to reflect on what went wrong, and then start again with a better strategy.

Hope: Investors may start to put some money back into the market, into safe blue-chip stocks or ETFs, with a focus on quality and diversification.

Relief: Some of the stocks or ETFs that have been bought begin to go up, providing a soothing effect on investors finances as relief starts to set in.

Optimism: Optimism returns, and the cycle begins all over again.

So, where are we now?

The first thing to remember is that we can never know for sure where the share market is going over the next few years. The world is highly complex with many interrelated and moving parts, and the future is often determined by not only what we already know, but by events that are still to happen in the future.

Having said that, it does appear that after several years of sideways movement, the market is now more optimistic, as evidenced by the recent share and bond market rallies. Hence, we appear to be in the Hope/Relief/Optimism part of the cycle. The optimism has been driven by falling inflation and the likelihood that a couple of interest rate cuts may occur later in 2024, which should be positive for equities and bonds.

Risks, however, are never far away. The Ukraine war has an uncertain outcome, and tensions have risen around the world. On top of this, more than half the world (including the US) will vote this year in elections.

Investment markets often climb a wall of worry, and this time may be no different. So, the key is to be aware of the opportunities and the risks, and set your investment strategy accordingly.

We can also prepare to manage our emotions. Here are a few ideas on how to do this:

How to manage our investing emotions

- Understand the cycle of market emotions. The better prepared we are for market emotions, the better we can manage them. Familiarise yourself with stock market history and note that all market falls are eventually followed by new highs.

- Remember your long-term goals. At InvestSMART we recommend clients have a long-term goal in mind. It may be a home deposit, a holiday or a specific figure you want to hit in 10 years. A goal helps to keep you on track. Which brings us to...

- Dollar-cost averaging. Invest into the market at regular intervals. This encourages you to buy stocks during all stages of the market cycle, including when fear is high (and prices are cheap). It also takes the emotion out of trying to time the market.

- Diversify your portfolio. A diversified portfolio helps to reduce stock specific risk, and smooths out investment returns. This can take much of the worry out of investing. InvestSMART portfolio's are built on this principle and are diversified across global and Australian shares via ETFs.

- Think long-term. We should be prepared to hold for long periods without the burning need to look at prices daily. Long-term investing lets the magic of compounding do its work.

Frequently Asked Questions about this Article…

Controlling emotions is crucial for successful investing because emotions can lead to poor decision-making, such as buying at market highs or selling at lows. Keeping emotions in check helps investors make rational decisions based on long-term goals rather than short-term market fluctuations.

The 'Cycle of Market Emotions' is a concept that describes the 14 emotional states investors typically experience during a full market cycle. These emotions range from optimism and excitement to fear and depression, and understanding them can help investors manage their reactions to market changes.

The Global Financial Crisis (GFC) illustrated the cycle of market emotions by showing how investor sentiment shifted from optimism and euphoria to fear and panic as markets crashed. Eventually, hope and optimism returned as markets recovered, highlighting the cyclical nature of market emotions.

To manage investing emotions, investors can understand the cycle of market emotions, remember their long-term goals, use dollar-cost averaging, diversify their portfolios, and focus on long-term investing. These strategies help reduce emotional reactions and promote rational decision-making.

Dollar-cost averaging is an investment strategy where investors regularly invest a fixed amount of money into the market, regardless of market conditions. This approach helps investors buy stocks at various price points, reducing the impact of market volatility and taking the emotion out of market timing.

Diversification is important because it reduces stock-specific risk and smooths out investment returns. By spreading investments across different asset classes and regions, investors can mitigate the impact of any single investment's poor performance, leading to more stable returns.

Long-term investing benefits everyday investors by allowing the power of compounding to work over time. By holding investments for extended periods, investors can potentially achieve significant growth, even if short-term market fluctuations occur.

Currently, we appear to be in the Hope/Relief/Optimism phase of the market cycle. Recent share and bond market rallies, driven by falling inflation and potential interest rate cuts, suggest a more optimistic outlook. However, investors should remain aware of ongoing risks and uncertainties.