LICs and fair value: A guide

Summary: Listed Investment Companies are powerful vehicles that give investors exposure to both local and overseas markets. When there are more buyers wanting in to an LIC than sellers, the share price can exceed the value of assets held in the portfolio. When an LIC is trading “below fair value”, this could be for a number of reasons, including poor investment performance, lack of investor awareness about the LIC, or lack of transparency around the investment process. |

Key take-out: LICs, like all investments, are more likely to deliver returns if investors buy them with long term goals in mind. |

Key beneficiaries: General investors. Category: Listed investment companies. |

Listed Investment Companies (LICs) are one of the oldest forms of collective investment vehicles available to Australian investors. Many have been in operation for several decades, and the best have shown the capacity to generate profits (and pay dividends) through all parts of the economic cycle. Most LICs adopt the long term, “buy and hold” approach to share investing, and use concentrated portfolios to drive returns that are well above the general returns of share market indices. LICs therefore provide many potential benefits for investors, compared to traditional actively managed funds. But for the uninitiated, LICs are difficult to fathom, especially with regard to the way they are valued and the prices at which they trade.

Open ended vs. close ended

Once you understand how LICs are structured, and how to evaluate them, they can provide a wealth of opportunities to expand your investment portfolio. To unravel the confusion, we first need to understand the structural difference between traditional actively managed funds, and LICs.

When you buy into an LIC you are buying a share in a company that invests in other assets, primarily shares in ASX listed stocks (or stocks listed on overseas exchanges). LICs are created through an initial public offering (IPO), and once the IPO is complete, the LIC shares commence trading on the ASX. Initial investors can only sell their LIC shares through the ASX, and incoming investors can only buy shares the same way. As with any share, once you are invested it's not possible to look to the issuing company to redeem your share/s, liquidity is only available through the secondary market on the ASX. Some LICs periodically increase the size of their share capital by subsequent rights issues, but these new shares (once issued) can also only be bought and sold on the ASX.

It's because of these limitations that LICs are referred to as “closed ended” investment vehicles.

Because there is a finite supply of LIC shares on issue, the forces of supply and demand can force the LIC price above the “fair value” (or NTA – “net tangible asset” backing)…or where demand for the LIC share declines, the LIC price can fall below fair value. This has important implications for LIC investors, and we will return to this point in a minute.

Prior to the 1982 Campbell Committee reforms to the Australian financial services market (the first such de-regulation since WWII), the dominant way that Australians obtained exposure to the share market was through insurance based products. Shares (including LICs) were bought and sold through private client stockbrokers – typically the domain of the wealthy. Don't forget, this was well before discount online stockbrokers!

Campbell recommended that pooled investment vehicles should be permitted, outside of the expensive and restrictive world of insurance products. The insurance industry responded with the “Managed Investment Scheme” mechanism which uses unit trusts to hold the underlying assets of the fund. In the unit trust structure, investors can freely come and go, with new units being issued to new investors, and existing units being redeemed by the fund manager when investors wish to exit. (Fund managers do match buyers and sellers, but can create and redeem units to respond to increased or decreased demand).

It's because of this flexibility that these managed funds are called “open ended” – but this flexibility comes at a price. Because of the potential for a run on these funds, they are forced to invest in highly liquid assets, and to hold large numbers of them. That's why traditional actively managed funds typically closely track general share market indices, and the high turnover associated with this approach creates high tax costs that are typically avoided with the LIC style of investment.

It's important to note that the open ended feature of traditional managed funds has one goal only – to ensure that there is always plenty of stock for industrial strength sales and distribution systems to saturate the market!

Table 1 below compares some of the key features of LICs compared to open ended managed funds.

LICs | Unlisted managed funds | |

Typical size of portfolio | 15-30 stocks | 80-100 stocks |

Typical turnover | 20% pa | 80% pa |

Benchmark Aware | No | Yes |

Distribution of trading gains | No, profits from share sales are re-invested | Yes, profits from share sales are distributed |

Trades at premium or discount | Yes | No |

Implications for LIC investors

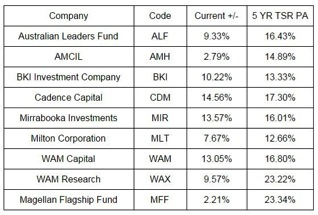

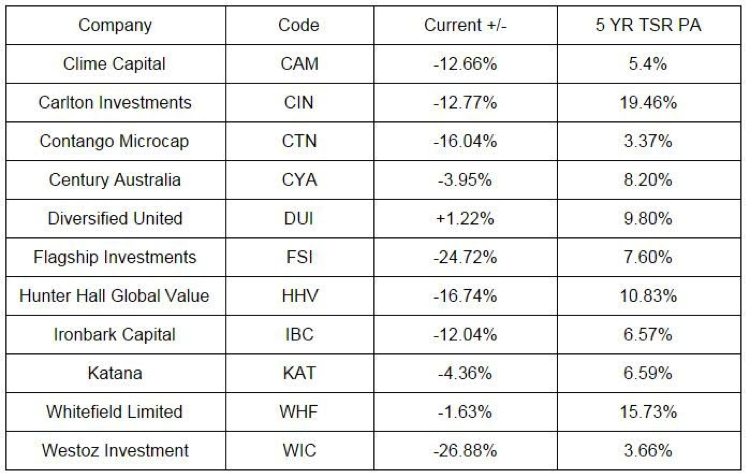

In an earlier Eureka Report article, Mitchell Sneddon provided tables which showed the premia or discounts at which leading LICs have traded, alongside the returns to their investors over the last 5 years:

Table 2: LIC Premia

Table 3: LIC discounts

While it can be readily understood why an LIC may trade at a premium to its fair value (“more buyers than sellers”), it's less easy to understand why the reverse is possible. Typical causes include:

• poor investment performance;

• lack of investor awareness (weak sales and marketing activity);

• lack of transparency regarding portfolio composition;

• irrelevance of investment style (for prevailing market conditions).

It is important to note total shareholder return in the tables above is calculated by the share price movement combined with the dividends paid by the LIC. It does not take into consideration the issue of bonus shares, which some LICs may choose to issue. The addition of these bonus shares may increase the total return to shareholders.

Some LIC managers have introduced share buyback programs where they stand in the market to buy back their shares, hoping by doing so to reduce the overhang in the market (ie. the excess of supply from sellers compared to demand from buyers). There are Corporations Act limits on the amount by which LIC managers can buy their own shares, but nevertheless this approach can be a welcome way to reduce LIC discounts (and in do doing, improve the overall returns for existing investors).

There's no easy remedy for LIC managers who hope to reduce the premium of their share price to fair value. Typically the existence of a premium is a reflection of strong investment performance, which can be responded to by the issue of more LIC shares (eg. through a rights issue). But when the LIC manager is playing in the small to mid cap sections of the stock market, increasing the size of the fund is problematic.

What does this all mean for you?

LICs implement a valuable and powerful style of investing, coloured for better or for worse by the skill of the investment team. Buying an LIC at a premia – if it's the style and performer you want – can be justified (but ideally should be avoided). All that this means is that you are extending the payback period on the underlying investment – ie. the time that it takes for the investment to have paid for itself.

If the LIC has a credible record of paying growing dividends, buying an LIC (especially if you are in wealth accumulation phase) can be a good way of accessing a solid investment with the hope of adding to your pool of retirement nest eggs. Similarly, buying a good LIC at a discount shouldn't necessarily be avoided. In both scenarios, like all investments, buying and holding for the long term is the real name of the game – speculating and hoping for a short term gain is rarely likely to succeed, with LICs as with any other form of investment.